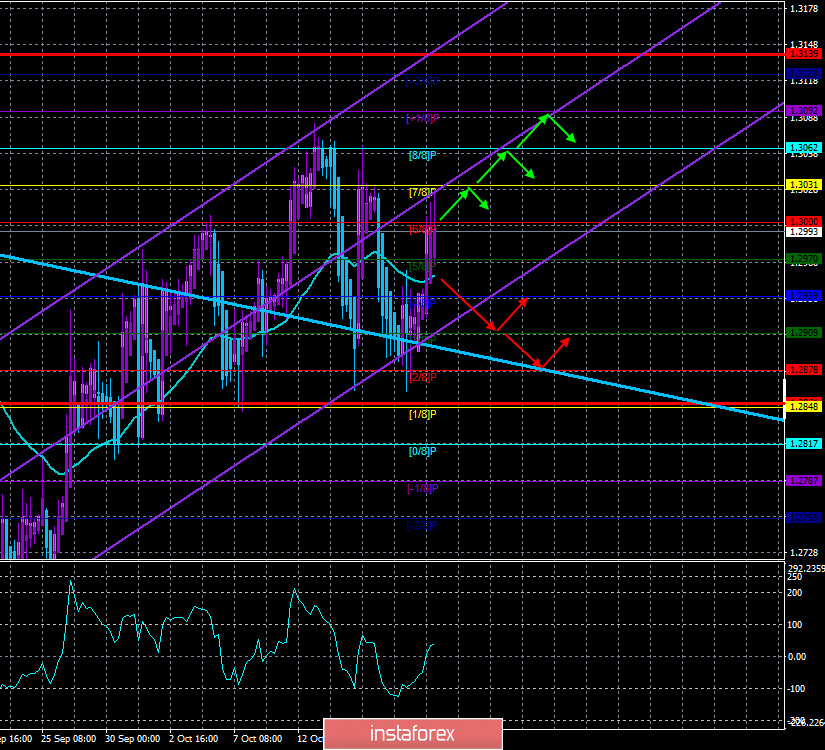

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: 36.5842

The British pound sterling paired with the US currency on Monday returned to a "stormy" state. During the day, the pair rose by more than 120 points, although there were no special reasons for this. However, over the past two weeks, the British currency has repeatedly demonstrated high volatility and frequent changes in direction. This still indicates that the market is in a panic or something like it. And market participants really have something to panic about right now. We have listed more than once the problems that the UK has already faced and will definitely face in 2021. In short, the British economy may continue to experience serious problems, even if the "coronavirus" epidemic is defeated. There is likely to be no trade deal with the EU. A trade deal with the US is even more questionable. Brexit itself will deal a new blow to British businesses and consumers. And thanks to the bill "on the internal market of Great Britain", London can not only remain in strained relations with Brussels but also finally quarrel with it. Recall that Johnson wants his bill, which violates the agreements with the EU reached last year, to come into force if it is not possible to agree on a free trade agreement before a certain deadline, which he sets himself. Thus, if this is not another attempt at the bluff, the bill will come into force, since it has already been approved twice by the Parliament, where the majority of votes are concentrated in the hands of conservatives. In addition, do not forget about the "Scottish question". Scottish First Minister Nicola Sturgeon will seek new permission from London to hold a referendum on independence in 2021. And even if a positive response is not received (and it will not be received), it will mean a heating up of relations between London and Edinburgh. Thus, the nervousness of market participants for the pound/dollar pair is quite understandable.

In addition, a change of power in 2021 in the UK is not completely excluded. If a deal with the EU is not reached, it will be Johnson's biggest defeat as Prime Minister, where he was so eager and in a hurry to get. The British, the Parliament, and its own party members may not forgive Johnson for this blunder. Already, some British media are spreading rumors that there is already a candidate to replace Johnson – Rishi Sunak, who currently holds the post of Finance Minister. Also yesterday, it was reported that Boris Johnson is not happy with his salary as Prime Minister, which is about 150,000 pounds a year. The British tabloid Daily Mirror writes that his predecessor Theresa May earned more than 1 million pounds during the time after her resignation, giving lectures. Boris Johnson has six children and also has to pay alimony to his ex-wife. Therefore, the British media believe that Johnson may leave his post on financial issues. It's hard to tell if this is true or not. But, as they say, there is no smoke without fire. This rumor can only be launched to justify the future resignation of Johnson, who as Prime Minister has not achieved any significant victories and is still leading the UK and its economy into the abyss.

At the same time, the future cooperation between the United States and the United Kingdom, which Johnson now has high hopes for, is in question. The fact is that it is Donald Trump who considers Johnson a friend and promises him a trade agreement. But Joe Biden, who is likely to become the next US President, does not have such warm feelings for the British Prime Minister. Moreover, Biden has Irish roots and highly honors the Belfast Agreement of 1998. Therefore, any possible conflicts on the island of Ireland that may arise due to the new regime that will operate after Brexit can only further distance Washington and London from each other. Moreover, Biden believes that London should clearly adhere to any agreements with the European Union, especially the Brexit agreement of 2019, and especially the protocol on the Northern Irish border, which Johnson intends to violate with his "internal market" bill.

Well, how can we not remember that any new financial and economic problems will inevitably lead to a new easing of the Bank of England's monetary policy? And this is an absolutely bearish factor for the British currency. BA has been exploring the possibility of introducing negative rates for several months and has already started consulting with commercial banks on whether they can withstand a new rate cut. Thus, the vast majority of experts believe that lowering the rate is just a matter of time. As early as 2020, the Bank of England may expand its quantitative easing program by another 50 or 100 billion pounds, which will also be a "bearish" factor for the pound.

Well, at the same time, do not forget about the "coronavirus" epidemic, which caused the greatest damage among all EU countries to the UK, and the current situation in the Foggy Albion also leaves much to be desired. According to the Johns Hopkins University website, about 15,000 new cases are reported in Britain every day. Recall that in the spring, already with 5 thousand diseases a day, the British health system was experiencing serious problems. Thus, given the range of current and potential problems that London has, we do not expect a strong strengthening of the British currency in 2020-2021. One gets the impression that the pound is now walking on a knife's edge and can go down at any moment. The uncertainty about the future of the United States and its economy somehow keeps the British pound afloat. From a technical point of view, the pound/dollar pair changes the direction of movement every day, so it is impossible to state any trend now. You can trade using lower timeframes, and even then very carefully. You should also take into account the high volatility of the pair in recent days. Four of the last six trading days ended with a passage of more than 126 points.

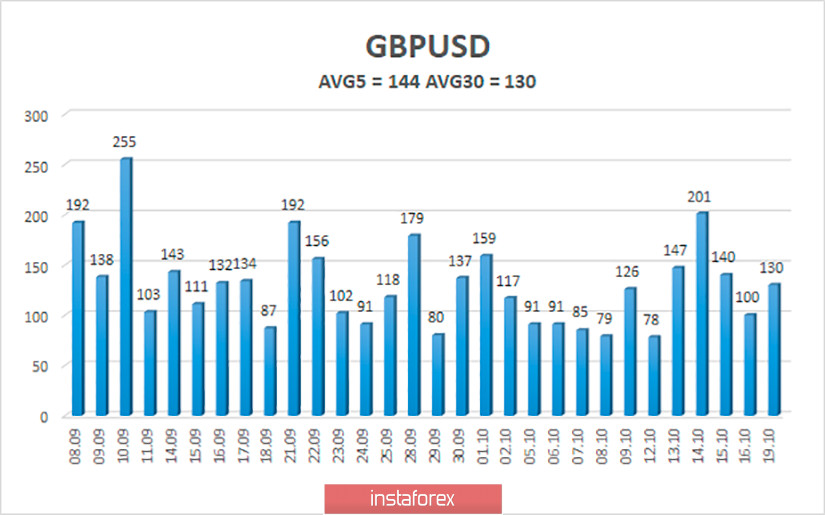

The average volatility of the GBP/USD pair is currently 134 points per day. For the pound/dollar pair, this value is "high". On Tuesday, October 20, therefore, we expect movement inside the channel, limited by the levels of 1.2854 and 1.3139. A reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.2970

S2 – 1.2939

S3 – 1.2909

Nearest resistance levels:

R1 – 1.3000

R2 – 1.3031

R3 – 1.3062

Trading recommendations:

The GBP/USD pair has started a new strong upward movement on the 4-hour timeframe, however, it is difficult to say how long it will last. Thus, today it is recommended to trade for an increase with the targets of 1.3031, 1.3062, and 1.3092 before the Heiken Ashi indicator turns down. It is recommended to trade the pair down with targets of 1.2909, 1.2878, and 1.2854 if the price returns to the area below the moving average line.