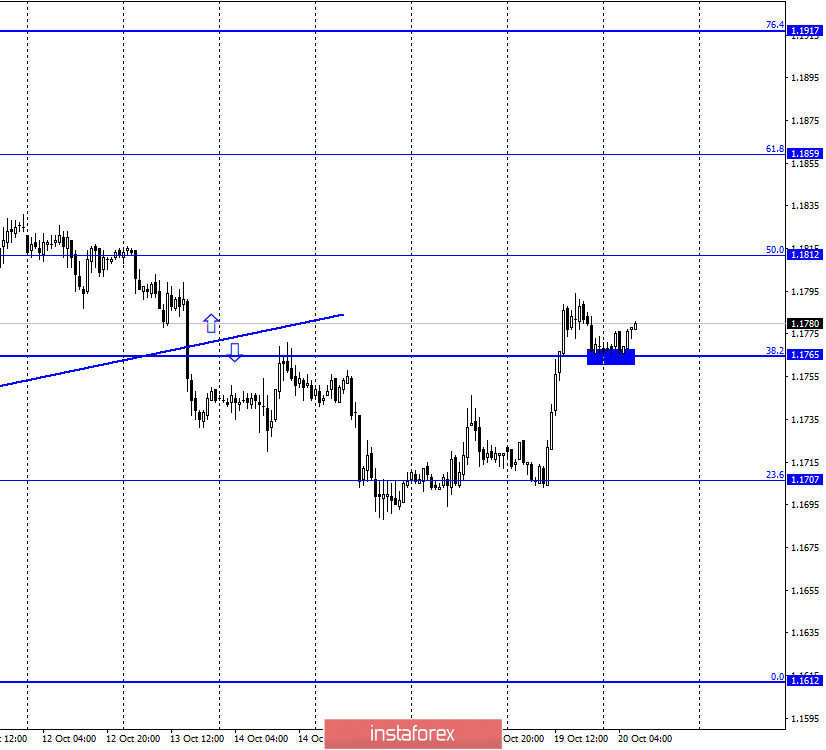

EUR/USD – 1H.

On October 19, the EUR/USD pair performed a reversal in favor of the European currency and resumed the growth process after two rebounds from the corrective level of 23.6% (1.1707). Fixing quotes above the Fibo level of 38.2% (1.1765) allows traders to expect continued growth in the direction of the next corrective level of 50.0% (1.1812). Meanwhile, European Central Bank President Christine Lagarde said on Monday that the European economy may start slowing again due to the second wave of coronavirus in Europe. Lagarde is particularly concerned about the epidemiological situation in France, which almost every day hits anti-records. Lagarde said the EU economy was in a breather over the summer and the recovery was incomplete and uneven. Now, with a new COVID outbreak, progress may be set back. The ECB still has tools in its arsenal to influence the economy, thus, the regulator may go for new incentives. For example, to create additional recovery funds or lower the key rate even more. One way or another, the second wave of COVID will hit the European economy. And the stronger it is, the more destructive consequences it will leave. The ECB President also said that by the end of 2020, the EU economy will lose from 8% to 12%, and not 5%, as previously predicted. Thus, the news from Lagarde was very sad. This, however, did not prevent traders from actively buying euros on Monday.

EUR/USD – 4H.

On the 4-hour chart, the graphic picture remains very boring. The pair continues to trade inside the side corridor. The pair's rebound from the lower border of the side corridor worked in favor of the EU currency and the resumption of growth of quotes in the direction of the upper border of the side corridor. Thus, bear traders still need to expect consolidation under the corridor, which will allow them to count on a new fall in the pair.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a rebound from the Fibo level of 261.8% (1.1825) and a reversal in favor of the US currency. Thus, now traders can count on a new process of falling in the direction of the corrective level of 200.0% (1.1566).

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has consolidated above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On October 19, Christine Lagarde's speech, which I mentioned above, took place in the European Union, and Jerome Powell's speech, which did not concern monetary policy, took place in the United States. There were no economic reports that day.

News calendar for the United States and the European Union:

On October 20, the calendars of economic events in the European Union and the United States are empty. Thus, background information is absent today.

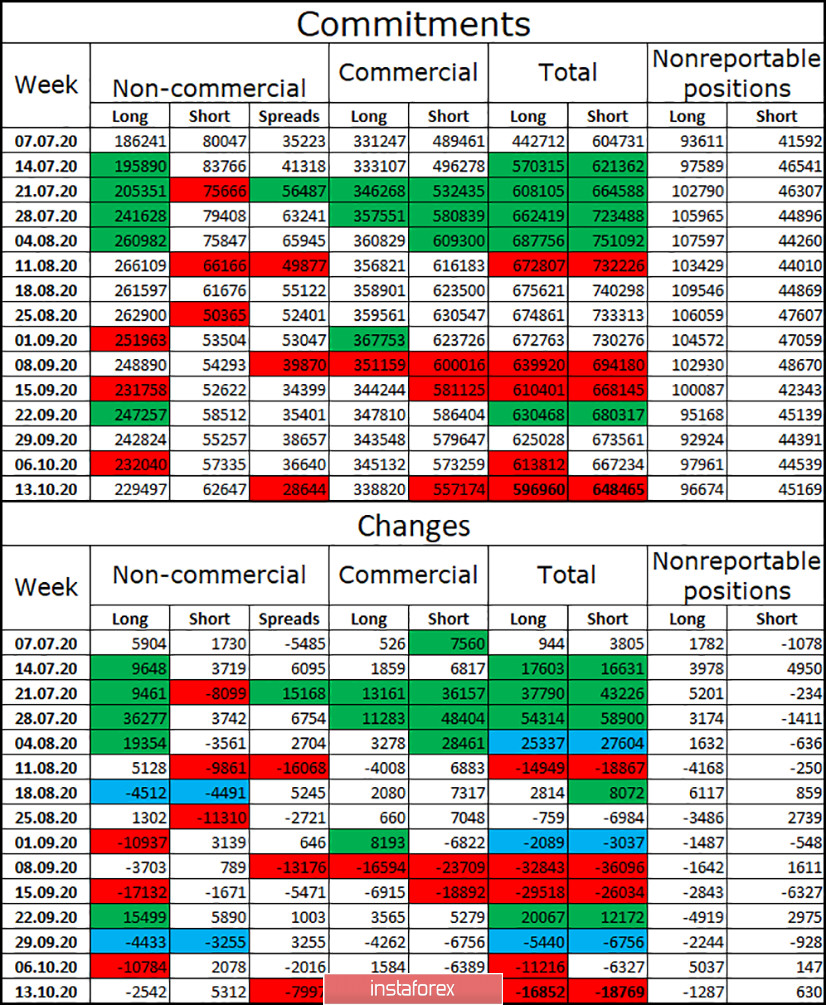

COT (Commitments of Traders) report:

The latest COT report was quite revealing. The most significant and important category of Non-commercial traders continues to get rid of long contracts for the third week in a row, closing another 2.5 thousand during the reporting week. Also, about 5 thousand short contacts were opened, thus, the mood of major players concerning the European currency became more "bearish" again. Thus, there is reason to assume that the euro currency can complete its victorious march and start falling again in a pair with the dollar. The total number of long contracts focused on speculators' hands remains several times larger than short contracts. However, this gap has been narrowing in recent weeks. The "Commercial" category of traders, on the contrary, gets rid of both contracts, but to a greater extent from short contracts, working in contrast to speculators.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with a target of 1.1707, if the close is made under the level of 38.2% (1.1765) on the hourly chart. Purchases of the pair are possible today with targets of 1.1812 and 1.1859, as a rebound was made from the lower border of the side corridor on the 4-hour chart and the level of 38.2% (1.1765) on the hourly chart.

Terms:

"Non-commercial" - large market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.