Good day, dear traders!

Yesterday's trading on the currency pair was quite nervous and multidirectional. First, the European Union and the UK are trying to revive negotiations after Brexit on reports, the British pound soared to 1.3023. EU Brexit negotiator Michel Barnier intended to arrive in London to continue the dialogue with his counterpart David Frost, who represents the British side. However, they only had a telephone conversation in which the parties discussed the prospects and direction of further negotiations. In General, the case did not move forward. Thus, you can talk for a long time without achieving concrete results and the time frame is still tight.

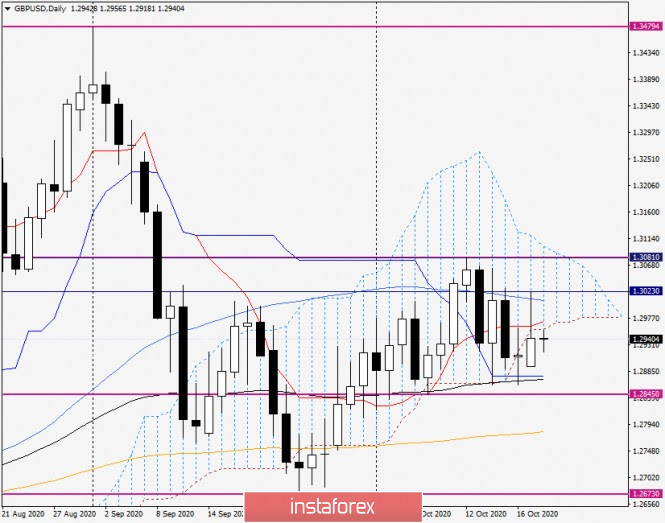

Daily

Looking at the technical picture, yesterday's attempts of the pound/dollar pair returned to the limits of the Ichimoku indicator cloud failed. Now it is obvious that a very strong resistance of sellers is concentrated in the price zone of 1.3023 to1.3028, where the maximum trading values were shown on October 19 and 15. In addition, the additional resistance is provided by the red Tenkan line and the 50 simple moving average which runs at 1.3008. Only the passage up of 50 MA and then the alternate breakdown of the resistance at 1.3028 and 1.3080, followed by an upward exit from the Ichimoku cloud, gave signals that the bulls have control over the pair.

For a bearish scenario, you need to break through the blue Kijun line and the black 89 exponent, then push through the support at 1.2845. If the downside players manage to complete these tasks, their next target will be the orange 200 exponential moving average, which is located at 1.2780. Given the very long upper shadow of yesterday's candle, as well as the pair's inability to stay within the daily cloud, most likely there is a subsequent decline of the British currency against the US dollar.

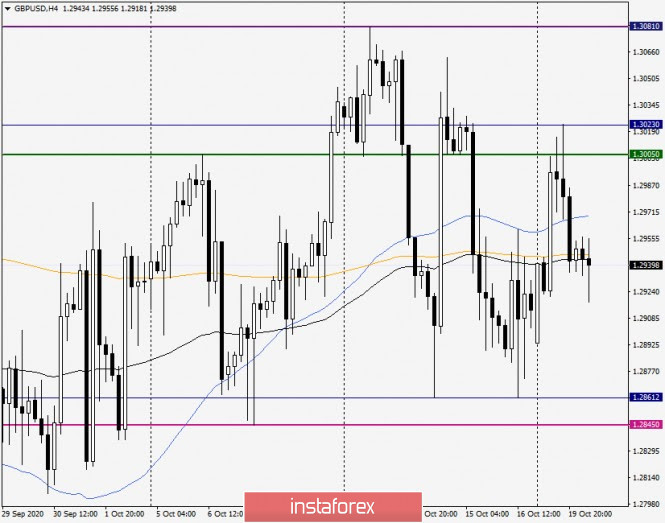

H4

In the four-hour timeframe, the pair is trading near the moving averages used: 89 and 200 EMA. At the same time, the quote is already fixed under the blue 50 MA, a rollback to which can be considered for opening short positions on GBP/USD. If the pair is fixed under 89 and 200 exhibitors, the next sales can be planned already on a rollback to them. To open purchases, it is necessary to see bullish candlestick analysis patterns in the strong support zone of 1.2865 up to 1.2845. The chart clearly shows how the price bounced from this zone and what long lower shadows appeared for several candles.

H1

While in this timeframe, the pound/dollar is trading near the used moving averages. To open sales, it is better to wait for a confident consolidation under them and in case of a rollback, open sales transactions. Short positions at more favorable prices can be evaluated after short-term rises in the area of 1.3000 to 1.3020 and the appearance of bearish candle signals there. In General, in my opinion, there is no need to hurry now and enter the market only if there are confirmation signals.

Looking at today's economic calendar, the data from the United States on construction permits and the laying of new homes will be published at 12:30 UTC. At 9:30 UTC, there will be a speech by a member of the monetary policy Committee of the Bank of England, Gertjan Vliehe. Although these events are not important, they may have an impact on the course of trading in GBP/USD to some extent.

Good luck!