As the US presidential election draw near, the greater the uncertainty grows. Last time, while Hillary Clinton was preparing her inauguration speech, Donald Trump won. This fact forces us not to depend on survey results suggesting the gap between two candidates, Biden and Trump, because the result may turn out to be completely unpredictable.

For example, on Monday, the US stock exchanges rose sharply, surprisingly, while the day ended on a rather pessimistic note. Markets do not know what to believe, what to bet on, and it becomes more difficult to predict the outcome of elections even than at the very beginning of the election campaign.

Media outlets that support Joe Biden write about what polls say about the undisputed leadership of the Democrat. While the others are talking about narrowing the gap in the rating of the two candidates.

Media companies such as Financial Times and BBC claims Joe Biden a landslide victory. According to the polls, Biden is gaining 51.5% of the vote, while Trump is only 42.2%. The remaining 6% of voters have not yet decided on their choice. The Gallup news agency, which predicted Trump's victory last time, writes that support for trump has increased to 46% from 42% since September. In another survey that was conducted, 56% of respondents believe that Trump will win, and 40% think that Biden will win.

The current elections are very different from the previous ones. Many are voting by mail in view of the coronavirus pandemic. Based on the votes of people who planned to Express their civil position by mail, Biden wins by a margin of 44 percentage points. Americans who will vote in person mostly leave their choice to the current President. Thus, Trump wins by a margin of 32 percentage points.

The topic of allocating funds to support the US economy adds to the nervousness in this whole process. The parties are still unable to agree, and it seems that they are deliberately delaying this moment until the elections. Yesterday, Nancy Pelosi made it clear that she is very doubtful about an agreement between Republicans and Democrats before the election. At the same time, she did not forget to issue an ultimatum, calling Tuesday the deadline for reconciliation of the parties. It is unlikely that this will change anything, but the markets are "taking the bait" and playing the theme of stimulus measures for the third week.

It is worth noting that more aggressive injections are expected from the Democratic Party. This means that the improvement in the rating of Donald Trump is perceived as a threat to future large-scale incentives. However, the actions of the parties are likely to be dominated by populism. The actual support measures are weakly dependent on whoever bags the position.

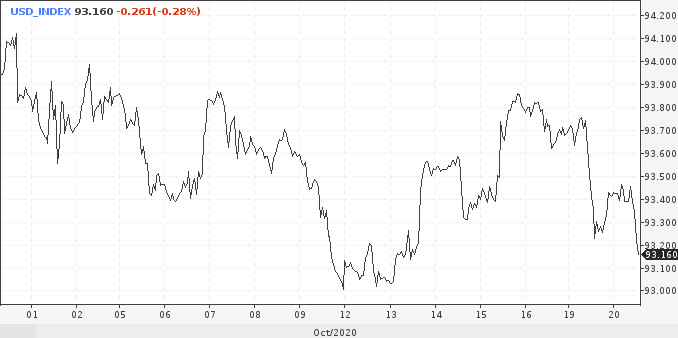

Markets appear to be preparing for high volatility ahead of the election. In an attempt to protect themselves, they switch to protective assets. The dollar suffers, because political uncertainty always causes an outflow from the country's currency.

In addition, there are at least two other reasons that force you to be careful with stocks in the near future. The first is the coronavirus. In fears that the medical system may stall again, the number of victims of the pandemic will increase sharply, and the authorities will have to resort to a partial closure of the economy. Coronavirus fears can overlap with pre-election uncertainty and result in high turbulence.

Another reason is the Fed. One of the senior officials of the regulator noted that in some states there is a weak recovery, while in some it is completely absent. Some of the losses in the labor market have not been replenished, and the economic stratification will continue to grow since the recovery is uneven.

Thus, we get a rare combination of a declining dollar and falling stock indexes. The question is how much the dollar can fall.

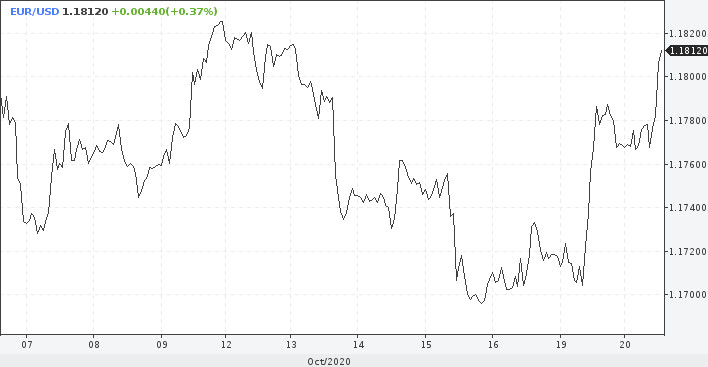

The euro continues to take advantage of the dollar's weakness. Bulls for the EUR / USD pair are again leading. Monday unexpectedly ended with growth around 1.176, which is above the resistance of 1.175. Naturally, this gives buyers of the single currency optimism. Today, they took the quote above the 18th figure. However, it will be possible to talk about annual peaks only after consolidation above 1.183.

If the bulls fail to take this level, then the road will open to the lows at around 1.16.