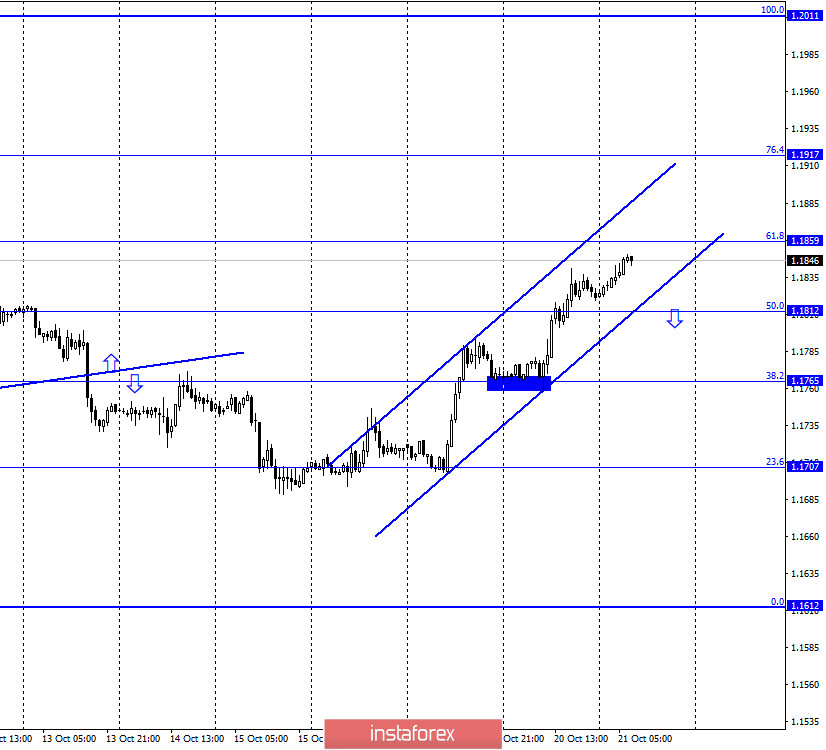

EUR/USD – 1H.

On October 20, the EUR/USD pair continued its growth process towards the corrective level of 61.8% (1.1859) after rebounding from the corrective level of 38.2% (1.1765). The pair's rebound from the level of 61.8% will work in favor of the US currency and some fall in quotes in the direction of the level of 50.0% (1.1812) and 38.2% (1.1765). However, the new upward trend corridor is more important now, which characterizes the current mood of traders as "bullish". Closing quotes below will work in favor of the US currency. Meanwhile, in the European Union, almost daily performances of Christine Lagarde continue. The ECB President said the 750 billion euro bailout plan agreed by EU countries this summer could be one of the ECB's long-term tools. Simply put, Lagarde does not expect a rapid and complete economic recovery, and the second wave of COVID may reduce its pace. Thus, the ECB President does not rule out that in the future the EU economy will have to provide new incentives, in particular, the expansion of the recovery fund, the formation of similar funds, as well as a reduction in the key rate. Such statements are not in favor of the European currency. However, traders are still quite actively buying euros at this time. Thus, I conclude that traders are now guided by other reasons when opening transactions than the information background.

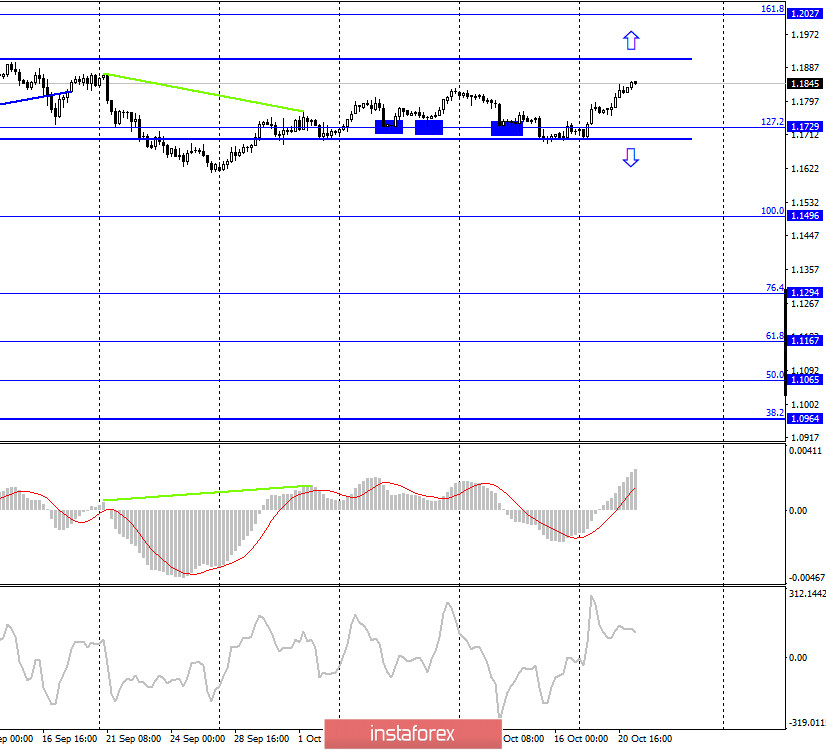

EUR/USD – 4H.

On the 4-hour chart, the graphical picture remains very boring, as the pair continues to trade inside the side corridor. The rebound of the pair's rate from the lower border of the side corridor allowed resuming the growth of quotes in the direction of the upper border of the side corridor. Thus, bear traders still need to expect consolidation under the corridor, which will allow them to count on a new fall in the pair.

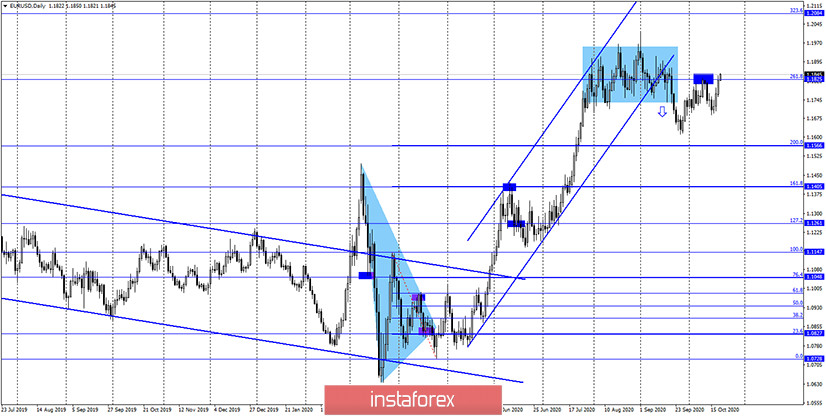

EUR/USD – Daily.

On the daily chart, the EUR/USD pair quotes returned to the corrective level of 261.8% (1.1825), which is not a strong level. Fixing above it will allow traders to expect continued growth towards the next corrective level of 323.6% (1.2084), however, the side corridor on the 4-hour chart is more important.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair has completed a consolidation above the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On October 20, there were no significant events or economic reports in the European Union and the United States. However, traders were quite active.

News calendar for the US and the EU:

EU - ECB President Christine Lagarde will deliver a speech (07:30 GMT).

On October 21, the calendars of economic events in the EU and the US are almost empty again. Only a new performance by Christine Lagarde is scheduled for today. Thus, the information background will be practically absent during the current day.

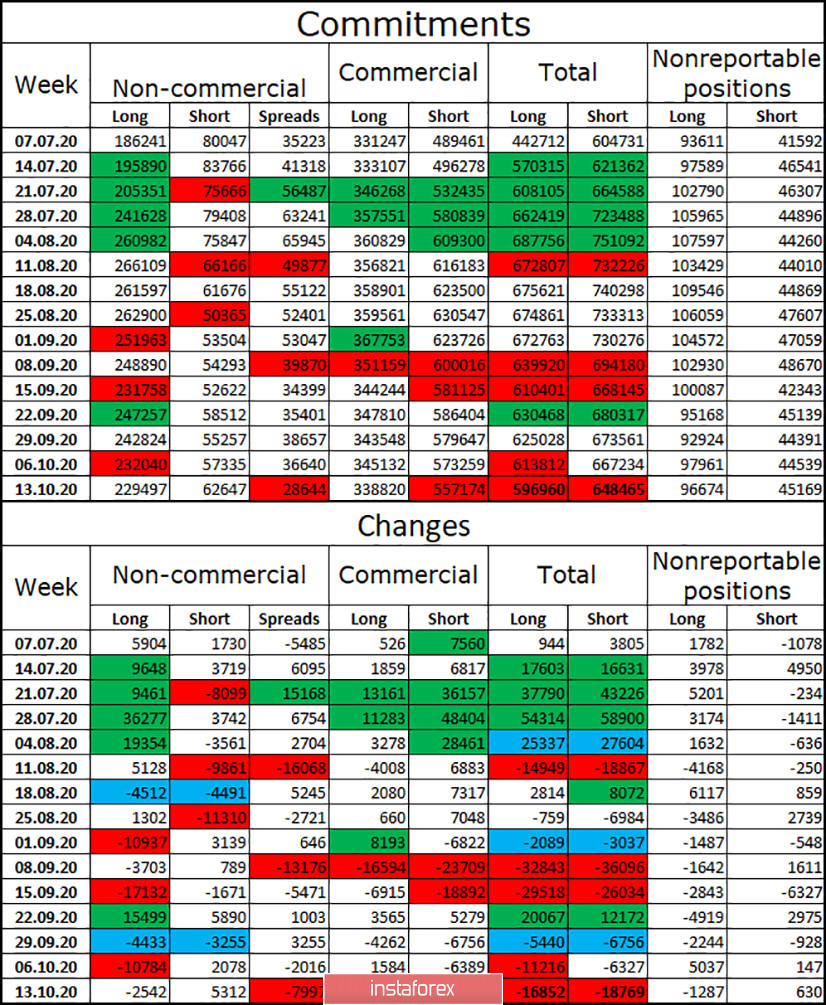

COT (Commitments of Traders) report:

The latest COT report was quite revealing. The most significant and important category of Non-commercial traders continues to get rid of long contracts for the third week in a row, closing another 2.5 thousand during the reporting week. Also, about 5 thousand short-contacts were opened, thus, the mood of major players concerning the European currency became more "bearish" again. Thus, there is reason to assume that the euro currency can complete its victorious march and start falling again in a pair with the dollar. The total number of long contracts focused on the hands of speculators remains several times more than short contracts. However, this gap has been narrowing in recent weeks. The "Commercial" category of traders, on the contrary, gets rid of both categories of contracts, but to a greater extent from short contracts, working in contrast to speculators.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro with targets of 1.1765 and 1.1707 if the closing is performed under the ascending corridor on the hourly chart. The pair can be bought today with the target of 1.1917 if the pair continues to stay inside the ascending corridor on the hourly chart.

Terms:

"Non-commercial" - large market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.