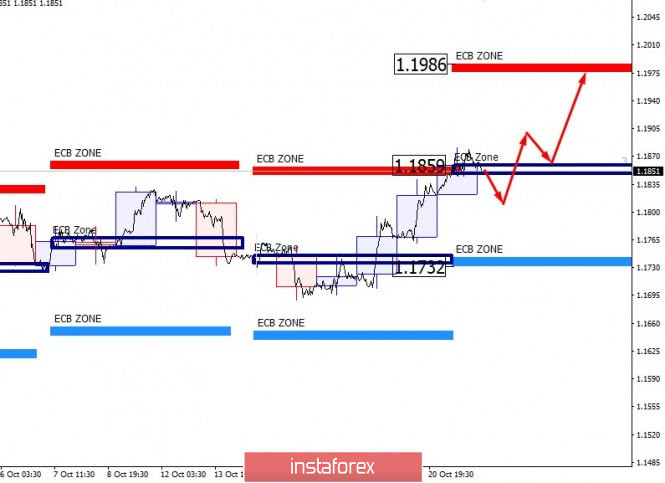

The 1.1859 level is the starting point for making trading decisions this week and in the first half of the next. Today's consolidation above this level will allow you to continue to hold purchases that were opened earlier. Any decline can be considered as a correction, as the Bank's recent actions indicate support for the growth of the Euro exchange rate. The formation of a buy pattern should be considered below the level of 1.1859. This will allow you to open a profitable long position. The growth target may be a zone with an upper limit at 1.1986.

Over the past four days, the pair has been growing. This indicates a large number of market buyers who are ready to enter transactions at unfavorable prices. Until the absorption pattern is formed on the daily period, it is unnecessary to talk about the cancellation of the upward momentum.

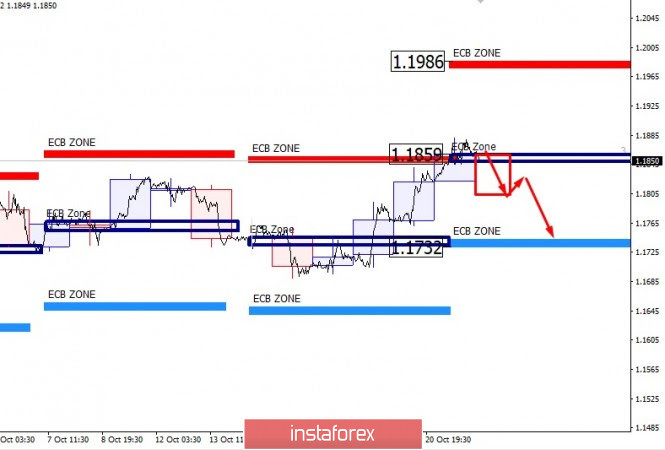

We will see an alternative option if today's trading closes below yesterday's opening. This will allow us to consider a decline to the lower banking zone, located above the level of 1.1732.