The global financial market in general and currency market in particular are directly and immediately affected by the topic of the presidential elections, as well as the continuous hopes for new stimulus measures in the US.

Yesterday, investors expected a positive result again about the incentives negotiations between the House Speaker, N. Pelosi and the US Treasury Secretary, S. Mnuchin. However, there was no result, except for the previous reports that the parties are optimistic about resolving this issue.

Why do investors react to these events in this way? And why are they so important for evaluating possible movements of assets and currency pairs in global markets?

The results of the US presidential elections are important primarily due to the extremely contradicting moods in the camps of candidates – the Democratic Party and the Republican one, as well as in American society. Investors fear that the losing side may not recognize the election result, which could lead to unrest in the country with a corresponding impact on the global financial markets. The US dollar is the world's reserve currency, so a decline in the US's credibility and economic weakness could hit hard currency ratios in the markets and lead to even broader economic problems than is currently observed.

On the other hand, the new fiscal stimulus injection in the US is also noticeable. A decision on incentives will lead to a rising demand for company shares and the yield on US Treasury bonds. In turn, the dollar rate on the currency markets will decline. However, investors are worried whether an agreement will be reached, which led to the weakening of demand for risky assets, which, in turn, supports the dollar, not allowing it to collapse.

So far, markets believe that the new stimulus package will be approved anyway, if not before the elections, then after. However, there is still a high probability that the parties will not be able to come to a compromise even after the election due to the high degree of confrontation.

Against this background, the yen, franc and euro strengthened against the dollar. We believe that there is a high probability that this factor of uncertainty will persist not only until the end of this week, but also until the US presidential elections.

Forecast of the day:

The EUR/USD pair is under pressure amid the failure of Democrats and Republicans in the United States to agree on new measures to support the US economy. Given the growing uncertainty, a local correction can be expected to 1.1800 after breaking the level of 1.1840.

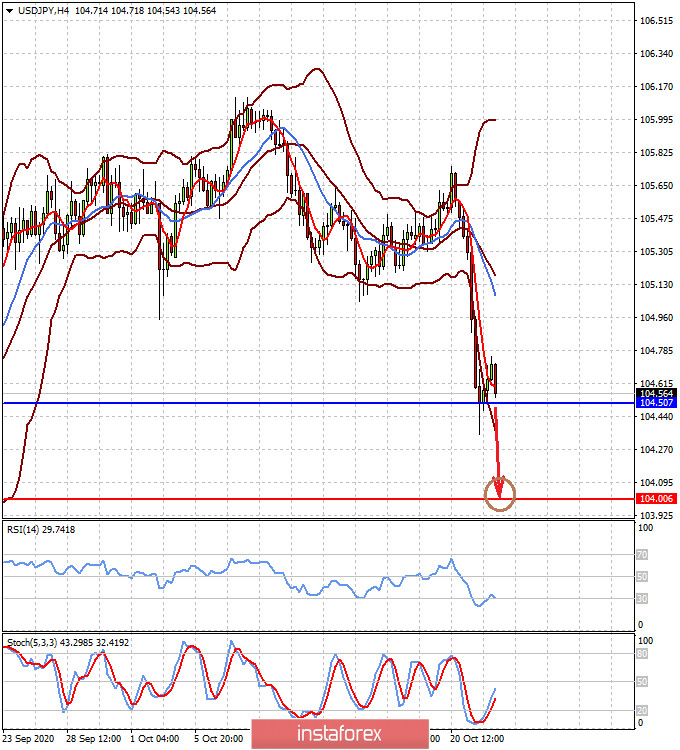

The USD/JPY pair found support at 104.50, but the intensifying negative mood may lead to a resumption of the pair's decline to the level of 104.00.