During yesterday's trading day, the GBP/USD currency pair literally soared, showing maximum values at 1.3175. This course of trading on the Pound was facilitated by the information that the negotiator from the European Union on the withdrawal of Great Britain from its membership announced the possibility of concluding a trade deal. However, it should be recalled that such statements are not heard for the first time. The parties to the separation process are still trying to negotiate the most favorable terms for themselves. What the final outcome of the negotiations will be, and whether an agreement will be reached, remains in question.

Meanwhile, in the United States, the election campaign of candidates for President is in full swing. Joe Biden is ahead of incumbent President Trump. There is one final debate remaining where the issue of adopting fiscal incentives to eliminate the negative consequences of COVID-19. The size of these consequences has ignited buzz and will probably be at the forefront of the debate. Many experts and analytical departments of large commercial banks are already trying to figure out the odds if a candidate wins. According to the general opinion, if Biden wins, the US Dollar will be under pressure and risky assets will show impressive growth. Given that at the moment the Democratic candidate is ahead of Trump, and the US dollar is falling, this probability seems quite justified and natural.

On today's events that may affect the trading of the GBP/USD pair, the Bank of England's Governor Andrew Bailey is scheduled to speak at 12:25 UTC where market participants will pay special attention to the likelihood of negative interest rates and the expansion of the asset purchase program. At 12:30 UTC, data on the number of applications for unemployment benefits will be received from the United States. Home sales in the US secondary market will be released at 14:00 UTC. Today's events will end with a speech by the head of the Federal Reserve Bank of Richmond, Thomas Barkin, which will take place at 17:10 UTC.

Daily

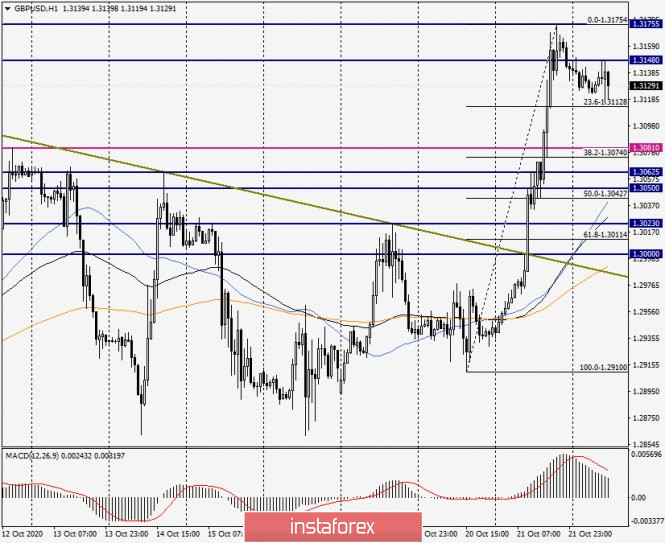

As a result of yesterday's rally of the Pound, the pair moved up from the daily cloud of the Ichimoku indicator, closing Wednesday's session at 1.3142. Such an impressive growth and the closing price allow us to count on further strengthening of the Kusa, where the nearest resistance zone will be 1.3175-1.3220.I believe that yesterday's rebound from 1.3175 was not accidental. Today, at the time of writing this article, the pair has slightly corrected and is ready to continue yesterday's upward movement. If so, the most relevant trading idea is to buy the British currency.

H1

On the hourly chart, I stretched the Fibonacci grid to 1.2910-1.3175. As noted in previous materials, usually after such strong movements, the corrective pullback is very small, after which the quote continues to move in the chosen direction. In our case, the correction may be limited to the first pullback level of 23.6 Fibonacci, which, in principle, has already happened.

Trading recommendations for GBP/USD

Since the expected pullback to the level of 23.6 Fibonacci has already taken place, the pair can resume the rise from current prices, which implies aggressive and risky purchases right now. In case of a deeper correction, I suggest that you take a closer look at opening long positions after a decline in the area of 1.3100-1.3080. Another option for opening long positions will be a census of today's highs of 1.3148, shown in Asian trading, as well as on the breakdown of the resistance of 1.3175.

If the pair is unable to overcome the resistance of sellers at 1.3148 and 1.3175 and bearish candlestick analysis patterns appear there, a signal will appear to open sales. If this happens, I do not recommend setting large targets.