The gold market is experiencing a calm before the storm, but the current situation leaves a lot of questions that I will try to answer in this article. Strange as it may seem, but gold is not popular among some investors, being inferior in popularity to, for example, cryptocurrencies. At the same time, among traders, trading in such an instrument as Gold commands deserved respect, and trading in long and short positions opens up additional opportunities for earning, which we will talk about in the context of the fundamental development of the situation.

Almost a month has passed since my previous review on the gold market, and the worst-case scenario, implying a decline in the precious metal to $1750, fortunately for investors, did not materialize. Moreover, the support at the $1800 level also held out. However, have these scenarios been canceled after the past four weeks? Not at all. Has the fundamental picture of gold deteriorated at the same time? Yes, it has undoubtedly worsened, but let's take it in order.

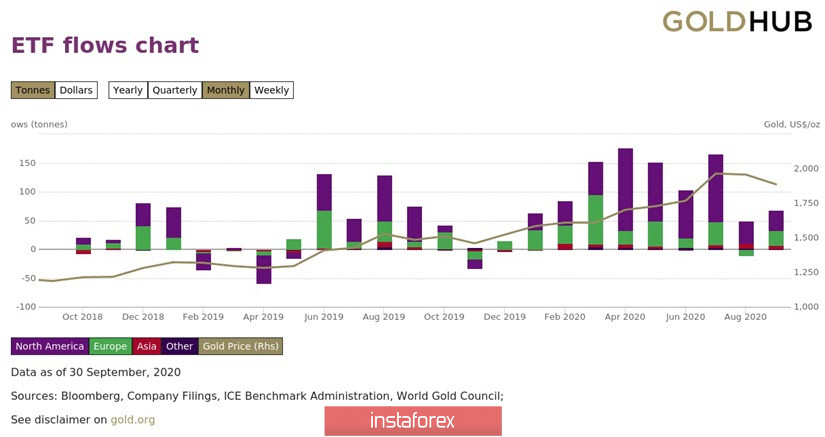

Until recently, the price of gold was strongly influenced by the demand from ETFs and positioning in the futures market. In September, demand from exchange-traded funds increased again, while the price of gold was declining, and investor purchases were not as active as it was in the first half of this year.

Figure 1: Buying Exchange Traded Funds Investing in Gold

At the same time, the situation on the futures market of the CME-COMEX exchange now poses the greatest danger to the gold market, and here's why. In 2019, the daily trading volumes of gold in futures contracts traded on this exchange exceeded $120 billion. Traders-speculators were actively buying gold with the expectation of its further growth. In terms of volume, the US futures market has become the largest in the world, surpassing London with its $80 billion in daily turnover. However, the volatility led to an increase in the margin in gold futures contracts on the CME exchange, which made this market less attractive for speculators who began to leave this commodity segment. As a result, from March to October, Open Interest indicators, which are an indicator of supply and demand in the futures market, fell, dropping from 1.2 million contracts to 906,000.

Whether we like it or not, it is speculators who fill the market with liquidity, raising the price of a particular product, and if the demand for an asset falls, then the price for it goes down. Americans are well aware of this, and it is extremely difficult, if not impossible, to compete with them in financial exercises. It looks like a conspiracy theory, but literally this Monday, the CME exchange again raised the margin for transactions in gold futures to $11,500 per contract. Moreover, this was done without any visible logic, since the market volatility at the current moment has decreased, and gold prices have fallen from their August highs by more than 5%. Why such reinsurance, and why should the exchange worsen the terms of such a popular contract?

However, if we assume that the American authorities in this way decided to cool the gold market, then everything develops into a certain model. According to the CME, the daily trading of all precious metals in September 2020 was only $93 billion, representing a more than 30 percent decline from last year. Now, with the next increase in the margin collateral, the trading volumes will fall even more, and speculators will continue to leave this market. There are no buyers, no price growth, no rise in the price of gold - the dollar can sleep peacefully, no one encroaches on its monopoly. This, of course, is just a theory, but it may not be far from the truth.

The fact that the Treasury and the US Federal Reserve are manipulating gold prices has long been suspected. An interesting experiment was recently described on the Zero-Hedge blog, during which a simple trading system was tested that tracks two options. In the first variant, gold was bought at the close of the trading session in London and sold at the opening of trading. In this version, $50 invested in 1975 turned into $20,000 by 2020. The second option involved buying gold at the opening of the session and selling it at the close of the market. In this version, $50 invested in 1975 turned into $3 by 2020. The results of the experiment, showing such strange results, allowed the authors to conclude that the price of gold in London is openly manipulated in favor of the US dollar.

Whether gold will be able to resume its long-term growth in the light of the recent events on the CME exchange raises certain doubts in me, since it was the stock speculators who gave the start to the trends in gold and other assets. However, doubts-doubts, but let's look at the technical picture of the daily half, describing the situation for a period of one to three months (Fig. 2).

Figure 2: Technical picture of gold daily values

Having reached semi-annual averages in late September and early October, gold formed support at $1855 and attempted recovery. However, it is too early to say that gold has started a new cycle of growth. Above the price is limited by the resistance of $1973, and until gold consolidates above this resistance, in the short term, there is a possibility of correction to the main upward trend.

The targets of this short-term correction may be the levels of $ 1800 and $1750, which, given the increasing margin collateral in the futures market, in the future up to one month, makes a short-term decline even more probable. In the medium term, from one to three months, gold continues to remain in a horizontal trend, which is fraught for investors and traders with false breakouts outside the boundaries of the horizontal channel located between the $1850 and $1975 levels. In the long term, up to one year, gold is still in an upward trend, the first target of which is the previous highs at $2075, the next target is located at $2215. Thus, before opening a trade, a trader or investor needs to position himself in the time horizon of the transaction and, depending on this, make a decision to sell, buy or stay out of the market. Be careful and make sure to follow the money management rules.