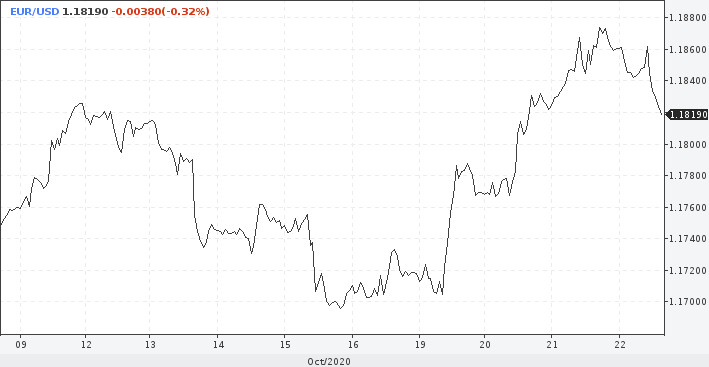

The movement of the EUR / USD pair depends on the dollar and the stimulus for the US economy. The previous deadline proposed by Nancy Pelosi to conclude an agreement between the two parties was, as expected, rejected. Representatives of the US administration and the Democratic Party should continue to work on agreeing on the terms of state aid. The parties have not yet given any specifics as to whether the deal will be concluded before the November elections or not. However, White House chief of staff Mark Meadows told CNBC that a compromise could be reached before the weekend. In addition, incumbent President Donald Trump has recommended that Republicans consider approving more aid.

The euro is developing corrective dynamics after reaching a multi-week high. The EUR/USD pair was trading around 1.1820 during the European session. Despite the decline, market players remain confident that the local weakness of the euro will not last long. The dollar is still under fundamental pressure due to expectations of support measures for the country's economy. Thus, the European currency maintains its growth target to 1.2000.

Meanwhile, the pair has reached a serious resistance zone, and if the downward movement increases, then you should refrain from buying.

In addition to the news on incentives, traders pay attention to the weekly publication of data from the US labor market. More disappointing numbers will exacerbate dollar sales. In the run-up to elections, markets become particularly nervous, so a violent reaction is possible.

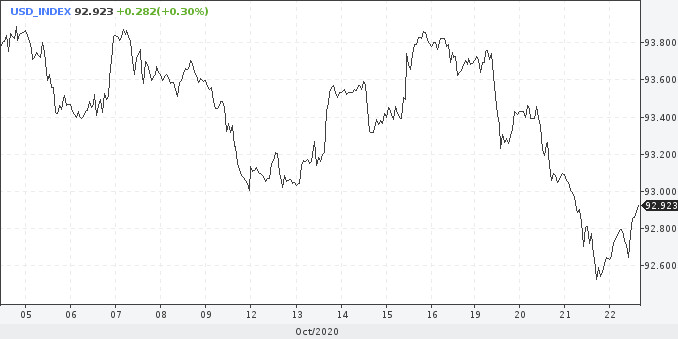

Moreover, the USD index fell to the lows since September 2 and almost completely played back the corrective pullback of last month. The indicator reached the support level of 92.5, which threatens to break out of the current range of 92.5–94.00.

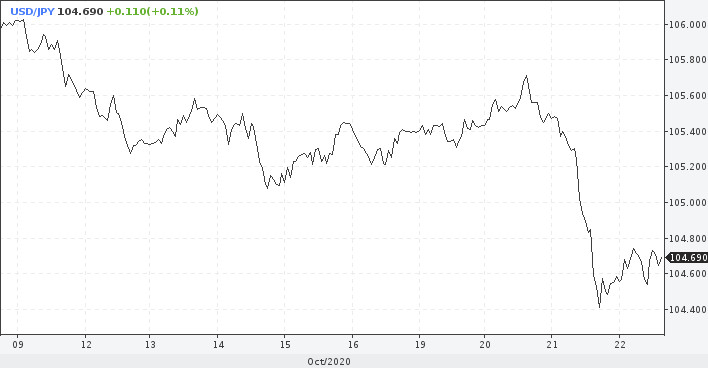

The USD/JPY pair fell to the level of 104.5, from where it moved to growth more than once over the past 4 years.

The dynamics of this currency pair are strongly linked to market sentiment. Its weakening indicates increased anxiety. This week, you need to carefully monitor its movement. If we see a rebound, it will be possible to push aside fears and tune in to restore optimism on trading platforms. If the yen rises, we should not rule out a stronger sell-off in the stock market.

Investors are concerned about the constantly weakening dollar and are waiting for the results of the US election. However, it is still difficult to predict what will result in the victory of this or that candidate, whether that would be the failure of the dollar, or Vice versa – growth. It doesn't matter who takes the position, but the succeeding US President will have to face all the same problems in the economy, including the huge national debt and the need to increase it in the face of a pandemic.