The US dollar continues to regain ground against the European currency after investor optimism faded. Market participants doubt that the fiscal stimulus will be adopted before the US election. The speculations about this topic and alleged progress on this issue have been pressing on the US dollar for the first half of this week. Now, when negotiators have again failed to reach a compromise over the size of a new stimulus package, risk assets are gradually losing their luster among investors. If Democrats win the election, the new president will take office only on January 20. So until then, the US lawmakers are unlikely to return to the issue of additional fiscal policy.

However, the US presidential debates held today may weaken the US dollar. If Joe Biden wins again, the greenback will soon come under pressure. Experts point out that today's debate may be the last chance for Donald Trump to catch up with Biden in this election race.

Now, let's talk about numbers and economic indicators.

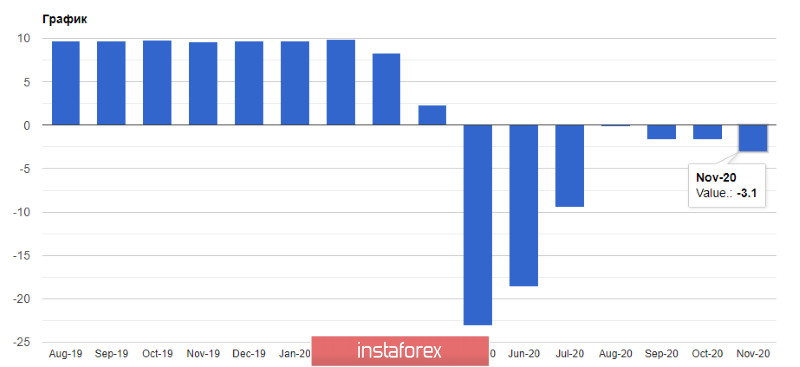

Early in the day, German consumer confidence index for November was released. Although it is a forward-looking indicator, it has already negatively affected the European currency. The indicator dropped even more, pointing at negative dynamics in German economy. The report from the market research group GfK showed that the consumer confidence index in Germany will fall to -3.1 in November from -1.6 in October. Economists projected the November indicator to be at -3.0. According to the survey, the main threat comes from the spread of the Covid-19 pandemic, as a rapid rise in new cases leads to tightening of restrictive measures. If the situation around COVID-19 deteriorates, strict quarantine measures will be introduced.

In addition, the rising public debt of the eurozone indicates the challenges that the European countries have faced during the pandemic. Today's report showed that the euro area budget deficits increased to 11.6% of the GDP, up from 2.5% in the first quarter of 2020. In the United States, for example, the indicator has approached 16.1%. The government debt to GDP ratio in the euro area stays at 95.1%, which is comparable to that of the United States.

Last week, the International Monetary Fund issued new recommendations for countries and supported further spending to keep households and companies afloat. Worries about increasing public debt should be left until later.

As for the current technical picture for the EUR/USD pair, the euro has come under pressure, and the breakthrough of the 1.1840 support level has dampened the risk sentiment. At the moment, the euro bulls have found support in the area of 18. There, we may soon observe another spike in the number of long positions. If the bulls fail to sustain momentum, then the euro will most likely pull back to the low of 1.1760. To regain control, buyers of risk assets need to wait until the price rises above 1.1840 and settles firmly there until the end of the trade. In this case, the pair will have a chance to test new weekly highs in the 1.1880 area and stay in the bull market.