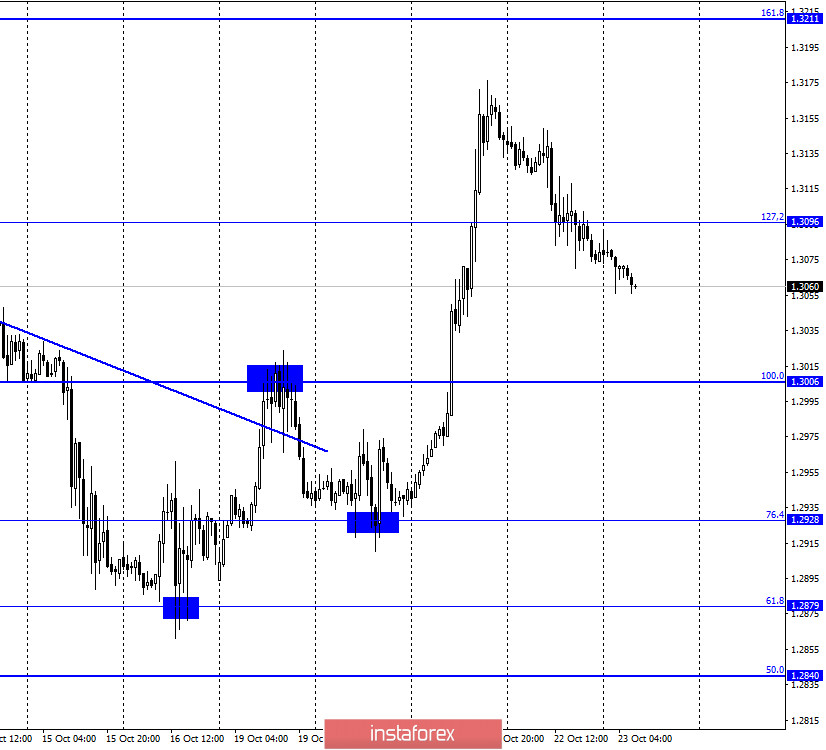

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US currency and began the process of falling, within which they also consolidated under the corrective level of 127.2% (1.3096). Thus, now traders can expect a further drop in quotes in the direction of the next Fibo level of 100.0% (1.3006). Paired with the British dollar, the US dollar received little support from traders yesterday thanks to a report on applications for unemployment benefits and a relatively calm debate between Donald Trump and Joe Biden this night. However, I would like to remind you that it is the British dollar that has been growing in price in recent weeks, and the information background remains extremely unfavorable for this currency. Thus, I continue to lean towards the option that the fall in prices will continue and even increase in the near future. Traders have experienced some optimism over the past few weeks. Still, it is too early to put an end to the trade agreement between Brussels and London. However, I personally still don't understand what exactly the bull traders were counting on. There are still no prerequisites for agreeing. There is no progress in the negotiations. Boris Johnson and EU representatives continue to blame each other for the "impasse". Thus, the growth of the British at these events looks at least strange. However, it's possible that bear traders were just taking a crackdown to start selling the pound at better prices. In any case, I am inclined to a new drop in prices.

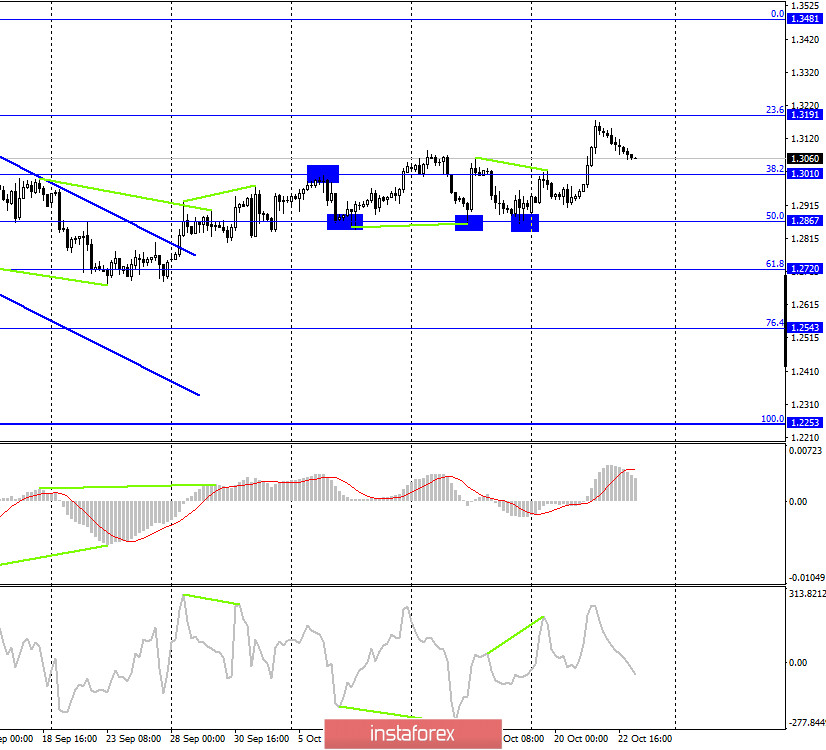

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar near the corrective level of 23.6% (1.3191). Thus, the process of falling in the direction of the Fibo level of 38.2% (1.3010) began. The pair's rebound from this level will again work in favor of the British dollar and resume the growth process. I am more inclined to consolidate below this level and further fall in the direction of the corrective level of 50.0% (1.2867).

GBP/USD – Daily.

On the daily chart, the pair's quotes consolidated above the corrective level of 76.4% (1.3016), which allows us to expect further growth in the direction of the corrective level of 100.0% (1.3513). However, the lower charts already indicate the opposite mood of traders.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. However, in recent weeks, it has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

On Thursday, the Governor of the Bank of England, Andrew Bailey, made a speech in the UK, who said nothing interesting. Traders calmed down after a totally crazy Wednesday.

News calendar for the US and the UK:

UK - PMI for the manufacturing sector (08:30 GMT).

UK - services PMI (08:30 GMT).

UK - composite PMI (08:30 GMT).

US - manufacturing PMI (13:45 GMT).

US - services PMI (13:45 GMT).

On October 23, the UK and US news calendar contain indices of business activity in the service and manufacturing sectors.

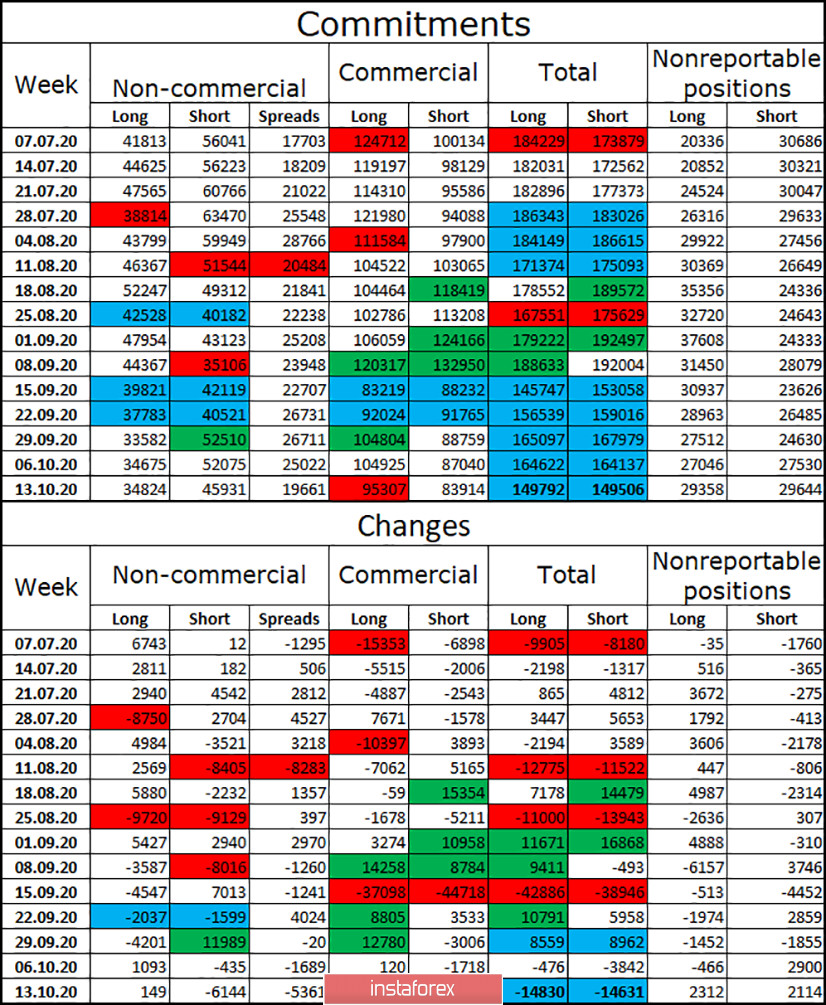

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed that the category of "Non-commercial" traders got rid of short contracts in the reporting week, closing more than 6 thousand in total. Long-contracts speculators opened only 149. Thus, the mood of major speculators has become more "bullish", which is quite strange, since in recent months there has been a desire to sell the British, rather than buy it. However, the last three weeks are left to the bull traders. At the same time, it is very difficult to say that the pound is showing strong growth. Most likely, the situation is as follows: due to the strong information background, major players often change their decisions, and the Briton often changes the direction of movement.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with a target of 1.3006, as it was fixed under the corrective level of 127.2% (1.3096) on the hourly chart. I recommend buying the British dollar with a target of 1.3191 if the rebound from the level of 38.2% on the 4-hour chart is completed.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.