In yesterday's trading, the US dollar dominated the foreign exchange market, as expectations for a new COVID-19 aid package before the presidential elections weakened and the number of people infected with the new type of coronavirus infection in various countries of the world increased significantly. This situation has led to increased demand for protective assets, one of which is the US dollar.

As for the negotiations on the adoption of a new package of assistance from COVID-19, market participants remain hopeful that before the US presidential election, the parties will agree and take measures to further stimulate the world's leading economy. In particular, the Speaker of the House of Representatives of the United States of America Nancy Pelosi is optimistic about this possibility, who hopes that the aid program can be adopted before November 3, when the US presidential election will be held. According to her, the negotiations are going well and the parties are close to reaching an agreement.

Now, let's briefly talk about yesterday's statistics and what events to expect on the last day of the trading week. Yesterday's data on applications for unemployment benefits fell to 787,000, although forecasts suggested a figure of 860,000. However, according to economists, this level is quite high. Data showed that the labor market is showing a fairly slow recovery. In the run-up to the second wave of COVID-19, this factor worries investors. On the other hand, the leadership of the Federal Reserve System (FRS) has repeatedly pointed out that the recovery will be slow and long. Today, market participants will focus on indices of activity in the manufacturing and services sectors of the Eurozone and the United States. The Europeans will submit reports at 09:00 (London time), and the US will publish similar data at 14:45 London time.

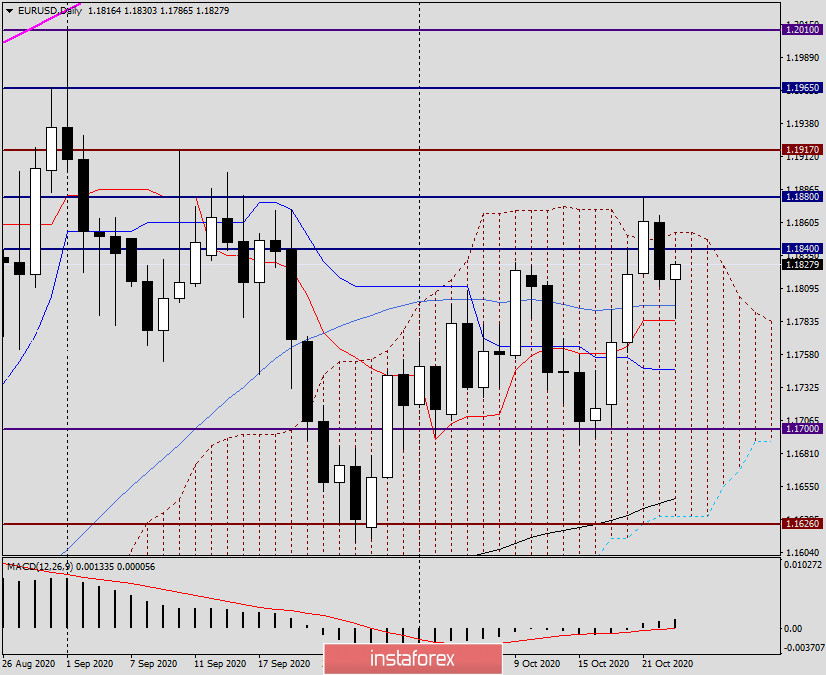

Daily

As you can see, one candle that closed above the upper border of the daily cloud was not enough to consider the exit from it true. In previous materials, it was repeatedly noted that for a true breakdown, it is necessary to fix three candles in a row, and even then, this does not always give a guarantee that the breakdown took place. There are no guarantees in the market at all, it is always full of surprises and changes in price movement. Yesterday, despite the previous strong growth, the pair failed to overcome the strong technical zone of 1.1840-1.1880 and returned to the cloud limits. Today, at the moment of writing, the bears intended to continue the pressure on the quote, but at the level of 1.1786, the pair found strong support and turned up. There is little doubt that the 50 simple moving average and the Kijun line of the Ichimoku indicator provided additional support for the price. Now players on the increase need to bring the price up again from the daily cloud and close the auction higher.

H1

Here you can see how strong the pair was supported by the 200 exponential moving average, which twice repelled bear attacks. Given that the rebound has already occurred, and now the euro/dollar is actively growing, you can try to buy aggressively at current prices. It is less risky to buy after a breakout and fixing above the black 89 exponential, on a rollback to this moving average. If bearish patterns of Japanese candlesticks appear in the area of 1.1835-1.1840, this will be a signal to open short positions on the EUR/USD pair. We will try to find a more detailed analysis and more unambiguous trading ideas on Monday. Taking into account the completion of the current week trades, the situation might become more clear.