The GBP / USD pair, after rising sharply on October 21, reached the local high of 1.3175, relative to which a correction arose, which returned the overheated quote to the level of 1.3080.

This technical correction is exactly what the pound needs amid its overbought status, because if we look at the dynamics, we will see that the market is not really active, and that it was speculation that drove the pound into rising.

Should we expect a new local high soon? Probably.

Speculators have already set the pace that no one is confused anymore why the pound is rising despite many problems in the UK.

The market will remain in control of speculative positions, to which information noise will become a lever for.

So, if we look at the M15 chart and analyze the trades set up yesterday, we will see that the main trading volume fell during the European session, so as a result, a low activity of only 81 points was recorded.

To add to that, as discussed in the previous review, traders were already waiting for a technical correction towards 1.3080, which really happened in the market.

With regard to news, a rather good data was published on the US labor market, and this is a decrease in jobless claims. According to the report, repeated applications decreased from 10,018,000 to 9,397,000, while initial applications fell from 898,000 to 840,000. This recovery in the US labor market had a positive effect on the US dollar.

Meanwhile, today, data on UK retail sales was released, the figure of which grew from 2.7% to 4.7%, against the forecast of 3.7%. This growth in consumer activity had a positive effect on the British pound.

However, after that, preliminary data in UK business activity was published, which indicated a decline in the indicators.

Services PMI: Prev - 56.1 ---> Forecast - 52.3

Manufacturing PMI: Prev - 54.1 ---> Forecast - 53.3

In the afternoon, a similar data for the United States will be published, but here, the forecasts are practically the same as their previous levels.

Services PMI: Prev - 54.6 ---> Forecast - 54.6

Manufacturing PMI: Prev - 53.2 ---> Forecast - 53.4

The upcoming trading week highlights data for Europe and the United States. However, the market, as before, will focus more on the information background, particularly on hot topics such as the coronavirus, Brexit and the US elections

Monday, October 26

US 15:00 - New Home Sales (September)

Tuesday, October 27

US 13:30 - Orders for durable goods (September)

Thursday, October 29

US 13:30 - Claims for unemployment benefits

US 13:30 - Preliminary GDP (Q3)

EU 13:45 - ECB meeting and press conference

Further development

As we can see on the daily chart, activity surged in the GBP / USD pair during the European session, which led to a local move towards 1.3100. However, after that, price returned again to its previous level.

If the quote continues to concentrate at the level of 1.3080, a short-term flat may occur on the pair. But if it consolidates below 1.3055, the pound will move down to the psychological level of 1.3000.

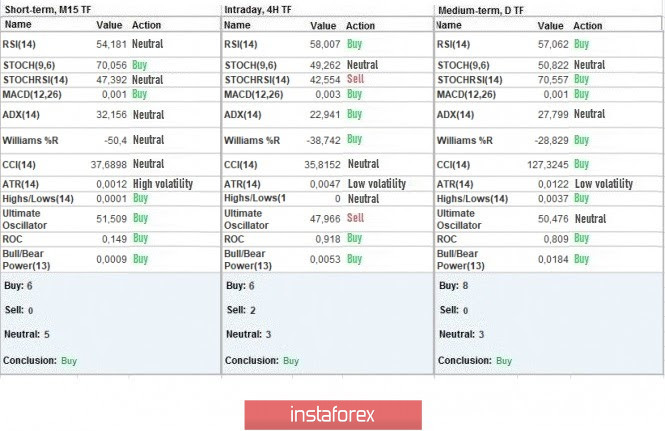

Indicator analysis

Looking at the different sectors of time frames (TF), we can see that the indicators on the minute and hourly periods signal BUY due to the quote stopping at the local high, whereas the daily period is signaling BUY because of the general upward move of the British pound in the market.

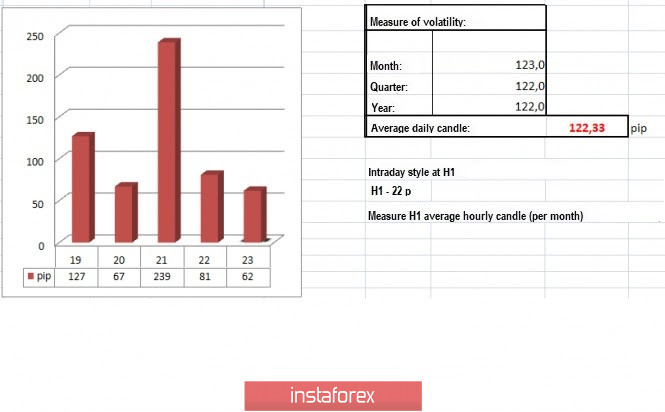

Weekly volatility / Volatility measurement: Month; Quarter; Year

Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year.

(The dynamics for today is calculated, all while taking into account the time this article is published)

Volatility is currently at 62 points, which is 49% below the average level.

It is presumed that speculative activity will again appear in the market, and, after a slight slowdown, an acceleration above 100 points will occur.

Key levels

Resistance zones: 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Zones: 1.3000 ***; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411).

* Periodic level

** Range level

*** Psychological level

Also check the trading recommendations for the EUR/USD pair here, or brief trading recommendations for the GBP/USD pair here.