Technical outlook:

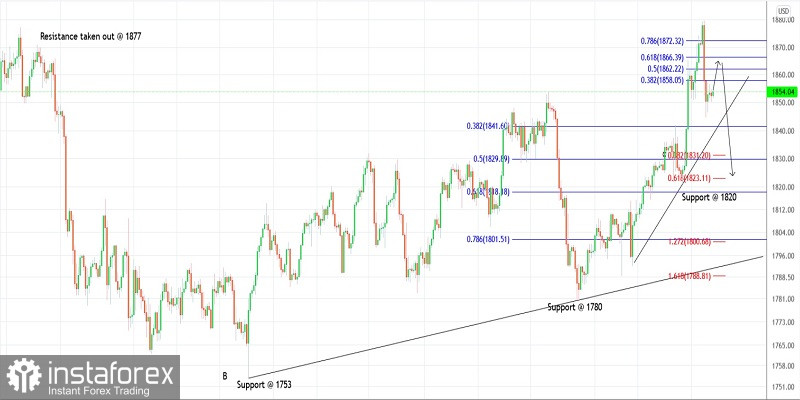

Gold prices reached close to $1,880 mark on Tuesday before reversing sharply. The yellow metal has reacted in line with expectations and projections as bears took control dragging prices through $1,844 mark, the day;s low. It is pulling back through $1,855 at the time of writing and potential remains for a push through $1,865-66 near term.

Gold is expected to face resistance around $1,865-66 and turn lower towards $1,820-25 in the immediate future. Also note that fibonacci 0.618 retracement of the drop between $1,880 and $1,844 is seen around $1,865-66 and hence potential for a bearish reversal there remains strong. Bears are poised to remain in control until prices stay below $1,880.

Gold is working on the upswing between $1,780 and $1,880 levels as seen on the 4H chart here. The Fibonacci 0.618 retracement of above rally is seen through $1,818-20 mark, which also converges with counter trend extension (shown in the Red). High probability remains for a bullish reversal if prices drop through $1,818-20 mark and bounces back.

Trading plan:

Potential drop to $1,820 against $,1885 then rally.

Good luck!