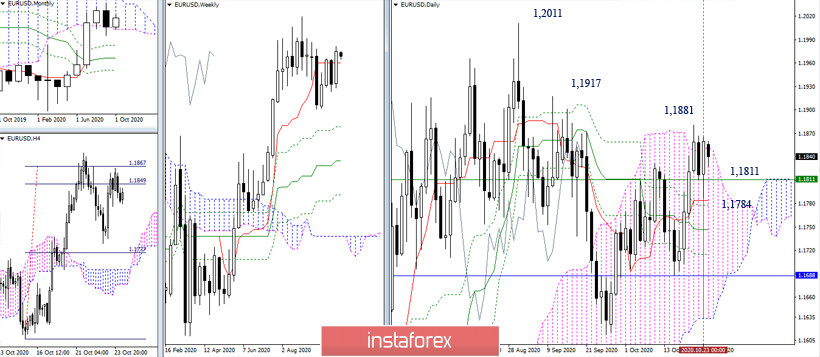

EUR / USD

The bulls closed the previous week very positively, but there is no need to talk about global changes and advantages yet. The pair remains in the daily and weekly downward correction zone and is still fixed to the daily cloud; however, attempts to consolidate in the bullish area relative to the cloud have not yet been successful. Therefore, these tasks remain to be the bulls' main task. The nearest upward benchmark can now be the maximum extremes of 1.1881 - 1.1917 - 1.2011. The support levels of short-term trends 1.1811 (weekly Tenkan) and 1.1784 (daily Tenkan) will be lost if the bulls failed to changed the situation.

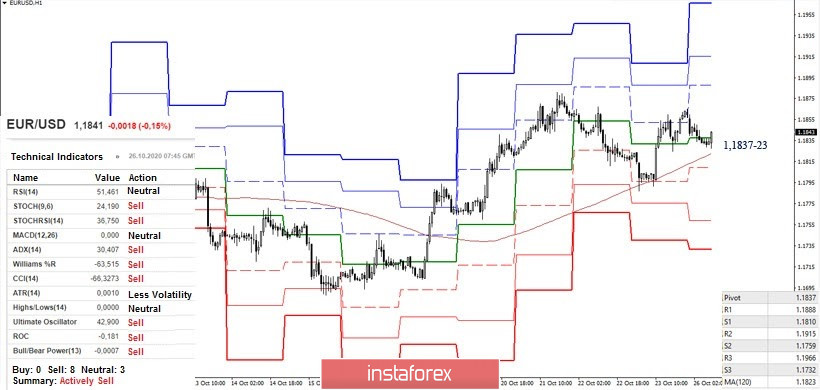

In the hourly time frame, the main advantage on H1 is still on the bulls' side. However, the pair is testing key supports that are responsible for the distribution of forces. Now, the analyzed technical indicators have already tuned in to support bearish moods. If the levels of 1.1837-23 (1-week long-term trend + central pivot level) will be broken, it may contribute to the strength of the bears and its mood.

On the other hand, maintaining the support levels of (1.1837-23) and restoring the upward trend (1.1865-81) will return the relevance of upward targets within the day in the form of classic pivot levels (1.1888 - 1.1915 - 1.1966). In turn, breaking through the support levels (1.1837-23) will change the balance of power in favor of the bears. The next support levels are located today at 1.1810 - 1.1759 - 1.1732.

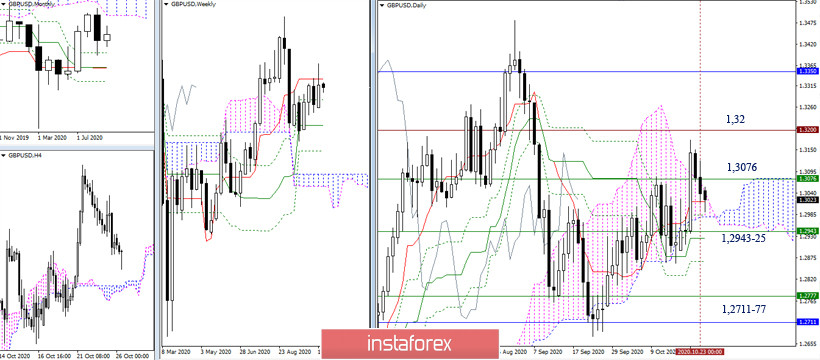

GBP / USD

The bears almost did not leave the opponent with hopes of continuing growth in the near future. At the closing of last week, they formed a long upper shadow and closed below the weekly short-term level (1.3076) in the daily cloud. Currently, a cluster of supports from the daily cross and cloud levels (1.3018 - 1.2980) is being tested. Next, 1.2925-43 (daily Kijun + weekly Fibo Kijun) will be important. The accumulation of such strong supports in a fairly narrow range can restrain further development of the situation and contribute to consolidation. Moreover, a successful break through of 1.2925-43 will most likely return activity to the bears and send them back to retest the level of 1.2711-77 (monthly Fibo Kijun + weekly Tenkan).

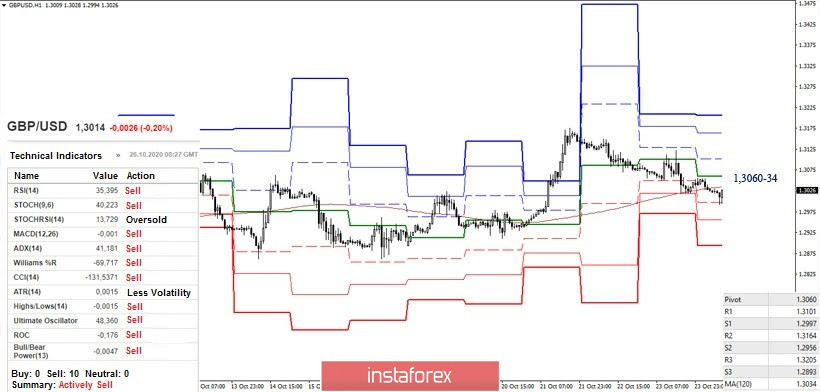

The pair continued to decline with the opening of a new trading week. The bulls have lost key supports of the smaller time frames. At the moment, retesting the overcome levels 1.3060-34 (weekly long-term trend + central pivot level) is possible. Trading below these levels and a reversal of moving averages will keep bearish sentiments, contributing to their strengthening. The return of the levels (1.3060-34) to the bulls, on the other hand, will contribute to uncertainty and the appearance of new opportunities to restore bullish positions.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)