Crypto Industry News:

Amid subsequent reports that the Bank of Russia rejected the Finance Ministry's proposal to regulate cryptocurrencies, the central bank began testing its own digital currency.

The Russian central bank officially launched the digital ruble test, successfully completing the first transfers of the central bank's digital currency among citizens, it announced on Tuesday. The premiere is in line with the bank's plans to debut the first digital ruble transactions at the beginning of 2022.

"Three banks from 12 financial institutions in the digital ruble pilot group have already integrated the CBDC platform, and two of them have completed" a full cycle of digital ruble transfers between customers using a mobile banking application, "the bank said.

Olga Skorobogatova, first vice president of the Bank of Russia, stated that the digital ruble was "a new opportunity for citizens, businesses and the state," adding that such transactions would be free and available in every region of the country.

The Bank of Russia also pointed out that the digital ruble will be unique in that it will be available through "any customer service bank's mobile application".

The announcement of the Bank of Russia came along with local reports that it officially opposed the Ministry of Finance's cryptocurrency-friendly regulation concept introduced on February 8.

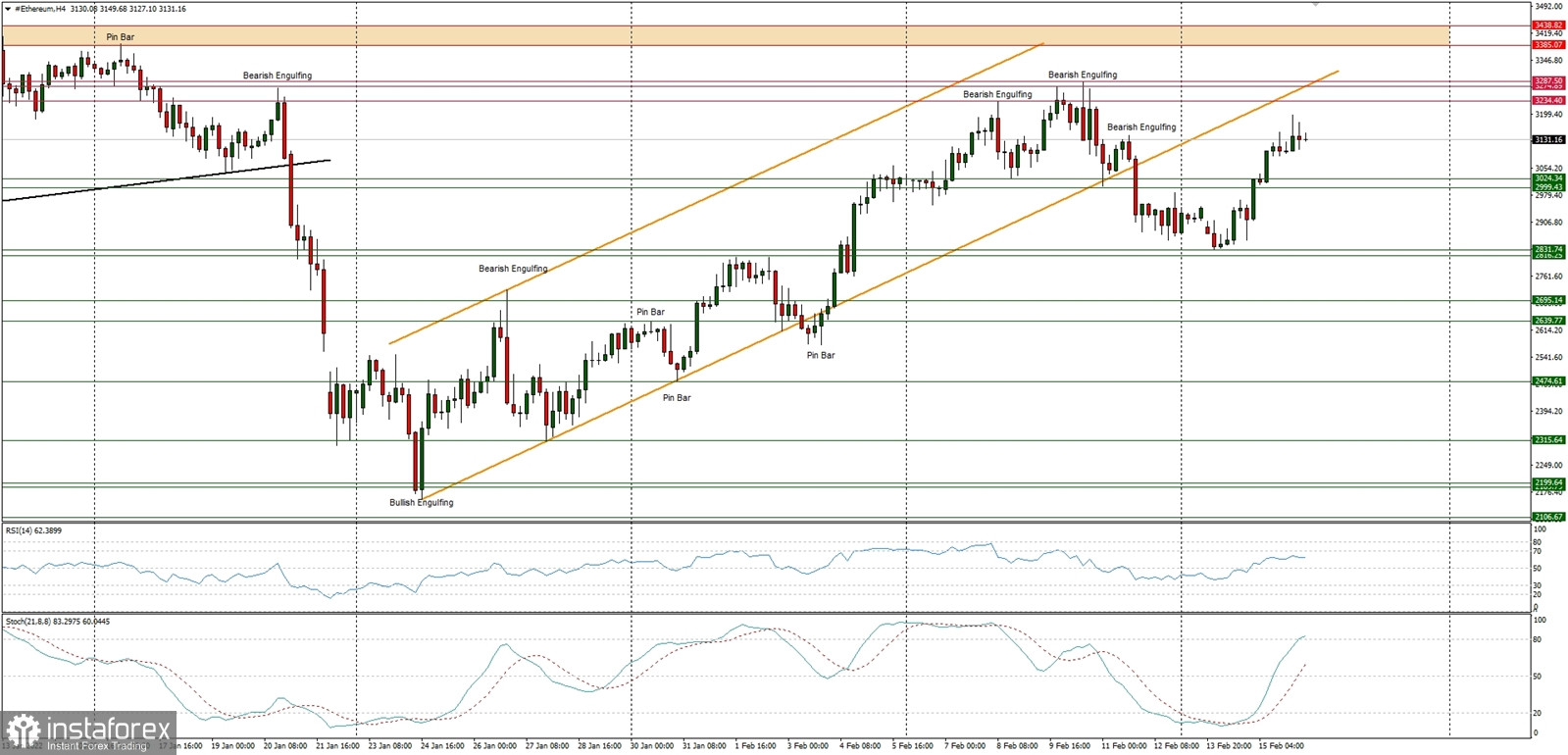

Technical Market Outlook

The ETH/USD pair has made the local high at $3,198 (at the time of writing the article). The next target for bulls is the supply zone located between the levels of $3,385 - $3,438. The nearest technical support is seen at $3,024 and $2,999. The intraday technical resistance is located at $3,234. The bulls are in control of the market on the higher time frames as the momentum is strong and positive on the daily time frame chart as well, so the market is bouncing from the extremely oversold conditions.

Weekly Pivot Points:

WR3 - $3,490

WR2 - $3,400

WR1 - $3,079

Weekly Pivot - $2,975

WS1 - $2,651

WS2 - $2,541

WS3 - $2,228

Trading Outlook:

The market is bouncing after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,436 is the next key technical resistance for bulls. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term