To open long positions on GBPUSD, you need:

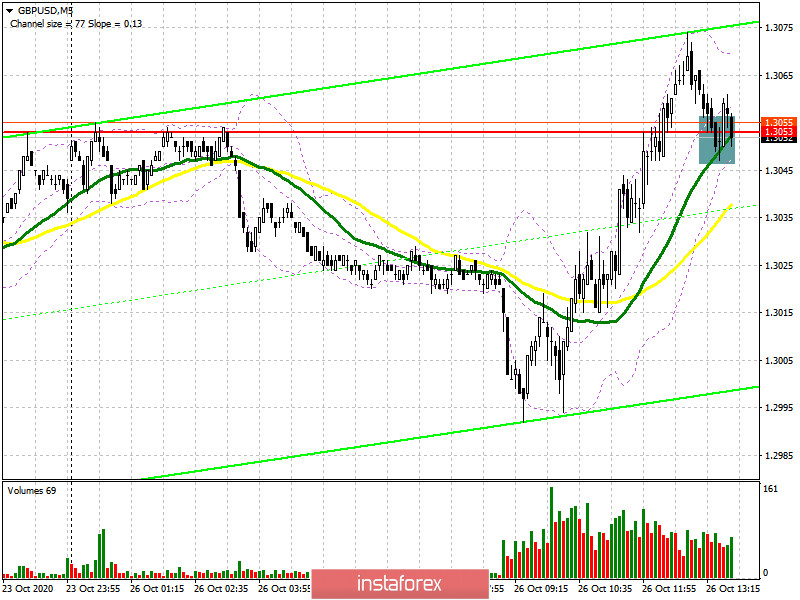

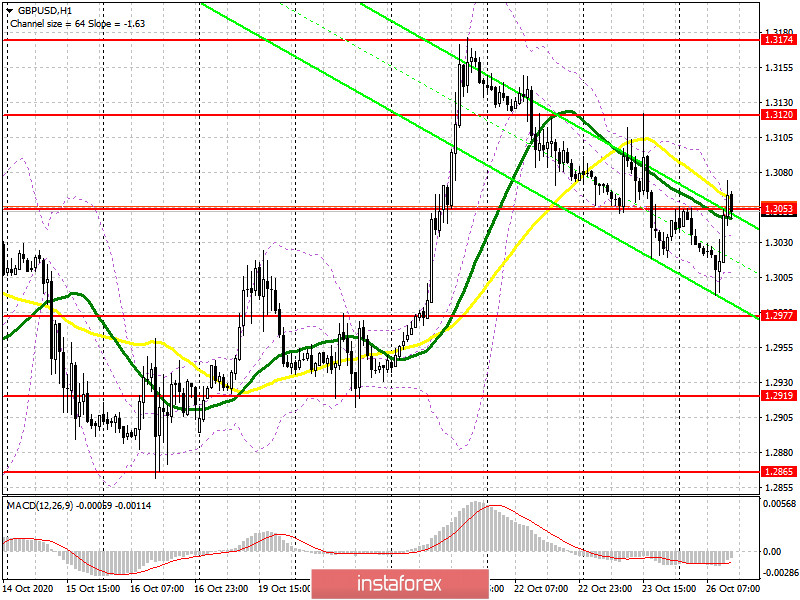

In the first half of the day, it was possible to observe the bulls' attempt to return to the resistance area of 1.3053, however, it was not possible to wait for the formation of a signal to enter long positions there. Let's figure out why. We can see that on the 5-minute chart, immediately after the price fell to the level of 1.3053 to test its strength, the bulls failed to keep the pair above this range. All that remains now is a price return and a trade above 1.3053. Only in this case, you can count on the continuation of the upward trend of the pair to the area of a new local maximum of 1.3120, where I recommend fixing the profits. A longer-term target will be the area of 1.3174, however, it will only be available if there is good news on Brexit. If the bears are stronger in the second half of the day and return the pressure on the pound, then I recommend opening new long positions only for a rebound from the new local minimum of 1.2977, based on a correction of 20-30 points within the day.

To open short positions on GBPUSD, you need:

The bears are still defending the resistance of 1.3053. All they need to do in the second half of the day is to form a false breakout and return the pair to the level of 1.3053, which will be a signal to open short positions. In the meantime, on the 5-minute chart, we can see an active struggle for this range. If a sell signal is formed for the pound, we can expect the pair to return to the support area of 1.2977, where I recommend fixing the profits. The area of 1.2919 will be a more distant target. If the bulls turn out to be stronger and the growth of GBP/USD continues in the second half of the day, then you can open short positions for a rebound from the new local maximum in the area of 1.3120 in the expectation of a downward correction of 20-30 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for October 20, there was a reduction in short and a sharp increase in long positions. Long non-commercial positions increased from the level of 36,195 up to level 39 836. At the same time, short non-commercial positions fell from the level of 45,997 to the level of 41,836. As a result, the negative value of the non-commercial net position increased slightly to -2,000, against -9,802 a week earlier, which indicates that sellers of the British pound remain in control and have a minimal advantage in the current situation.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily averages, which limit the upward correction of the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Only a breakdown of the lower border of the indicator around 1.3005 will increase the pressure on the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.