GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair fell to the corrective level of 100.0% (1.3006), giving a rebound from this level and began the growth process. However, at the moment, a downward trend corridor has also been built, which characterizes the current mood of traders as "bearish". Closing the pair's rate over this corridor will work in favor of the British dollar and greatly increase its chances of growth in the coming days. At the same time, the growth of the British dollar still looks extremely doubtful. At this time, there is a situation where the information background for the pound is almost unambiguous. There is still no trade deal with the EU, Brexit is inexorably approaching, the problems of the British economy are visible from a distance of 10 kilometers without glasses, and in the last month, the country was also mired in a new outbreak of coronavirus. However, traders are now trying not to get rid of the Briton and are trying to respond to the full range of news related to Brexit. In other words, traders are not completely pessimistic about the British currency. Whether this is correct or not, there is no point in discussing it. Traders behave like this now, so you need to adapt to the majority. And since the information background is not in the first place now, you need to pay more attention to graphic signals in trading. However, new information from the negotiations, which are currently ongoing in London, can be received at any time. And it can affect the mood of traders.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a fall to the Fibo level of 38.2% (1.3010). The pair's rebound from this level will allow traders to count on a reversal in favor of the British dollar and new growth in the direction of the corrective level of 23.6% (1.3191). Fixing quotes below the level of 38.2% will increase the probability of continuing to fall in the direction of the next corrective level of 50.0% (1.2867).

GBP/USD – Daily.

On the daily chart, the pair's quotes consolidated above the corrective level of 76.4% (1.3016), however, the reversal in favor of the US currency has already been completed and the fall has begun. More important now is the 4-hour chart and the corrective level of 38.2% on it.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. However, in recent weeks, it has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

There were no economic reports in the UK and America on Monday. There was also no new information about the progress of negotiations between the UK and the European Union, which are currently ongoing in London and have even been extended for several days.

News calendar for the United States and the United Kingdom:

US - changes in the volume of orders for durable goods (12:30 GMT).

On October 27, the news calendar of the UK and US contains only one report, but at any time, there may be important information from London about whether Michel Barnier and David Frost have agreed or not this time.

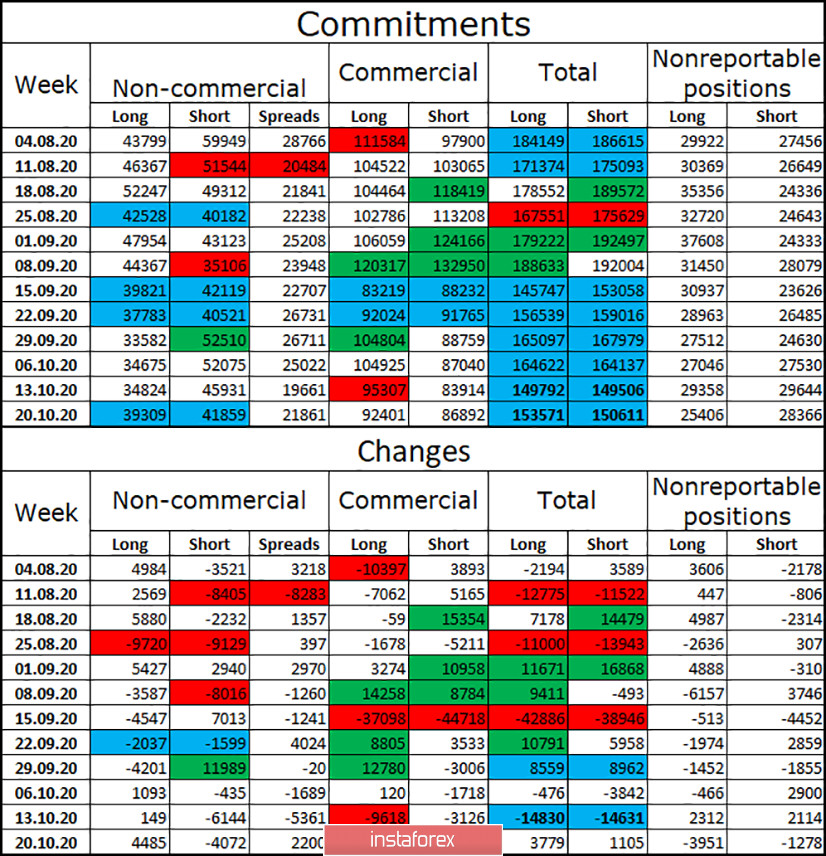

COT (Commitments of Traders) report:

The latest COT report on the British pound that was released last Friday showed that the mood of the "Non-commercial" category of traders has become more "bullish". Speculators immediately increased by 4.5 thousand long-contracts and got rid of 4 thousand short-contracts. Thus, after three weeks of "bearish" advantage, speculators are again inclined to buy the British. However, I believe that such a change in mood does not mean anything specific. In a week or two, major players can start building up short contracts again. And the total number of long and short contracts focused on their hands is almost the same. Thus, I would conclude that the major players are now in disarray.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with a target of 1.2867, if the consolidation is made under the corrective level of 38.2% (1.3010) on the 4-hour chart. I recommend buying the British dollar with a target of 1.3191 if there is a rebound from the level of 38.2% on the 4-hour chart or a close above the descending corridor on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.