Conditions to open long deals on the euro/dollar pair:

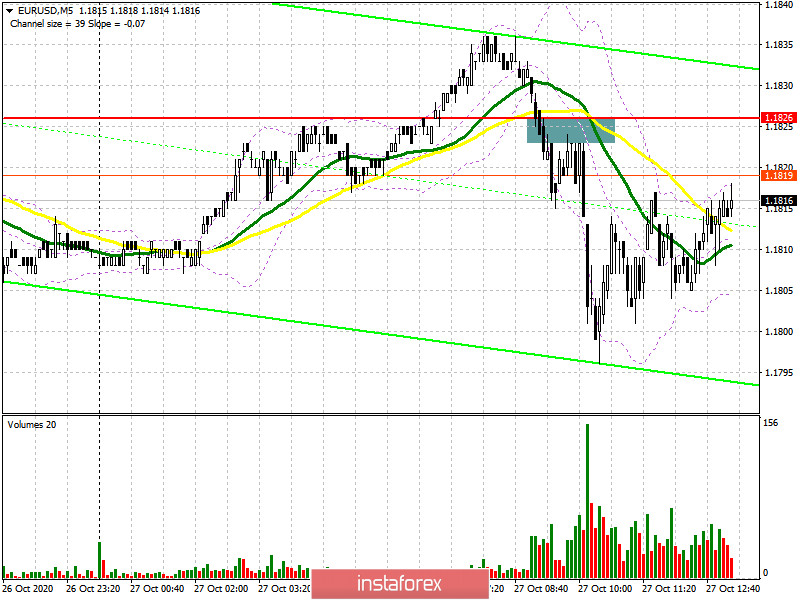

In the early forecast, I emphasized that buy deals on the euro could be opened only after a consolidation above 1.1826. However, bulls failed to do this. Let's take a look at the five-minute chart. We can see that bulls are trying to break the resistance level of 1.1826. They may even succeed in it. However, a downward break of this level, which should have become a signal to open long deals, turned out to be unsuccessful. That is shy the euro/dollar pair returned to the area of 1.1826. After that, bears formed a good entry point for short positions. This led to a new wave of short positions. However, the euro managed to keep its positions amid a lack of important fundamental data.

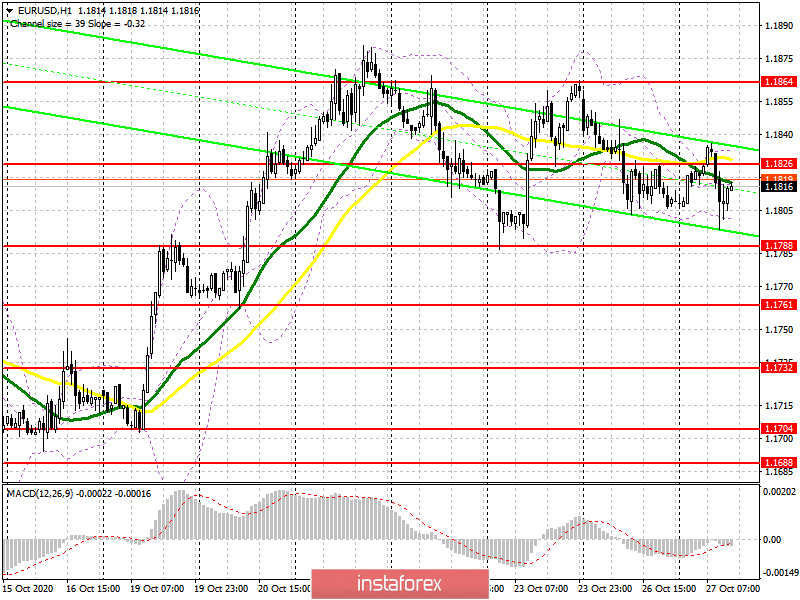

In the second half of the day, the main aim of buyers is to regain control over the resistance level of 1.1826. Only consolidation on the level and its break could provide a good signal to open long deals. In this case, the uptrend is likely to continue. At the same time, bulls should return to the high of 1.1864 where it is recommended to take profit. If the euro continues falling, the lower limit of the range located at 1.1788 will act as a support level. However, long deals could be opened only in case of a false break. It is possible to buy the euro/dollar pair from the low of 1.1762 with the correction of 15-20 pips within one day.

Conditions to open short deals on the euro/dollar pair:

Sellers regained control over the support level of 1.1826, thus forming a signal to open short positions. The euro is likely to lose in value until traders perform deals below the mentioned level. Bullish momentum is fading away. The closest target is the pair's return to the support level of 1.1788 where it is recommended to take profit. The low of 1.1761 is the next target. However, the pair reach it only amid strong data on the US consumer activity. If the euro/dollar pair climbs above 1.1826 and sellers show tepid activity at this level in the second half of the day, it is better not to open short positions. Instead, it is recommended to wait for the update of the high of 1.1864 and sell the euro there.

Notably, the COT report on October 20 revealed a simultaneous rise in the number of both long and short positions. However, there were more short deals that led to an even greater drop in the positive delta. Despite this fact, buyers of risky assets expect a continuation of the bullish trend. However, they remain cautious due to the lack of good news from the eurozone. Thus, long non-profit positions rose from the level of 228,295 to t 229,878, while short non-profit positions advanced from 59,658 to 63,935. The total non-commercial net position fell to 165,943 from 168,637 a week earlier. However, bullish control over the euro remains quite high in the medium term. The deeper the euro declines against the US dollar at the end of this year, the more attractive it will be for new investors.

I recommend reading my video forecast for today.

Signals of the indicator:

Moving Averages

Trading is conducted around the 30- and 50-day moving averages, which indicates the sideways nature of the market.

Note: the period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the upper limit of the indicator in the area of 1.1835 will lead to a new wave of growth in the pair. A break of the lower limit of the indicator located at 1.1805 may increase the pressure on the euro.

Description of indicators

- Moving average (a moving average that determines the current trend by smoothing out volatility and noise). Period is 50. It is marked in yellow on the chart.

- Moving average (a moving average that determines the current trend by smoothing out volatility and noise). Period is 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence is a convergence/divergence of moving averages). The small EMA period is 12. The big EMA period is 26. The SMA period is 9.

- Bollinger Bands. Period is 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet particular requirements.

- Long non-commercial position represents a total long open position of non-commercial traders.

- Short non-commercial position represents a total short open position of non-commercial traders.

- The total non-commercial net position is a difference between short and long positions of non-commercial traders.