To open long positions on GBP/USD, you need:

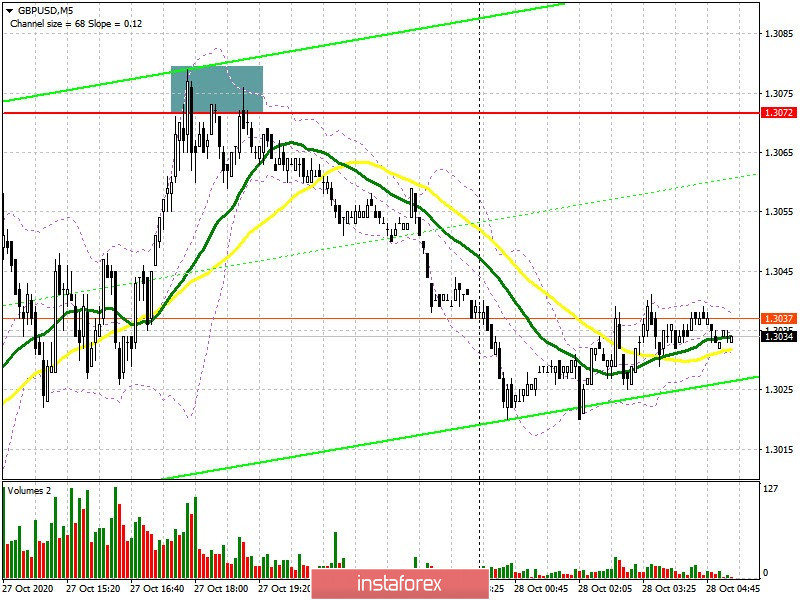

The pound formed an excellent sell signal yesterday afternoon, and I drew attention to the high probability of its appearance in my review. Let's take a look at the 5-minute chart and break down the trade. You can see how the bulls are approaching resistance at 1.3072 in the afternoon, and it is difficult to go above it. Each attempt to cling to this level leads to a quick return to the area below it. After some time, testing this area from the bottom up and closing below it led to forming a good entry point for short positions. The pound lost more than 40 points by the end of the day.

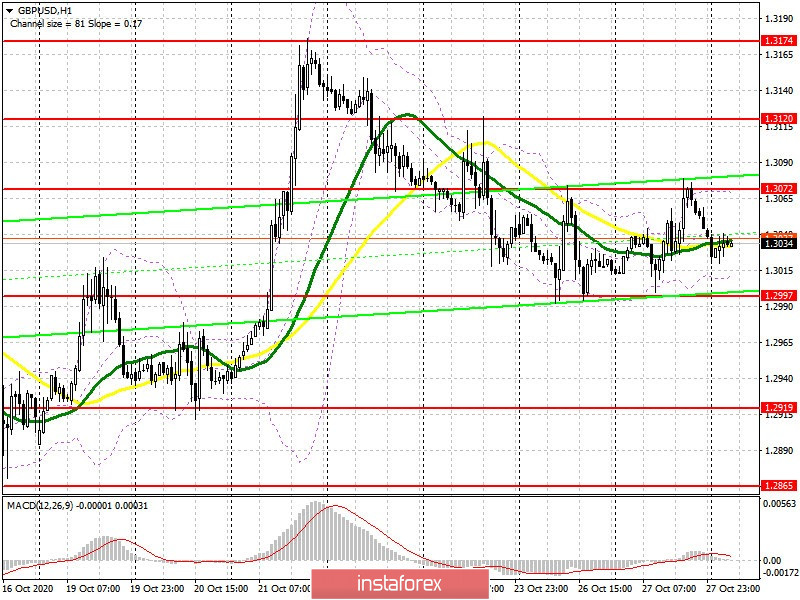

Everyone is waiting for decisions on the trade deal and any news related to it. Any insider information will lead to a sharp movement for the pound in one direction or another. Buyers still need to protect support at 1.2997, and forming a false breakout on it will be a signal to open long positions in order to return to yesterday's resistance at 1.3072. However, only a breakout and being able to settle at this level will result in producing a good additional entry point into long positions, and could also lead the pound to highs of 1.3120 and 1.3174, where I recommend taking profits. In case GBP/USD falls below the 1.2997 level, it is best not to rush into long deals, but to wait until the 1.2919 low has been updated, where you can open long positions only if a false breakout is formed. I recommend buying GBP/USD immediately on a rebound, but only in the area of large support at 1.2865, counting on a correction of 20-30 points within the day. You need to understand that in case we receive negative news on Brexit, trading against the newly formed trend even for a rebound from the mentioned levels will not be a completely correct decision.

The Commitment of Traders (COT) report for October 20 showed a reduction in short positions and a sharp increase in long positions. Long non-commercial positions rose from 36,195 to 39,836. At the same time, short non-commercial positions fell from 45,997 to 41,836. As a result, the negative value of the non-commercial net position slightly increased and reached -2,000, against - 9,802 a week earlier, which indicates that the sellers of the pound retain control and also shows their minimal advantage in the current situation.

To open short positions on GBP/USD, you need:

Sellers of the pound will focus on the breakout and settle under the support of 1.2997, since this will increase the pressure on the pair and pull it down to the 1.2919 level, where I recommend taking profits. A stronger bearish momentum will only emerge if disagreements persist in the UK-EU trade deal. A break and being able to settle below 1.2919 forms a good entry point for short positions while expecting to update the lows of 1.2919 and 1.2865, where I recommend taking profits. If the pound is still in demand in the morning, then, just like yesterday, I do not recommend rushing with sell positions. It is best to open short positions from the resistance of 1.3072, subject to forming a false breakout there, similar to yesterday, or sell GBP/USD immediately on a rebound from the 1.3120 high, counting on a correction of 20-30 points within the day.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates some market uncertainty.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the upper border of the indicator in the 1.3072 area will lead to a new wave of growth for the pound. A breakout of the lower border at 1.3010 will increase pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.