The dollar climbed up in the market yesterday, after Donald Trump announced his decision to postpone negotiations on the new economic aid package. To add to that, the persistent rise of COVID-19 around the world, as well as the increasing risk of another closure and lockdown, are decreasing the demand for risky assets, thereby boosting up the attractiveness of the dollar to traders.

Although many already expected that the Congress would fail to agree on a stimulus package before the US elections, the dollar still jumped up when Donald Trump confirmed this. Aside from that, the US president also promised that he will make every effort to ensure that the US economy receives the best aid programs after the elections, especially since he is confident that the Republicans will not only retain the majority in the Senate, but will also regain the House of Representatives.

Against this background, the EUR / USD pair resumed its decline in the market, and, to maintain this pressure on risky assets, the bears need to push the quote even lower, past the support level of 1.1760. Such will lead to the demolition of a number of buy stop orders, which will push the quote down to lows 1.1730 and 1.1960. But if the bulls regain control in the market, and this will be possible if the euro consolidates above the resistance level of 1.1835, the quote would have a chance to reach the highs 1.1880 and 1.1920.

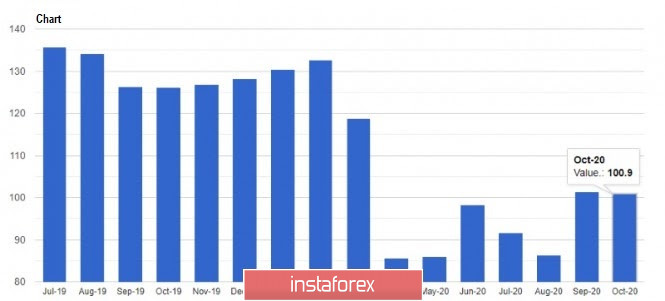

With regards to economic statistics, the recent report on US consumer confidence showed good figures even though the indicator decreased slightly due to the new wave of COVID-19. The data published by the Conference Board said the index fell from 101.3 points to 100.9 points for October, while economists had expected it to amount 102.0 points. in October. Meanwhile, the index of current conditions increased to 104.6 points in October, while the index of expectations regarding the short-term prospects fell to 98.4 points against 102.9 a month earlier.

These figures on consumer confidence reflect concerns not only over the coronavirus, but also over the US elections, where everyone predicts a devastating defeat for Donald Trump. In his interviews, Trump has repeatedly declared that he will appeal the results in courts if there is a minimal gap in votes. Most likely, he will try to bring the case to the Supreme Court, where "his man", Amy Barrett, has already been appointed to the position. If Trump brings the case to court, it is already obvious in whose favor the decision will be made.

Anyhow, another important report was the data for US durable goods, which, in the recent months, has been almost the only one to grow. However, given the current risk of another pandemic wave, which could decrease the activities of manufacturing companies, disrupt supply chains and close a number of enterprises, it will be rather difficult to count on the same growth rates in the index. Nonetheless, the current orders for durable goods have risen to 1.9% this September, up from its previous level in August.

Manufacturing activity in the area of Richmond Fed also continues to rise this October, so the composite manufacturing index to 29 points, against only 21 points in September. Economists had expected the index to amount only 16 points. In addition to that, an improvement in the business environment was also observed.

As for the US National House Price Index, a 1.1% increase was observed in August, however, it is unlikely to affect the market despite its good figure. Moreover, this current rise is not surprising at all, especially since interest rates in the US are practically at zero values and no one is experiencing problems with regards to credit.