Gold is demonstrating an unusual activity before the presidential elections in the United States. Experts of the precious metals market expect the gold to sharply rise in the near future.

At the moment, this metal is taking a wait-and-see position, but never yields to move to new peaks. The total weakness of the US dollar, which may continue until the election is held, strongly supported gold. In this case, the "solar" metal will benefit, as USD remains to weaken.

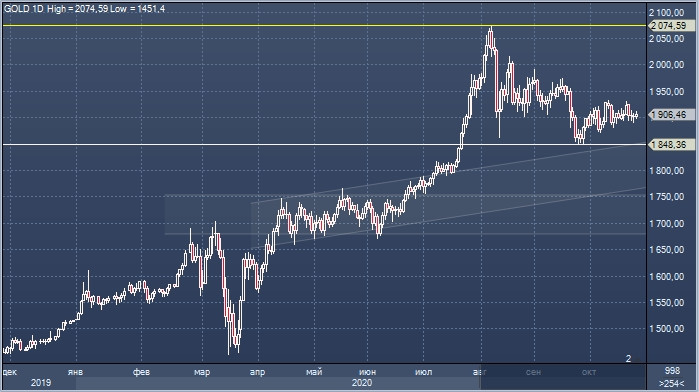

The quotes of gold have consolidated above the psychologically important level of $ 1900 per ounce this week. Today, gold is trading near $ 1909-$ 1910 per ounce. Therefore, experts expect it to further increase, as it overcame the local high of $ 1933 per ounce last October 12. Earlier in August this year, gold peaked at $2,074.60 an ounce, allowing analysts to make bold forecasts about its prospects in the near future.

The current state of the precious metals market is determined not only by the upcoming US presidential election, but also by a number of other factors, such as trade relations with China and the policies of World Central Banks. However, the priority right now is the elections in the United States. For the first time in a long time, many experts agree that the current situation on the global gold market is in its favor. Analysts believe that the favorable "golden" period will last for a long time.

Experts also believe that it is not important for gold who will be the next head of state in the United States – either Joe Biden or Donald Trump will be in control. Both candidates are ready for new large-scale measures to stimulate the economy, therefore, the quantitative easing (QE) program will continue in any case. In view of an impressive national debt, the Federal Reserve has no other tools to solve financial problems, except for continuing a soft monetary policy.

The US regulator will have to restart the printing press, flooding the national economy with unsecured dollars. As a result, the price of the US dollar will inevitably decline, yielding to other currencies and gold. If this scenario comes true, gold will benefit from it. Experts are confident that the "gold" quotes will receive strong support and a new impulse to continue the upward trend.