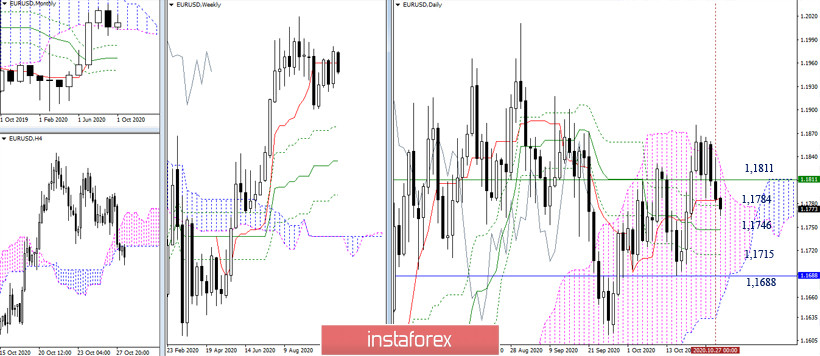

EUR / USD

The pair continued to make a downward movement, so the weekly short-term trend (1.1811) was left behind. At the moment, the issue of support for the daily Tenkan (1.1784) is being resolved. The loss of short-term trends on the weekly and daily time frames will give us a chance to further strengthen the bearish moods. Now, we can note the levels of 1.1746 (daily Kijun) - 1.1715 (daily Fibo Kijun) - 1.1688 (lower limit of the monthly cloud) as new downside goals.

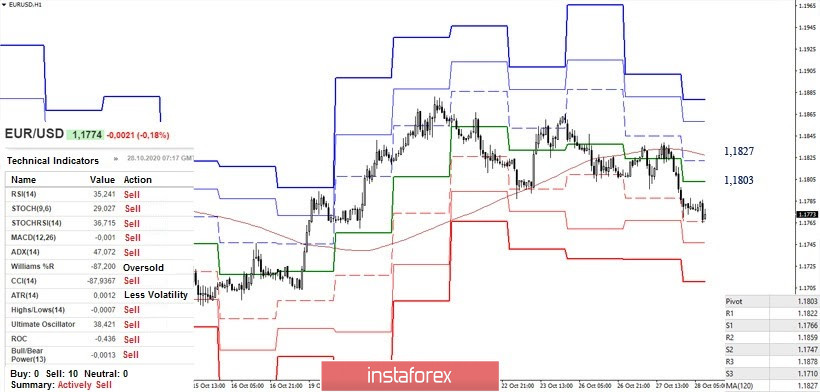

In the smaller time frames, the bearish players managed to leave the attraction zone of the key levels, where they increased for a retest after the breakdown. As a result, the advantage of forces is now on the bears' side. The support for classic pivot levels is a benchmark for intraday decline 1.1766 - 1.1747 - 1.1710. Today, the key levels form the resistances of 1.1803 (central pivot level) and 1.1827 (weekly long-term trend), which are responsible for maintaining the bearish advantage.

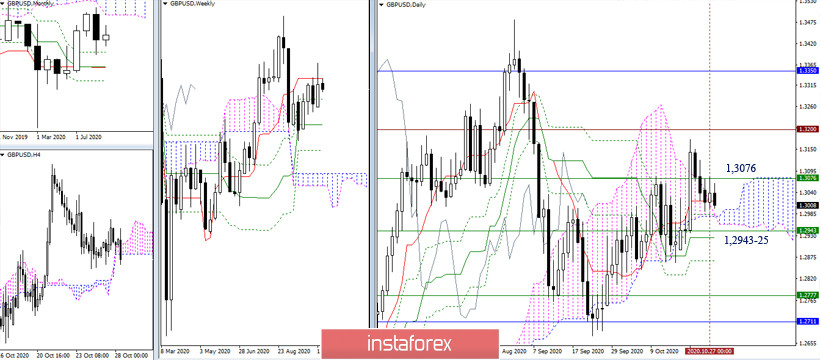

GBP / USD

Yesterday's accumulation of support levels delayed the development of the decline, but the resistance of the weekly short-term trend (1.3076) insists on a new attempt. After overcoming the level of 1.3018 (daily Tenkan), the accumulation of support levels at 1.2980 (daily cloud + daily Fibo Kijun) and 1.2943-25 (daily Kijun + weekly Fibo Kijun) will be significant. If it is fixed below, it is better to analyze the situation again to assess new prospects.

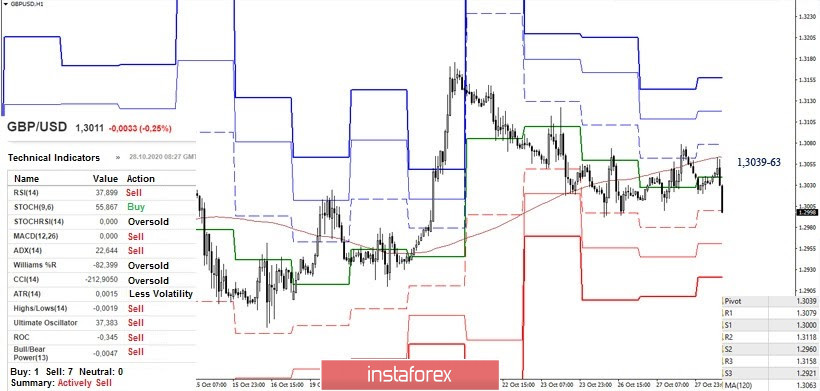

The bulls failed to regain the key levels of the smaller time frames, despite making several attempts. As a result, there is a formation of a rebound from the resistances of the weekly long-term trend (1.3063) and the central pivot level (1.3039). In turn, the bears have updated their low, left the correction zone and continue to decline. The support within the day can be provided by the classic pivot levels located at 1.3000 - 1.2960 - 1.2921 today.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)