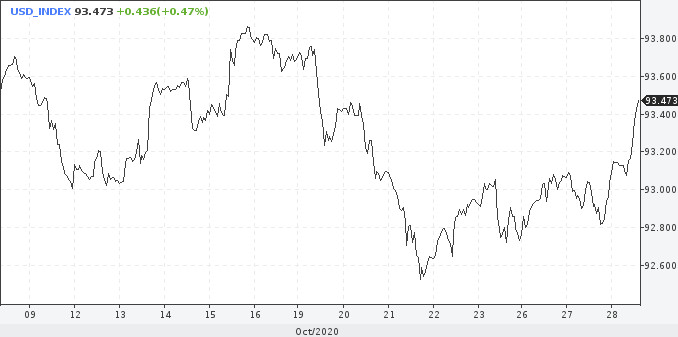

Surprisingly, the US dollar did not react to the risk aversion during the previous sessions. In such a case, investors usually flee to safe haven assets, including the US dollar, but this did not happen. Today, the greenback seems to have recouped its losses. However, its growth is unlikely to last long. USD can give up its gains as soon as next session, and there are several reasons for this.

The stimulus package for the US economy will be adopted only after the election, so we can downplay this factor. It is unlikely that traders will buy the US dollar before the election that will take place in just a few days. No matter who wins, Donald Trump or Joe Biden, the prospects for the US currency are still uncertain.

Notably, during today's growth of the US dollar, investors tried to avoid hasty transactions with the US currency. They did not rush to buy it even despite the collapse of the euro, caused by the news about a possible introduction of tight lockdown measures in such European countries as France and Germany.

Although the US dollar has slightly advanced on Wednesday, the market sentiment remains bearish. The upcoming US presidential election is the main reason for that. There is a lot of uncertainty around this political event. Market players are gearing up for increased volatility. The election results are difficult to predict. Besides, there is a risk that they won't be approved at all. Another possible outcome is that no candidate will gain the required majority of votes.

The third-quarter US GDP will be released tomorrow. The data is very likely to determine further direction of the US dollar.

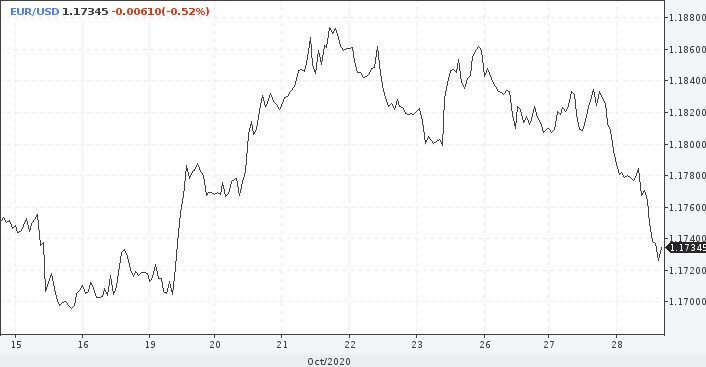

Thursday will be an important day for the euro as well. The ECB will make a statement on its monetary policy and will announce its decision on interest rates. The regulator has many reasons to rush with the asset purchases, with negative inflation and declining business activity among them. Judging by the situation around coronavirus, consumer and industrial sectors will remain subdued in the near future.

It is worth noting that the European STOXX 600 dropped by almost 2% on Wednesday. Previously, the ECB managed to stabilize it when necessary. Obviously, the current volume of asset purchases is not enough. Markets will be disappointed if the European regulator does not announce plans to ramp up the asset purchase program on Thursday.

A rate cut and an increase in the inflation target would be great news for the market. But this is unlikely to happen, and investors do not even hope for such a decision. The ECB will most likely wait until next time. By the end of the year, long-term forecasts will be ready, and the indicator of business activity may become critical. At the same time, the ECB officials may hint at an increase in open market operations planned for next month.

Such expectations may trigger the sell-off in the EUR/USD pair which now aims at 1.17. Given the current and upcoming events, the pair may test a September low at 1.1610 in early November.

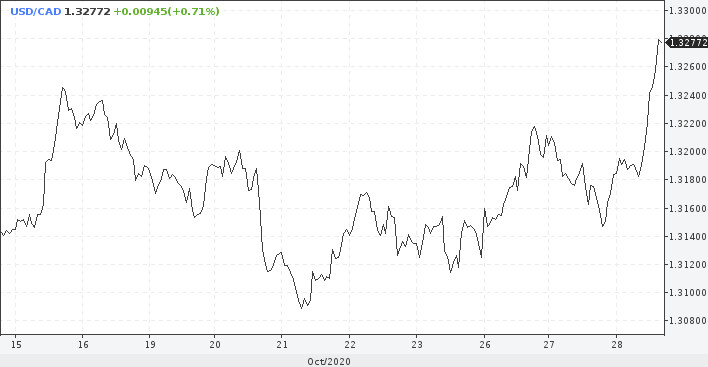

Today, investors' focus has shifted to the Canadian dollar thanks to the Bank of Canada policy meeting. The Canadian regulator kept the rate unchanged. However, the consequences of the COVID-19 pandemic continue to weigh on the country's economy and the labor market. Economic indicators suggest further easing of the monetary policy.

Traders will study the accompanying statement of the regulator, where the Governor of the Bank of Canada will explain his position and may signal the need for further policy easing. In this case, the Canadian currency will start to depreciate. In any case, the volatility on the USD/CAD pair is expected to increase soon.