4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - downward.

CCI: -119.4899

The British pound sterling paired with the US currency on Wednesday also began a fairly strong downward movement, however, it has a completely different meaning than the fall of the euro/dollar pair. The fact is that the euro/dollar pair continues to "sit" tightly in the side channel, which can not be said about the pound/dollar pair. If for the EUR/USD pair the fundamental background is more in favor of the euro, then in the GBP/USD pair the fundamental background is more in favor of the US currency. Therefore, yesterday's fall in the British currency may not just be a drop of a hundred points, but the beginning of a new downward trend. The fact is that in America now the main negative is associated with uncertainty. Uncertainty in the life of the country after November 3 or, better to say, after January 20, 2021. Until it becomes clear who will be the new president, the US currency is unlikely to be in high demand. However, in the case of the UK, the problems are purely macroeconomic. And these problems are serious. We will not list again all the possible problems that the British economy may face in 2021. Let's just say that there can be a lot of these troubles. Therefore, we continue to believe that the pound will continue to fall in the long term.

As for the most important topic for the British pound, the topic of Brexit and negotiations on a trade agreement, no new information was received during the third trading day of the week. It was stated that the next round of negotiations will last until at least Thursday, so if we expect any positive information, it will be during today. However, to be honest, despite the "positive rumors" and statements of some top officials of the EU countries, there is still little chance of reaching an agreement between London and Brussels. Yes, the negotiations are ongoing, but they have been going on for more than 6 months. During these six months, has there been a single communication concerning the sections of the document where the Europeans and the British managed to reach a consensus? Everyone talks only about those issues in which it is impossible to come to a common opinion and nothing changes here. Therefore, today we may receive another batch of "optimistic" news that Michel Barnier and David Frost again failed to agree with each other. Also on Wednesday, Charles Michel, President of the European Council, gave an interview to a British tabloid. He said that the negotiations are entering the most important phase, however, he is not at all sure that a deal with Boris Johnson is possible within the next two weeks (remaining until the next deadline of the British Prime Minister). Also, Charles Michel did not tell the markets anything important, limiting himself to general phrases.

Thus, the British pound still has no place to wait for support. Even technical factors are currently against it. The pound has risen quite strongly against the dollar in the past six months, as well as in recent weeks. Given the fact that the state of the UK economy is not much better than the US, we do not believe that such a strong growth of the pound is fully justified. But even if it is justified, there must be a downward correction. Also, as part of the upward movement in recent weeks, the price has worked out the Fibonacci level of 61.8% from the fall between September 1 and 23. Thus, the probability of further downward movement is growing, and we expect to see the pair near the level of 1.2700 in the coming weeks. As you can see, both fundamental factors and technical "for" the US dollar. If after November 3, tensions related to the presidential election in America subside, this will be another, additional reason to buy the dollar, which has become cheaper in the last six months.

As for the "coronavirus" problems, we previously considered this topic extremely important, but now both the United States and the United Kingdom have entered the phase of the second "wave", so the epidemiological situation is approximately the same in both countries. Therefore, traders are unlikely to react to the new figures for the spread of the COVID-2019 virus. But if the British economy is waiting for a new "lockdown", this may be another reason to get rid of the British currency, as the British economy will again begin to shrink at a high rate. Unlike the American one, which Trump is not going to close for a second "hard" quarantine.

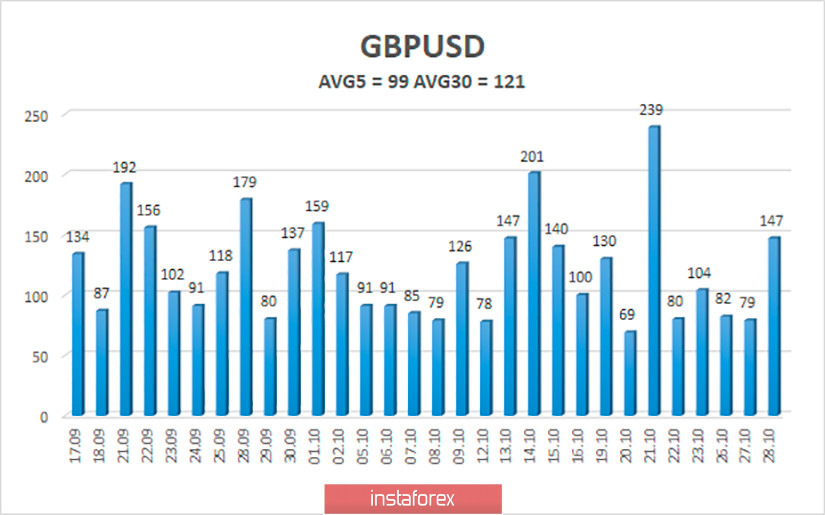

The average volatility of the GBP/USD pair is currently 99 points per day. For the pound/dollar pair, this value is "average". On Thursday, October 29, thus, we expect movement inside the channel, limited by the levels of 1.2888 and 1.3086. A reversal of the Heiken Ashi indicator-up signals a possible resumption of the upward movement. Please note that the last 4 out of 5 trading days ended with volatility lower than 104 points. So, the average volatility may be even lower than 99 points per day.

Nearest support levels:

S1 – 1.2939

S2 – 1.2878

S3 – 1.2817

Nearest resistance levels:

R1 – 1.3000

R2 – 1.3062

R3 – 1.3123

Trading recommendations:

The GBP/USD pair has started a new round of downward movement on the 4-hour timeframe. Thus, today it is recommended to stay in short positions with targets of 1.2888 and 1.2817 as long as the Heiken Ashi indicator is directed down. It is recommended to trade the pair for an increase with targets of 1.3086 and 1.3123 if the price is fixed back above the moving average line.