There are talks about reintroducing quarantine measures, as soon as the number of new covid cases began to grow rapidly in Europe. This concerned the investors and unfortunately, their fears are getting real. Germany has introduced the so-called limited quarantine, which will take effect on November 2 and there is an assumption that it will be in effect for a month. Angela Merkel said that the government will conduct monitoring in mid-November and a decision will be made on the possible extension of this quarantine based on its results. Of course, unless the COVID-19 situation improves. As Germany is introducing such measures, then other countries of the European Union should also follow.

The situation in some countries is significantly worse than in Germany. Therefore, France hastened to follow its neighbor's example and imposed even stricter restrictions. In addition to closing bars and restaurants, shops in France are also closing, except those that sell essential goods. Moreover, severe restrictions on movement are being introduced. In particular, going between regions of France is prohibited. Leaving the house is also not allowed unless urgently needed. But apparently, the current quarantine does not seem so harsh as the one introduced this spring. On the other hand, Italy and Spain will follow Germany and France.

According to rumors, Boris Johnson also insists on re-introduction of quarantine measures, but so far, he is meeting with sharp resistance, including from his fellow party members. But looking at what's happening across the channel, the UK is unlikely to avoid re-closure. The worst thing is that amid all this, the business has not yet recovered from the spring quarantine, and small and medium-sized businesses will simply not survive the second. Therefore, it is no surprise that investors are rapidly getting rid of their European assets, including the pound with the euro.

It is clear that against this background, macroeconomic statistics did not bother anyone at all, especially since it wasn't there yesterday unlike today. For example, data on the lending market is published in the UK, which is expected to be quite good. The only thing that can somehow disappoint is the dynamics of approved mortgage loans, with a forecasted growth of 76 thousand. Last month, 84.7 thousand of them were approved. Nevertheless, the volume of consumer lending should grow by 0.7 billion pounds, while the volume of mortgage lending can grow by as much as 3.5 billion pounds. As we can see, the lending market is still growing. However, this does not interest the market at all, since the UK is seriously threatened by the re-introduction of the quarantine. After that, all the current success of the banking sector can be safely ignored.

Number of approved mortgages (UK):

Today's main event will be held in Frankfurt, where ECB's next meeting will take place. The interest rates will remain unchanged, but it doesn't make it any easier. The fact is that when the first quarantine was introduced in the spring, the European Central Bank significantly expanded the program to stimulate the European economy. For this, a separate asset purchase program was created in the form of direct redemption of government bonds. In other words, the ECB has increased the volume of direct financing of the countries of the European Union in the form of monetary easing. This program will operate at least until the end of next year. But considering the COVID-19 situation in Europe, Ms. Lagarde may increase the volume of this program. Although the interest rates will remain unchanged, the printing press will actively work much more. In fact, this is roughly the same as reducing interest rates. The result of such actions will lead to a greater decline in the yield of European bonds, which means that investors need to look for some other places to invest their own funds.

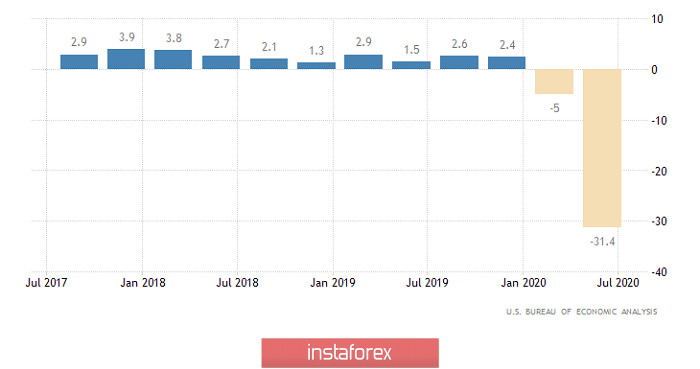

Looking at the US statistics, the first estimate of the US GDP for the third quarter is being published, which may show that the American economy has grown by 30.0%. This is not surprising, since GDP sank by -31.4% during the Q2. Therefore, this is just a kind of a rebound. This is the reaction of the economy to the end of the quarantine, which was essentially just in the second quarter. Moreover, the number of applications for unemployment benefits is expected to further decline. In particular, the number of initial applications should be reduced from 787 thousand to 750 thousand, while the number of repeated requests may decline from 8,373 thousand to 7,900 thousand. In general, the dollar has clearly reason to grow even without the pandemic.

GDP Growth Rate (United States):

The EUR/USD pair found support at the level of 1.1718, where a stop occured, followed by a pullback. We can assume that if the price hold below 1.1730, there will be another round of short positions below the support level of 1.1700, relative to which the next movement in the market will be clear.

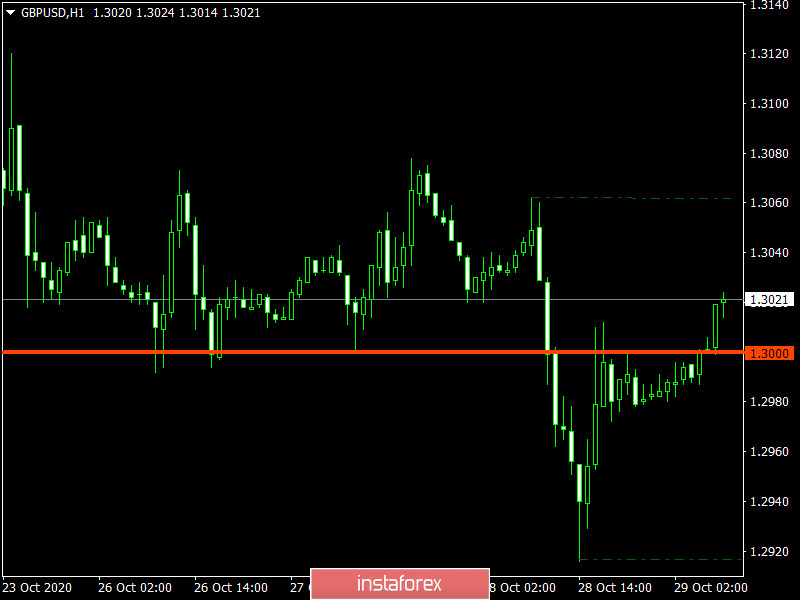

The GBP/USD pair declined, which resulted in a local surge in short positions that was noticed in the direction of the low (1.2910) on October 20, where the quote found a variable support and how it formed a pullback. We can assume that holding the quote below the level of 1.3000 will give sellers a chance to decline further towards 1.2910-1.2860. Alternatively, a subsequent pullback towards 1.3060 can be considered.