Today's review of the interesting and much-loved currency pair USD/JPY will start with the fact that the Japanese yen is regaining its leadership among safe-haven currencies, which are still considered the Swiss franc and the US dollar. The inability of the White House administration to resolve the issue of adopting a new stimulus package, the outbreak of the second wave of COVID-19 in Europe and the United States, as well as the upcoming November 3 presidential election in the United States completely discourage investors from risky operations. Against this background, market participants prefer to go to a safe-haven. In this situation, the Japanese currency is the most popular, which is observed during trading in recent weeks. Before considering the price charts for the dollar/yen pair, it is worth paying attention to the fundamental events of today, where the main role will be played by initial applications for unemployment benefits and preliminary data on US GDP for the third quarter.

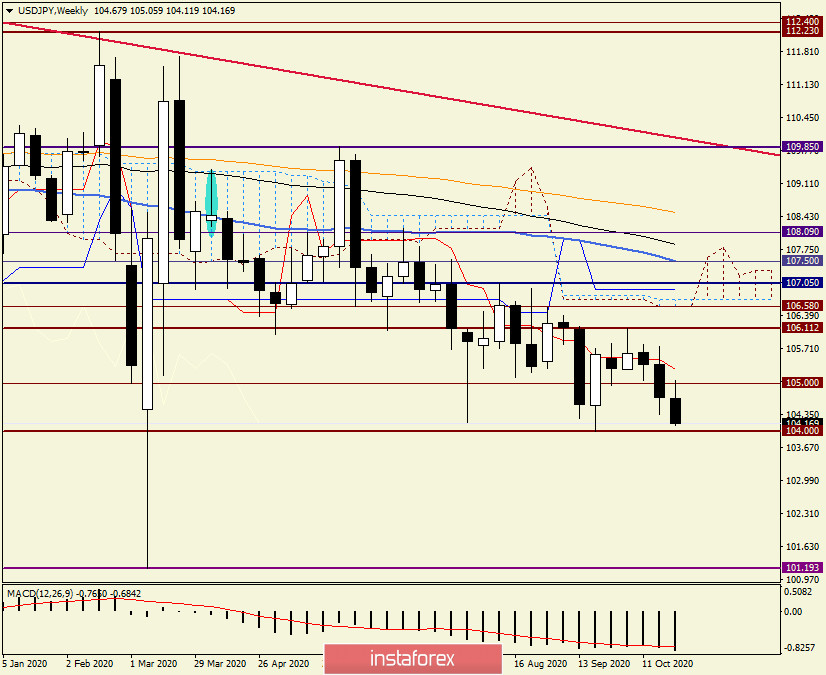

Weekly

The weekly chart clearly shows that for the third week in a row, the pair shows a downward trend and gradually approaches the lower border of the trading range of 106.00-104.00. If the support level of 104.00 does not withstand the pressure of bears on USD/JPY and weekly trading closes below this mark, with a high probability, the level of 104.00 can be considered broken and prepare for the subsequent weakening of the instrument. At the same time, a single candle (even a weekly one) closed at 104.00 may not be enough to consider this level truly broken. Bulls on the dollar/yen pair have a much more difficult task. Increasing traders first need to return trades above the strong and extremely important psychological and technical level of 105 yen per dollar, then break through the red line of the Tenkan Ichimoku indicator, located at 105.28, and raise the rate to the current key resistance of sellers, which passes at 106.11. In the current situation, the control pair is in the paws of bears, therefore, the most likely breakdown (or its attempt) is an extremely important support level of 104.00.

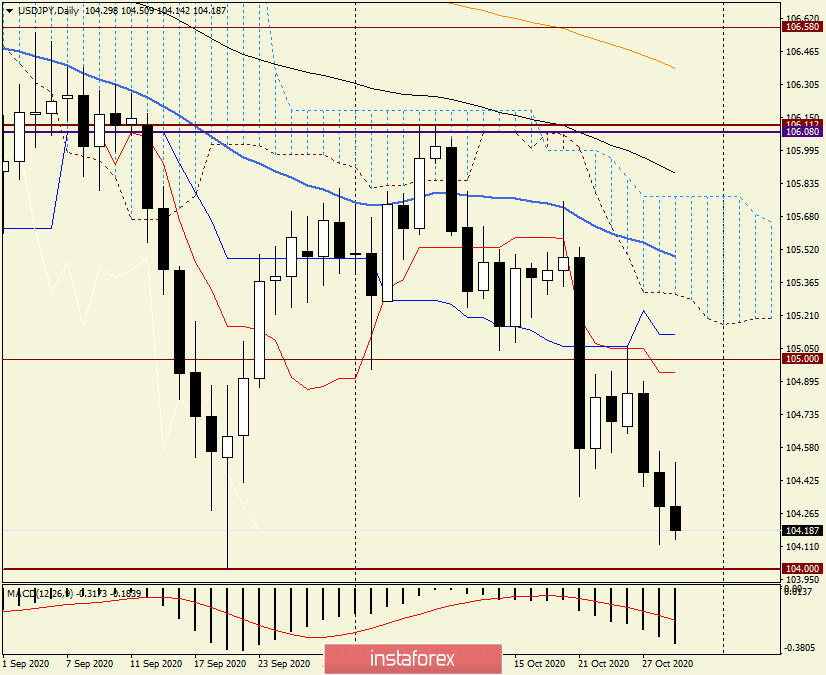

Daily

On the daily timeframe, we see that on October 26, the bulls' attempts to return the quote above the psychological mark of 105.00 failed, after which the pair moved to a downward trend. It is quite obvious that in addition to the level of 105.00, the Tenkan and Kijun lines of the Ichimoku indicator provided active resistance to growth attempts. As can now be seen, this was a good opportunity to open short positions on USD/JPY, but the train has already left. However, with today's favorable macroeconomic reports for the US dollar, the quote may turn in the north direction and once again rise to the area of 105.00. Although, judging by the market sentiment in this particular currency pair, this probability is hard to believe. At the moment, the bears are confidently monitoring the course of trading on USD/JPY and are waiting for a driver to break through the 104.00 support.

Given the technical picture on both timeframes considered, as well as higher demand for the Japanese yen, the main trading recommendation for this currency pair will be sales, which are better to open after corrective price bounces to the area of 104.40-104.50. Another option for sales will be a rollback to the truly broken level of 104.00, but for this, you need to wait for the price to consolidate under this mark.