Following the results of yesterday's trading, the British pound fell against the US dollar. The reasons for such price dynamics of the GBP/USD currency pair remain the same. This is a lack of results in the Brexit negotiations, where the conclusion of a trade agreement between the European Union and the UK is still in limbo. As noted earlier, the invasion of the second wave of COVID-19 also forces investors to escape from risks and go to protective assets, which in the current situation is the US dollar. Yesterday's press conference of Christine Lagarde, at which the ECB President announced the readiness to introduce a new round of monetary policy easing, had a negative impact on the British currency. It has long been no secret that the Bank of England is considering introducing negative interest rates and (or) expanding the asset purchase program. Since the ECB has already given such a signal yesterday, we cannot exclude similar decisions from the Bank of England. Moreover, such a step is expected, and it is already partly embedded in the value of the British currency. Moreover, the situation with the number of infected people in the UK continues to worsen, which will inevitably affect the economy of the United Kingdom, which needs more support.

If we touch on today's events, a large block of macroeconomic statistics from the United States, which will start arriving starting from 13:30 London time, may have an impact on the course of trading on the pound/dollar currency pair. For more information about all today's reports, their release times and forecasts can be seen on the economic calendar.

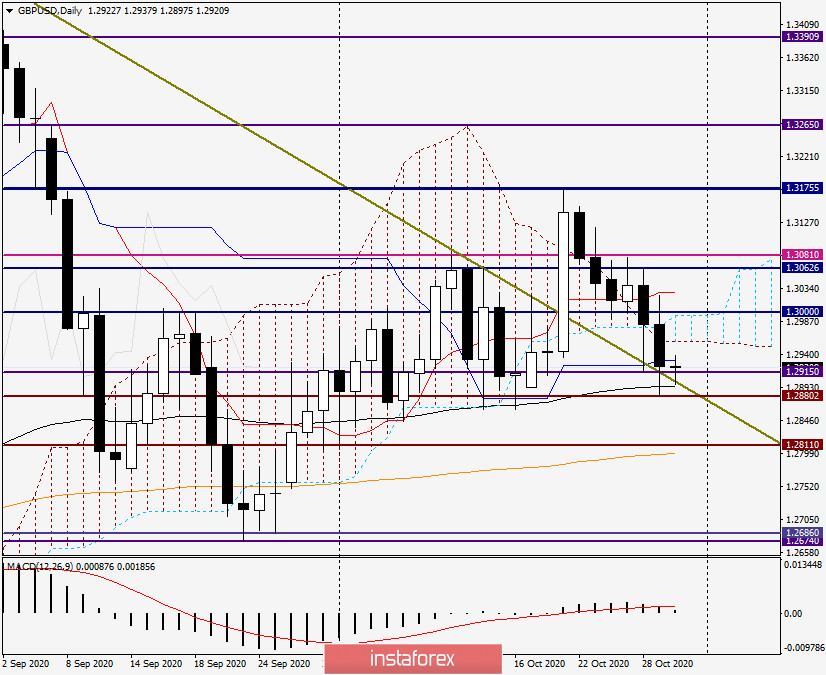

Daily

Despite yesterday's decline, trading on GBP/USD ended above the support level of 1.2915 and the previously broken resistance line of 1.3479-1.3063. As you can see, the black 89 exponential moving average played an important role as support, which limited the decline and provoked an upward rebound. Nevertheless, both the support at 1.2915 and the indicated resistance line were punctured as a result of yesterday's decline, which increases the chances of a true breakdown of 1.2915 and the return of the quote under the resistance line 1.3479-1.3063.

At the time of writing, the GBP/USD pair is trading with a slight decrease, but the main events of today are still ahead. Given the upcoming publication of statistics from the United States and the fact that today is the last trading day of the week and month, the main activity and increased volatility should be expected with the arrival of American players. The end of today's trading below the broken resistance line of 1.3479-1.3063 and yesterday's lows of 1.2880 will signal the subsequent implementation of the bearish scenario for the pound. If market sentiment changes and US statistics disappoint investors, I do not rule out growth and closing above the most important psychological and technical level of 1.3000. In this case, the chances of further strengthening of the pair will increase significantly. However, to do this, the pound bulls will have to make an incredible effort, because the resistance zone of 1.2994-1.3024 is very strong, and given that the red line of the Tenkan indicator Ichimoku passes a little higher, the indicated resistance looks even more impressive.

Given the market sentiment and technical picture for this currency pair, the main trading idea is sales, which are better considered after short-term corrections to the price zone of 1.2960-1.2990, and higher from the price area of 1.2974-1.3024. Bearish candlestick analysis patterns in the designated price zones, which will appear on lower timeframes, will serve as confirmation signals for opening short positions on the pound.