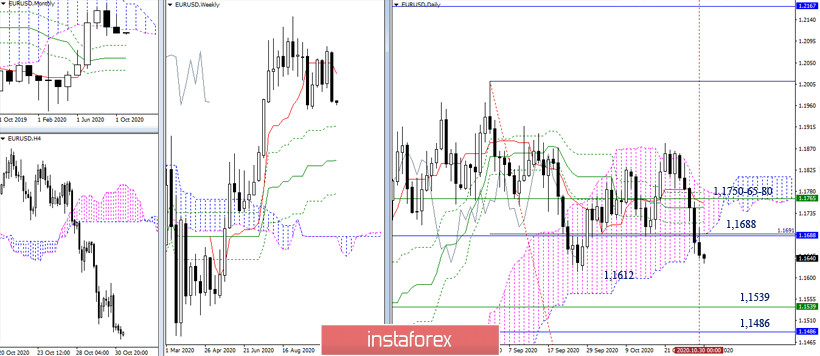

EUR / USD

The bears managed to close the month of October below the monthly cloud. Now, the decline continues and the main task in this direction is to update the low extremum (1.1612) and consolidate below it, which will help us to restore the weekly and monthly downward correction. In this case, the nearest pivot points will be Fibo Kijun support (weekly 1.1539 + monthly 1.1486). If the bulls' position slow down and restore it to grow, the resistances around 1.1688 (lower limit of the daily and monthly clouds),as well as a cluster of resistances at the limits 1.1750-65-80 (daily cross + weekly Tenkan + upper limit of the daily cloud) can be noted.

Meanwhile, the downward trend can be seen developing in the smaller time frame, which is supported by all analyzed technical tools. The downside benchmarks within the day in the form of classical pivot levels are located today at 1.1623 - 1.1600 - 1.1559. The development of an upward correction will lead to testing the central pivot level (1.1664), which will lead to traders' fairly large margin of safety.

In turn, the correction can develop up to a weekly long-term trend (1.1744), this area is strengthened by the resistance of the larger time frames (1.1750-65-80), so it is strategically important not only for lower time frames, but also for higher ones. In this direction, the nearest resistances can be noted at 1.1687 (R1) – 1.1728 (R2).

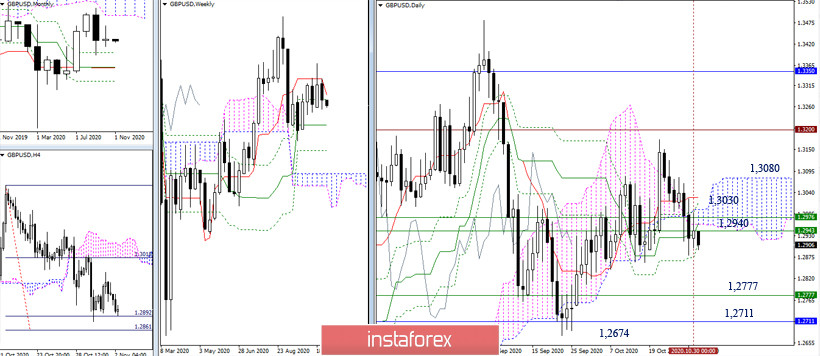

GBP / USD

The bears tend to take the initiative in order to leave the confrontation zone. If this plan is fulfilled, their main interest will be concentrated in the area of 1.2777 (weekly Kijun) - 1.2711 (monthly Fibo Kijun) - 1.2674 (extreme low). However, the attraction of a large cluster of fairly strong levels of the larger time frames can still restrain the development of the situation. Thus, it will be possible to consider the possibility of the bulls only after a reliable consolidation above the cluster of resistances of 1.2940-1.3030 or possibly 1.3080, if the situation drags on for a while.

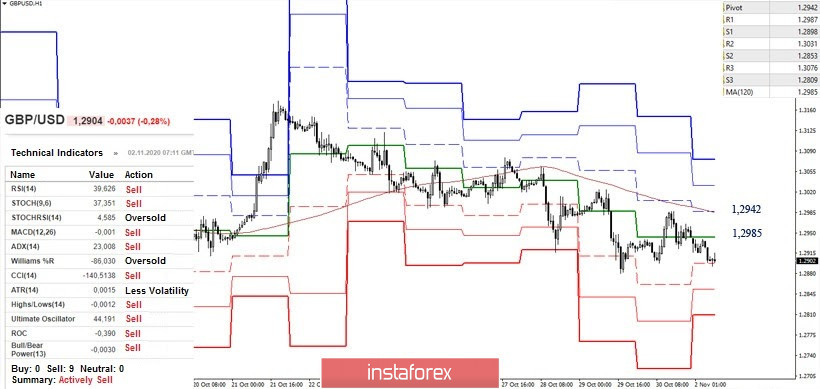

The bears in the smaller time frame are in the correction zone, despite their advantages. To further strengthen their moods, updating last week's low (1.2880) will be necessary. At the same time, further support levels can be noted at 1.2853 (S2) and 2809 (S3) today. The level of 1.2898 (S1) is currently being tested.

The key resistance levels, in turn, are located at 1.2985 (central pivot level) and 1.2942 (weekly long-term trend). A consolidation above which will change the balance of power in the lower TF, but the bulls' further success will depend on passing the accumulation of resistance levels of the higher TF, which now strengthen the resistance within the day from the classical pivot levels (1.3031-1.3076).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)