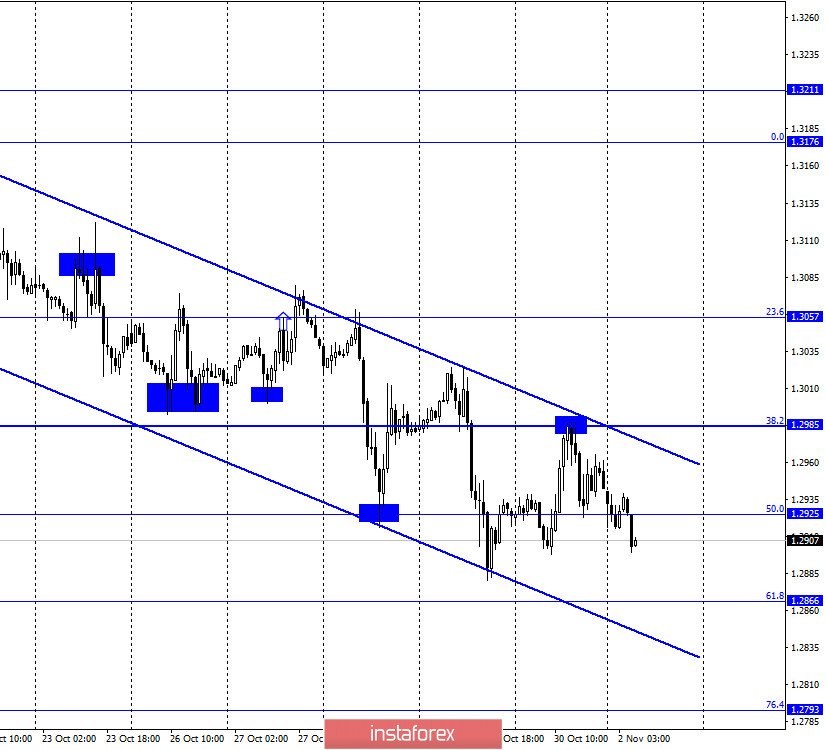

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a rebound from the corrective level of 38.2% (1.2985), a reversal in favor of the US currency, and resumed the process of falling in the direction of the corrective level of 61.8% (1.2866). The downward trend corridor continues to characterize the current mood of traders as "bearish". Meanwhile, in the UK, Prime Minister Boris Johnson announced the introduction of a four-week "hard" quarantine. Such measures were taken by the British government against the background of an emergency epidemiological situation in the UK. In recent days, almost 25 thousand new cases of coronavirus have been registered daily. To prevent further spread of the virus in the UK, all pubs, restaurants, and various entertainment facilities are being closed. All stores except grocery stores will also be closed. However, people are allowed to go to work, school, universities, medical institutions, as well as to walk in the fresh air and parks. Thus, the British government tried to preserve the working state of the economy as much as possible. Only the service sector will suffer, as it is the one that the quarantine measures concern. The British government has promised financial assistance to businesses and those who lost their jobs due to the new coronavirus outbreak. But no information was received on negotiations on a trade deal between the European Union and the UK. Although traders have been waiting for them for several days. Most likely, the negotiations are continuing and we will get their results in the near future.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair continues to fall in the direction of the corrective level of 50.0% (1.2867). The CCI indicator continues to have a bullish divergence. A rebound of the pair's quotes from the Fibo level of 50.0% will work in favor of the British currency and the beginning of growth in the direction of the corrective level of 38.2% (1.3010), and may also coincide with the formation of a bullish divergence. Closing the pair's exchange rate below the 50.0% Fibo level will increase the probability of a further fall towards the next corrective level of 61.8% (1.2720).

GBP/USD – Daily.

On the daily chart, the pair's quotes have been fixed under the corrective level of 76.4% (1.3016), which now allows us to expect a fall in the direction of the next corrective level of 61.8% (1.2709).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. However, in recent weeks, the pair has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

On Friday, the UK again did not have a single economic report. There was also still no official information about the progress of negotiations between the UK and the European Union.

News calendar for the US and the UK:

UK - PMI for the manufacturing sector (09:30 GMT).

US - ISM manufacturing index (15:00 GMT).

On November 2, the UK news calendar contains only the PMI index for the manufacturing sector, while the US news calendar contains a similar index. It is unlikely that these two reports will cause a serious market reaction.

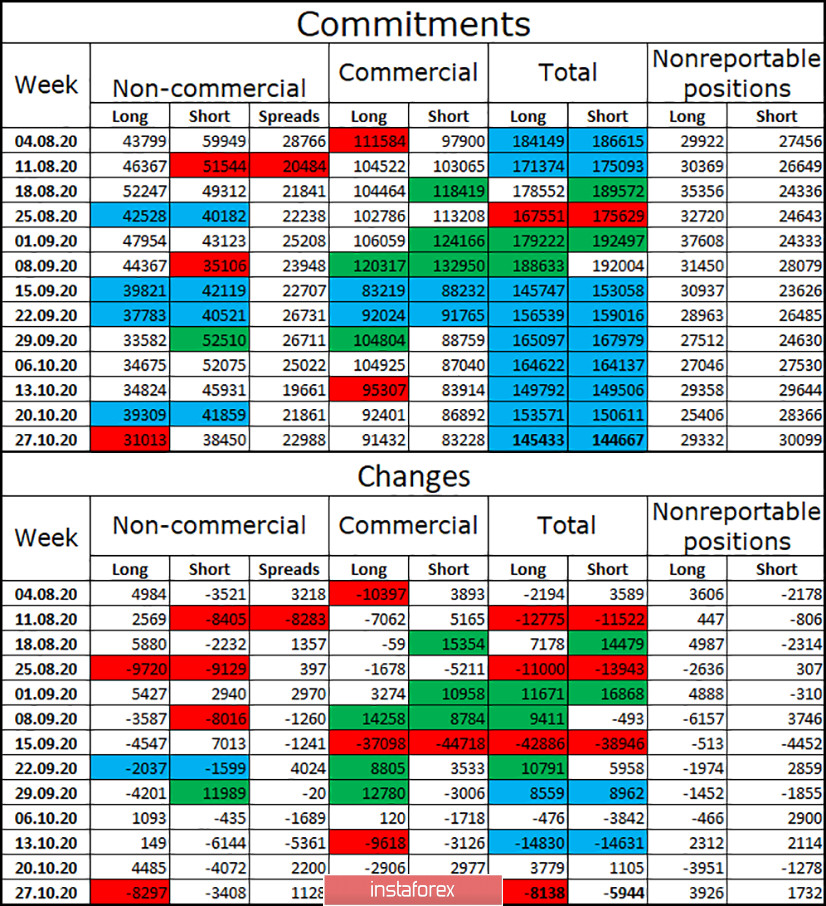

COT (Commitments of Traders) report:

The latest COT report on the British pound showed that the mood of the "Non-commercial" category of traders became more "bearish" over the reporting week. Speculators got rid of 8,297 long contracts and 3,408 short contracts. Thus, in general, speculators got rid of any contracts for the British. However, it is mostly from long-contracts. This suggests that the major players do not believe in the pound. It is extremely difficult to do this in the current conditions, as the prospects for the British economy remain extremely vague. Since August, the total number of long contracts in the hands of speculators has decreased to an absolute minimum – only 31,013. The total number of open contracts among all categories of traders has been almost the same for two months.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend keeping open sales of the GBP/USD pair with a target of 1.2867, and opening new sales when this level is overcome with a target of 1.2793. I recommend buying the British dollar with a target of 1.3010 if the rebound from the level of 50.0% (1.2867) on the 4-hour chart is completed.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.