Today's data on manufacturing activity in the Eurozone helped the euro to maintain its position against the US dollar, however, the bears still managed to achieve another low update. This is where the active sales phase may end before the US election, which starts tomorrow. In any case, there are several key scenarios that the market will follow, and we will talk about them below.

As expected by leading economic agencies, if the Democratic Party wins and gets a majority in both Houses of Congress, the US dollar may significantly weaken against risky assets due to the rather high probability of adopting the next economic stimulus program in the amount of 2.0-2.5 trillion US dollars in the spring of next year. Such a scenario is likely to cause a significant correction of the US dollar and weaken its position on the world stage.

If the current US President Donald Trump and his Republican Party win a complete victory, and the latter get a full majority in the US Congress, the position of the US dollar will only strengthen. The reason for this is the persistent opposition of Trump and his completely different, less expensive attitude to the next package of measures to help the American economy, which needs another financial support against the background of the second wave of coronavirus infection.

The worst scenario for the US dollar, and traders in general, is Joe Biden's victory in the elections with a majority in only one House of Congress, as well as with a minimal margin, which Donald Trump will try to challenge in the Supreme Court. This situation will put many people in a dead-end, because the confrontation that was observed before, even if we do not take political points, will continue, and what kind of assistance measures will be taken in the end – we can only guess. Let me remind you that since August of this year, Republicans and Democrats have been unable to agree on a new package of assistance to the population and businesses.

Now, as for European statistics, today's data, although not particularly surprising to traders, helped risky assets to stop their fall against the US dollar. Both the euro and the British pound managed to protect their rather important support levels.

Thanks to industrial activity, which will now be assigned the main task of saving the economy, we can expect a less steep peak, which occurred after the spring introduction of quarantine measures and complete economic paralysis.

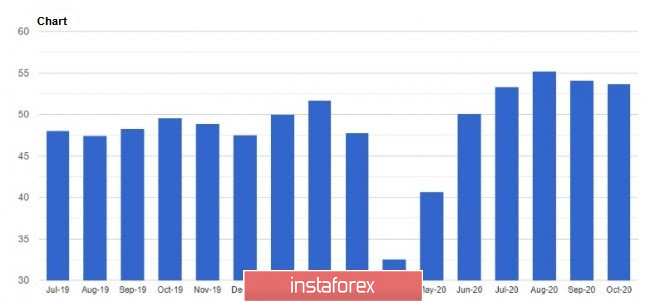

According to the data, activity in the manufacturing sector of the Eurozone in October 2020 grew stronger than expected. The IHS Markit report indicated that the purchasing managers' index (PMI) for the Eurozone manufacturing sector was at 54.8 points against the preliminary estimate of 54.4 points. Economists had expected the index to remain unchanged. Let me remind you that back in September, the index was 53.7 points, and its value above 50 indicates an increase in activity compared to the previous month. The lack of growth in consumer goods orders was offset by a surge in orders for equipment and transport.

In the second half of the day, similar data are expected for the US, but most likely, investors will refrain from aggressive purchases of the dollar due to tomorrow's US elections. Euro buyers have already proved their strength, and to maintain the downward trend in the EURUSD trading instrument, objectively new events are needed that can shake the market in any of the parties.

One of them may be a downgrade of Italy's rating by the credit agency Moody's. There is talk on the market that during the next rating review this Friday, Moody's Investors Service may lower the outlook for Italy's 'Baa3' rating from stable to negative. But we remember Friday's data on Italian GDP growth, which turned out to be much better than economists' forecasts, so if nothing changes and the rating is not revised, this will be a positive signal for buyers of risky assets.

As for the technical picture of the EURUSD pair, it has not changed much compared to the morning forecast. Bears will seek to break through the support of 1.1615, which will open a direct path to a new low of 1.1580, but the longer-term goal will be the area of 1.1540, where the pressure on the euro may ease. Sales will increase especially strongly in the event of weak data on activity in the manufacturing sector of the Eurozone. But it's also worth keeping in mind this week's Federal Reserve meeting, which is set for the second half. Therefore, the fact of slowing demand for the US dollar is also present. A return above the level of 1.1650 will open a direct path to the base of the 17th figure, the breakout of which will lead the trading instrument to the area of 1.1760 and 1.1835.

GBPUSD

The British pound recovered a little after the statements of the British government, which announced that later this week, England will be quarantined. This was done with the sole purpose of containing the spread of COVID-19. Good indicators on manufacturing activity helped the pound. According to IHS Markit and CIPS, the purchasing managers' index for the UK manufacturing sector in October 2020 was revised up to 53.7 points from a preliminary estimate of 53.3 points. In September, the index was 54.1 points.

Some expert agencies expect demand for British goods in the last months of this year due to the likelihood of the most severe Brexit scenario. The parties failed to reach an agreement last week and so far there is no information about the continuation of negotiations, which will continue to put pressure on the British pound. Previously accumulated stocks may enjoy higher demand, which will support the UK economy at the end of this year, before the end of the Brexit transition period on December 31. Consumer goods will also be in high demand due to paralysis and the closure of the service sector due to the coronavirus pandemic. This may provide good support for the pound at the beginning of next year and lay a good foundation for further recovery of the pair.

As for the technical picture of the GBPUSD pair, the bears once again failed to break below the support of 1.2855, which indicates that a large static buyer remains at this level. Let me remind you that last week I repeatedly drew attention to the high importance of the 1.2855 level, as it may determine the further upward trend of the pound. However, there is no doubt that more cautious players are leaving the market. In the reports of Commitment of Traders for October 27, there was a reduction in both short and long positions. Long non-commercial positions fell from 39,836 to 31,799. At the same time, short non-commercial positions dropped from 41,836 to 38,459. As a result, the negative non-commercial net position was at -6,660 against -2,000 a week earlier. If buyers of the pound still lose control of the 1.2855 support, we can expect a new major fall in the trading instrument to the lows of 1.2800 and 1.2745.