To open long positions on GBP/USD, you need:

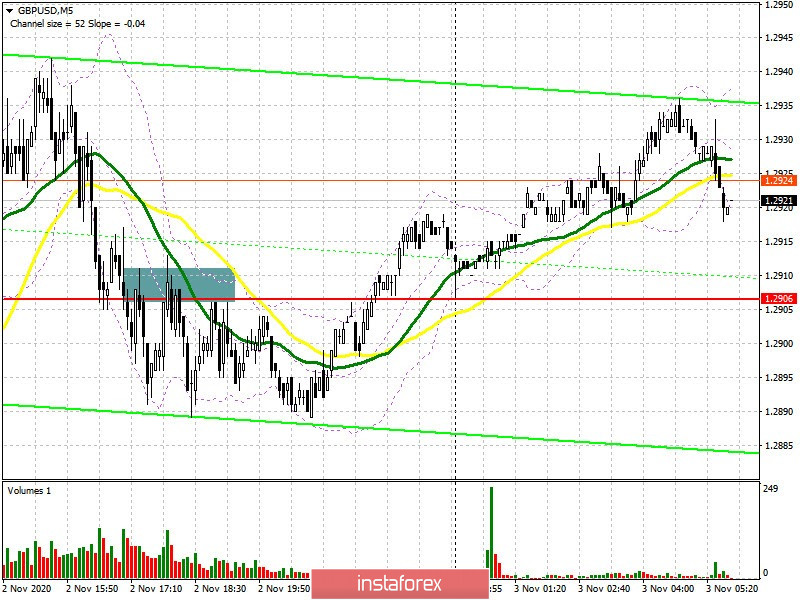

Yesterday's news that the parties reached a significant compromise on the Brexit trade deal, especially in terms of fishing, did not allow the British pound to continue strengthening against the US dollar and stopped its next return to a low of 1.2856, although all the prerequisites for this were present. In my afternoon forecast, I recommended opening short positions after returning and settling below the support of 1.2906, which is what happened. On the 5-minute chart, I marked the point of entry into sell positions, but to my regret, as it did not work in the first half of the day. The downward movement was no more than 15 points, although all the prerequisites for a new decline were there.

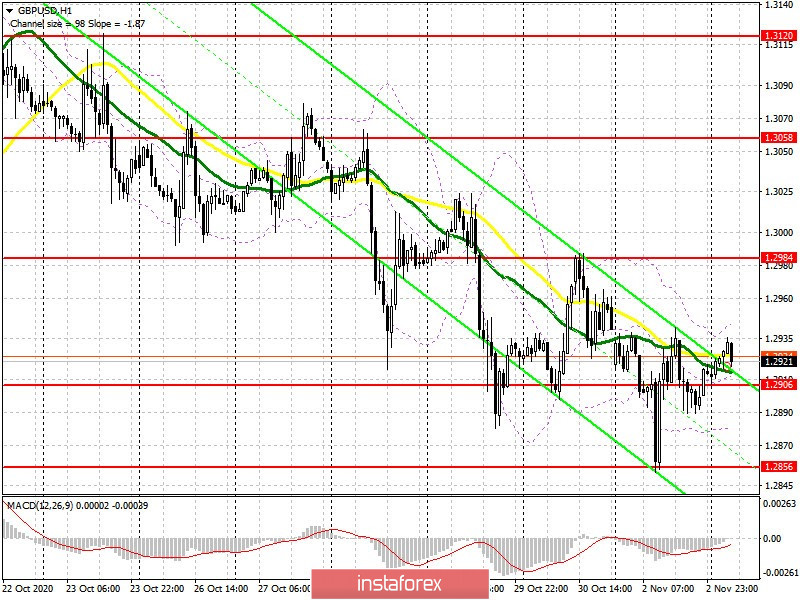

From a technical point of view, nothing has changed. Buyers of the pound need to defend support at 1.2906, above which the main trading is currently being conducted. The fact that the bulls returned this level yesterday after such a large fall to the support area of 1.2856 indicates the presence of a major player. Much will now depend on the outcome of the US presidential election, as well as on whether yesterday's rumors of a compromise in the trade deal are confirmed or not. As long as the trade remains above the 1.2906 range, the chances of a recovery in GBP/USD will remain quite high. Forming a false breakout there will be a signal to buy the pound in order to open long positions in the area of the high of 1.2984, where I recommend taking profits. The next target will be the 1.3058 area, but you can only reach it with good news on Brexit. If buyers are not active in the 1.2906 area in the first half of the day, and since we do not have new important fundamental statistics today, it is best not to rush to buy. Forming a false breakout in the support area of 1.2856 will be a signal to open long positions against the trend. I recommend buying the pound immediately on a rebound from the low of 1.2807, counting on a correction of 15-20 points within the day.

To open short positions on GBP/USD, you need:

Sellers have already returned to the 1.2906 level several times on Monday and tried to continue the downward trend there, but each time they rested against the support of 1.2856. Today, the primary task of the bears is to settle below 1.2906, similar to yesterday's sale, which I analyzed a little higher. This case will return the pressure on the pair and result in bringing back the bearish market. The next, and more challenging target will be the low of 1.2856, which yesterday for the fifth time in the last month withstood the onslaught of bears. Getting the pair to settle below this range will increase the pressure on the pound and lead to a larger sell-off to the 1.2807 low, where I recommend taking profits. However, such a scenario can only be realized in the event of another victory of Donald Trump in the US presidential election. In case GBP/USD grows in the first half of the day, it is best to wait for the test of the 1.2984 high and sell the pound there immediately on a rebound, counting on a correction of 20-30 points within the day.

The Commitment of Traders (COT) reports for October 27 showed a reduction in both short and long positions. Long non-commercial positions fell from 39,836 to 31,799. At the same time, short non-commercial positions fell from 41,836 to 38,459. As a result, the negative non-commercial net position was at -6,660, against -2,000 a week earlier, which indicates that the sellers of the British pound retained control and also shows their minimal advantage in the current situation.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates the sideways nature of the market ahead of important events.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Volatility has decreased and it is not worth paying attention to the indicator buyers for now.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.