Yesterday, some macroeconomic data was published. In particular, the final indexes of business activity in the manufacturing sectors of Europe, Great Britain and the United States. However, the market did not react to this, since their only focus is today's US presidential elections. In this regard, the single European currency has been standing still throughout the day. The pound, in turn, showed a sharp decline, but then changed its mind and entirely recovered all its losses and is now waiting for the elections. This decline was nothing more than a reaction to the announcement of the re-introduction of full-scale quarantine. But this is not surprising, as Germany and France had introduced similar measures before. The fact that other European countries would follow their example did not raise any questions.

In general, the markets are in their starting positions, preparing for a sharp surge. However, the question is where will it be? Up or down? From the viewpoint of common logic, Donald Trump's victory can be perceived extremely positively. The fact is that during the election race, both candidates enthusiastically accused each other of corruption, working for all imaginable and inconceivable foreign intelligence services, and the like. As a result, economic issues were not discussed, even though these are very important. Thus, it turned out that investors and big business have no idea what the economic policy of Mr. Biden will be. In contrast, everything is clear with Mr. Trump, since he will pursue the same policy, which has proven itself well. If you forget about such force majeure, like COVID-19 under Trump, the US economy was doing well – the 2019 unemployment rate back was at its lowest ever value and the industry showed steady growth. In fact, many companies did gradually bring production back to the United States. As mentioned earlier, we don't know what will happen if J. Biden wins. This uncertainty scares investors. Nevertheless, all the most interesting things will happen after the closing of the US session. The first results will be announced only after the poll stations will be closed, so markets will stand still today.

The EUR/USD pair found a variable pivot point within the level of 1.1620, where it slowed down the decline and formed a stagnation at 1.1620/1.1660. We can assume that the quote will continue to fluctuate in a narrow range, which will eventually lead to a speculative surge in activity against a strong information background.

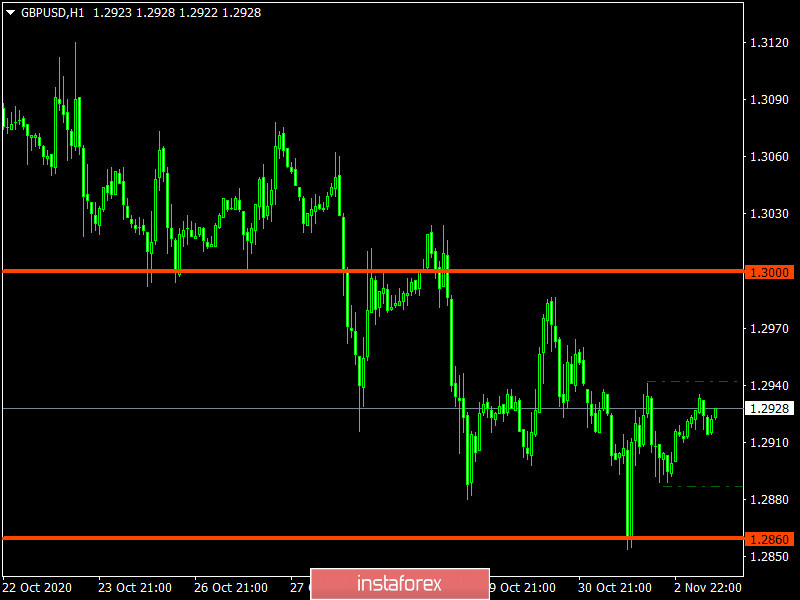

The GBP/USD pair naturally found a pivot point, that is, to the support level of 1.2860, where there was a stop, followed by a correction. We can assume that the correction course will be replaced by a variable oscillation, where the coordinates 1.2880/1.2940 will be used as the amplitude boundaries.