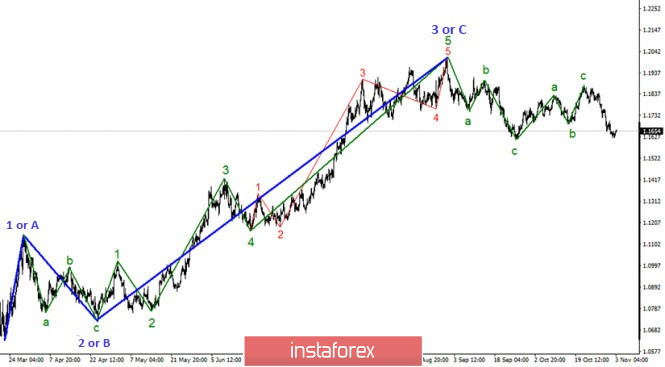

On the global scale, the wave marking of the EUR/USD instrument has undergone certain changes after the quotes fell below the minimum of wave b. Thus, the entire section of the trend, which begins on September 23, now looks three-wave and completed. If this is true, then the decline in the instrument's quotes will continue with targets located around 15 figures and below. Perhaps another three-wave structure will be built down. However, trading today can be overactive and, as a result, can lead to a change in the entire wave picture.

Wave markings on a smaller scale also indicate that markets are ready for new sales of the instrument. The option with a further increase in quotes is canceled at the moment, and now it is expected to build at least three waves down, the first of which may already be completed. Accordingly, the dollar has a good reason to increase in a pair with the euro currently. But it should be noted that the news background is superior to the wave analysis. In other words, it is the news background that can easily cause a new increase in the instrument's quotes and the wave markup will have to adjust.

There were hardly any economic reports in both the US and the European Union in the first two days of the new week. Yesterday, only reports on business activity in the EU and US manufacturing sectors were released. All indexes were better than the markets' expectations and none of them caused any reaction. Since market activity yesterday was generally mega inert, the instrument has smoothly approached the US election day. And now, anything can happen. In general, there is little to no doubt that many instruments in the currency market will be in a state of "storm" today and tomorrow. Thus, the wave markings may be broken and in the future they will have to be revised or supplemented. Further actions of the markets when the elections are over are more important at this time. I am still counting on the option of Joe Biden's victory, since the absolute majority of ratings and opinion polls speak in favor of the Democrat. If he does win, demand for the US dollar is expected to decline. However, it will also be important who controls the Senate and Congress. Recall that not only the President will be elected in America today, but also senators and congressmen. So, Republicans may lose their advantage in the Senate or, on the contrary, win the Lower house of Congress. However, it is unlikely for the Republicans to be able to control both chambers. Considering the events of the past four years while Trump was President, it is safe to say that there are many more opponents of the Republican party in America. Thus, it is believed that the option of losing the Republicans on all fronts is quite likely. And in this case, the Democrats will have total control over the country. In particular, there will be no doubt that an additional 2 or 3 trillion package of financial assistance to the American economy will be adopted.

General conclusions and recommendations:

The euro-dollar pair has presumably completed the construction of a three-wave upward trend section. Thus, it is recommended to sell the instrument with targets located near the 1.1519 mark, which corresponds to 38.2% Fibonacci, for each MACD signal "down," based on the construction of a downward wave C (after the quotes go up within the b wave).