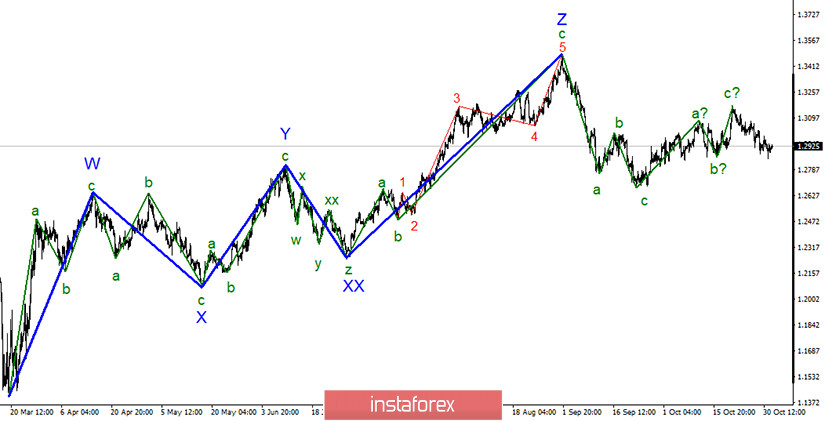

In the most global terms, the construction of the upward section of the trend, which begins on September 23, may already be completed. At this time, the wave patterns of the EUR/USD and GBP/USD instruments are very similar. For the euro currency, I assume that the construction of a new downward section of the trend will begin, possibly a three-wave one. The same can be said about the pound/dollar instrument. At the same time, I recommend waiting a couple of days for the US election to end and the markets to calm down after a fairly strong and important news background. After that, you will need to make additions to the wave markup and draw new conclusions.

The wave markup on the lower chart does not look more convincing. The rising wave 3 or C looks as if it has already completed its construction. At the same time, an unsuccessful attempt to break through the 50.0% Fibonacci level suggests that the increase in the instrument's quotes will resume. Thus, if the current wave markup is correct, the instrument will have to pass through the 50.0% level to continue building a new downward trend section.

There is still little good news for the British currency. More precisely, there is no news for the pound at all right now. Negotiations in London seem to be continuing, and markets continue to wait for information about their results. But there is no information, and this is beginning to frighten. On the other hand, if the negotiations had failed, they would not have lasted so long. The parties may actually be able to conclude a trade agreement before December 31, 2020, which will be a strong growth factor for the British pound. But there is still no news yet, so the markets are invited to pay more attention to the events in America on November 3 and 4. We can expect strong market movements on these dates. The White House, meanwhile, commented on the results of opinion polls that predict a victory for Joe Biden. According to the White House Director of Strategic Communications, Alyssa Farah, most polls and forecasts are wrong, as they were in 2016 when everyone was betting on Hillary Clinton. "The silent majority, which in 2016 showed all its strength, again confidently supports President Trump," Farah said. Thus, Republicans are counting on the fact that the majority of Trump supporters simply did not participate in various opinion polls. But they will come to the polls on November 3 and re-elect Donald.

General conclusions and recommendations:

The pound/dollar instrument presumably completed the construction of an upward trend section. However, I do not recommend selling the instrument until a successful attempt to break the 1.2860 mark, which corresponds to 50.0% of the Fibonacci level. If a successful breakout attempt takes place, I recommend selling with targets located near the calculated marks of 1.2719 and 1.2543, which is equal to 61.8% and 76.4% for Fibonacci.