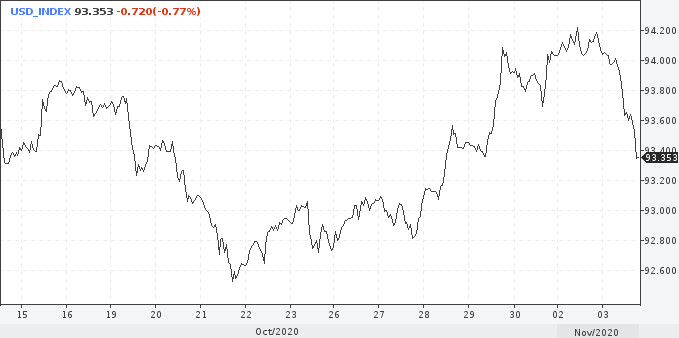

The US dollar increased to a 4-week high last Friday, while it traded mostly in narrow ranges in October. Investors move quickly to defensive assets, since they are worried that the results of the election would eventually be challenged in court. The situation with the development of the pandemic, which threatens new economic damage, has added pressure.

Today, the dollar index declined again. It is expected that short positions in the US currency will remain, and may increase immediately after the presidential elections.

In a Reuters poll conducted from October 27 to November 2, nearly 70% of respondents said that net short dollar positions would remain the same or that the number would rise immediately after the election, while a few of the respondents shared the opposite opinion.

In another poll, more than 50% of survey participants (39 out of 50 analysts) said the election result in the next few weeks will be the greatest impulse of the dollar's growth. In this regard, the spread of COVID-19 will fade into the background. The re-election of the current president with the preservation of the Republican Senate is unlikely, but this could lead to a significant strengthening of the dollar.

Experts believe that the dollar's oversold condition suggests that President Trump's surprising victory could easily have a significant effect of reducing short positions on the USD.

However, the most extensive poll, involving more than 70 analysts, pointed out that the dollar will weaken next year.

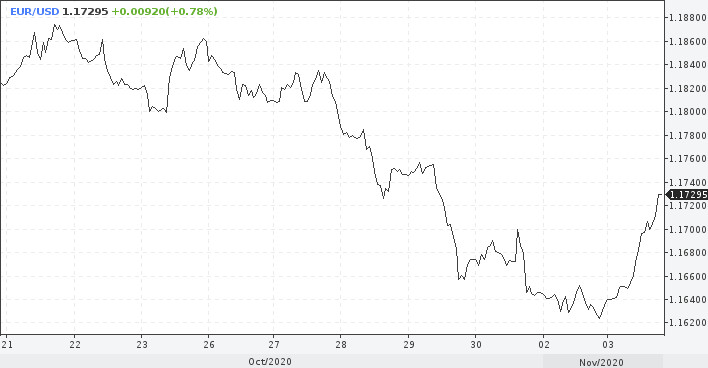

In turn, if Biden wins the election, the US dollar is expected to decline, which is partly because of the rising expectations of a large aid package for the US economy under the Democrat's presidency.

The euro should support this scenario. The single currency has collapsed recently due to the rally in the dollar and the re-introduction of quarantine in some parts of Europe. In October, the euro sank by 0.6% against the dollar. However, the exchange rate increased by almost 4% over the year. The nearest target for buyers of the EUR / USD pair is 1.18. Over the course of the year, the rate should increase by at least 4%. Thus, the forecasted growth above the level of 1.20 is still relevant.

Analysts say that the euro, which is fairly the story of COVID-19, has not been affected as much as expected.

As for the current realities, a positive background is being formed. The upward trend in the commodity market should support the Euro, since the Eurobloc currency is correlated with metals and energy carriers.

On another note, the US Financial Department seized $ 73.7 billion through the placement of Treasury securities the day before. This is the highest number in the last month. It was known that large-scale operations of the Ministry of Finance lead to the growth of the US currency, but operations of a similar scale are not expected in the coming week. Yesterday, the volume of repayments exceeded the volume of placements by $ 9.9 billion, which will slightly put pressure on the position of the US dollar.