Crypto Industry News:

According to PeckShield, OpenSea users complained about a phishing attack that resulted in the theft of countless non-exchangeable tokens. At the same time, the NFT entity announced that it was investigating these "rumors" and that no attack was related to its website.

The first reports started arriving from OpenSea users who saw disturbing behavior on their accounts. Soon after, blockchain security company PeckShield alerted that a phishing attack was underway, asking customers to authorize the migration to another OpenSea site that promised to be gas-free. The market team said it is "actively investigating rumors of an exploit", adding that the incident was indeed a phishing attack "originating from outside the OpenSea site".

Co-founder Devin Finzer also addressed the case, later pointing out that 32 users "fell into an attacker's trap and some of their NFTs were stolen."

Finzer further claimed that the team believed the attack was stopped because there were no more reports of phishing emails. Additionally, he refuted rumors that $ 200 million had been stolen from the platform. Internal estimates have shown that the perpetrator has so far sold a portion of the NFT worth $1.7 million.

PeckShield has provided a list of allegedly stolen NFTs according to which there are hundreds of ERC721 digital artworks and dozens of ERC1155 stolen from users. Some of them are Bored Ape Yacht Club (BAYC), Azuki, Farm Land by Pixels and others.

Technical Market Outlook

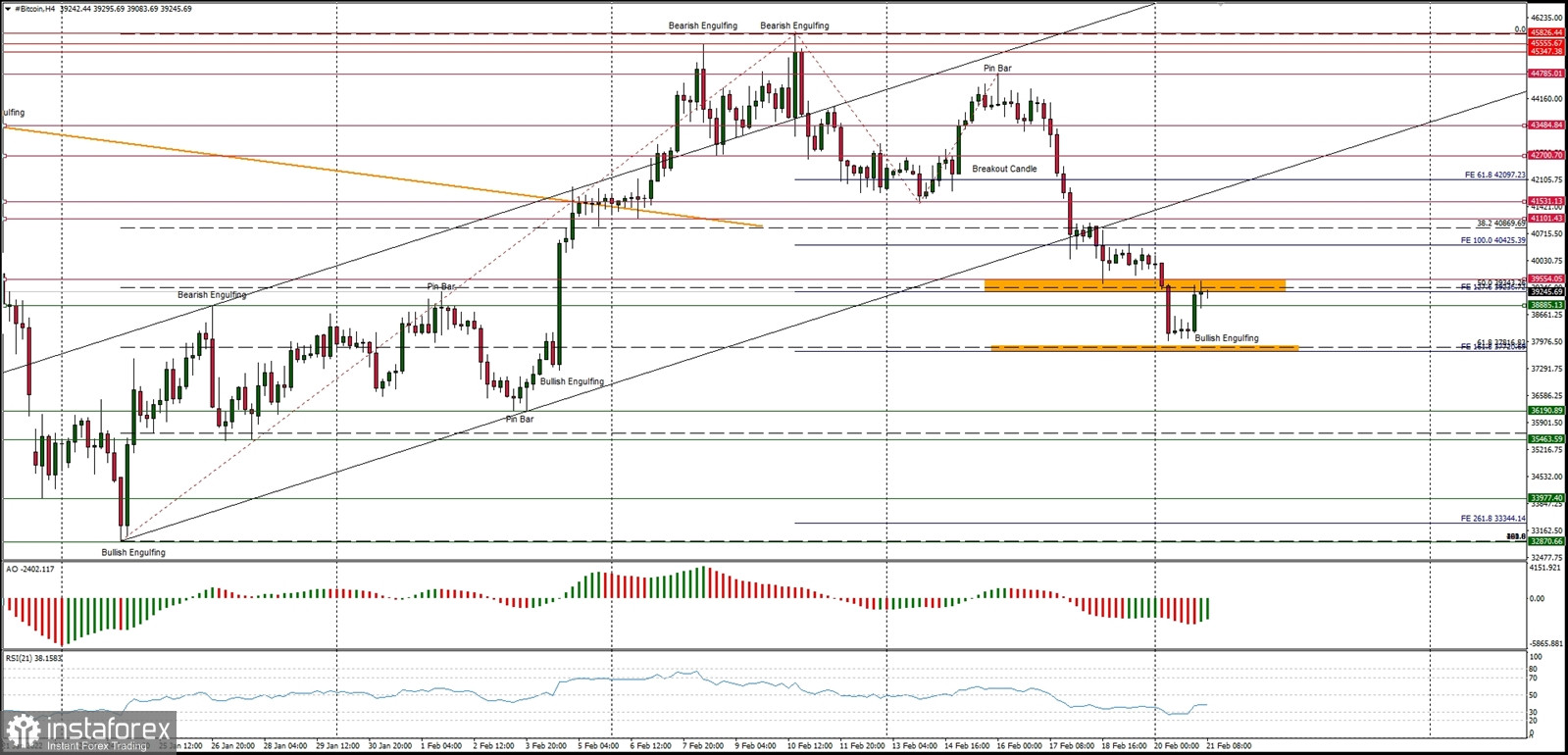

The BTC/USD pair has retraced 61% of the last wave up and made a new local low at the level of $37,993. Moreover, the market broken out of the lower ascending channel line, so the bearish pressure intensify. The next Fibonacci cluster used as the target for bears is seen between the levels of $37,817 - $37,720. Any violation of the last support level located at $36,190 will result in sell of towards the swing low seen at $32,870. The immediate technical resistance is located at the level of $39,555.

Weekly Pivot Points:

WR3 - $48,426

WR2 - $46,630

WR1 - $41,615

Weekly Pivot - $39,882

WS1 - $34,802

WS2 - $32,798

WS3 - $28,034

Trading Outlook:

The market is bouncing after over the 80% retracement made since the ATH at the level of $68,998 was made. The level of $44,442 is the next key technical resistance for bulls, but the game changing technical supply zone is seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend.