The X-hour has passed, America has made its choice, it remains to find out who is the winner. Early results indicated Joe Biden's precarious leadership, Donald Trump retaining a chance to win. Curiously, the market reaction is relatively calm when compared with the previous US presidential elections. Then, on the unexpectedly strong results of the Republican, the fall in futures on indices reached 5%. After Trump's triumphant speech, they turned to growth. During this time, investors have already realized that Trump is not a nightmare at all, but somewhere even a driver for the markets. Therefore, his defeat in the short term can be perceived negatively.

Joe Biden's presidency will be calmer. He may raise the adoption of the stimulus package for the US economy to over $2 trillion, which is very important for the markets.

There have been many speculations lately about which sectors of the economy will benefit under Biden. There was no concern in the markets about the possible negative the Democrat could bring. Since the beginning of the week, market players have been trying to buy back stock indices on the decline in the S&P 500, where there have been purchases since July.

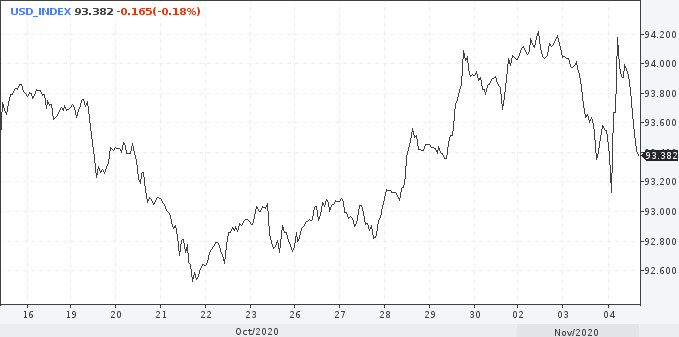

As far as the dollar is concerned, the end of the election race was good for it. The USD index managed to recover losses, the indicator briefly touched the maximum levels since the end of September, exceeding the important psychological level 94. Today, the situation is volatile, and this is not surprising. In the Asian session, it managed to grow up due to increased uncertainty. It is extremely difficult to predict the results of the presidential race.

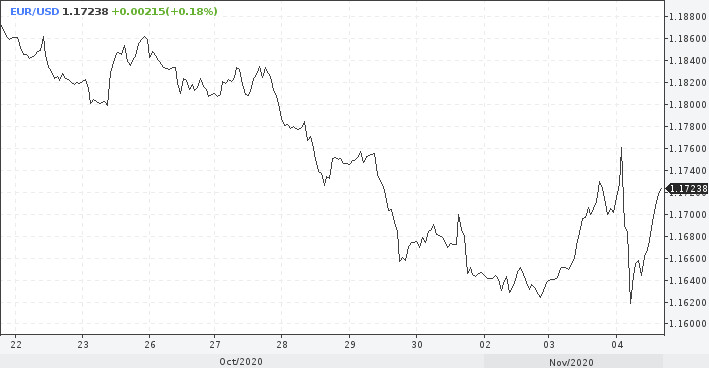

The EUR / USD pair today into the area of the 16th figure, but then quickly made up for the lost time, returning to the level of 1.17 due to another wave of dollar sales.

In general, it is already clear now that the current elections did not cause such a large-scale reaction as it did four years ago. This is important to understand for traders who were preparing for high volatility. In addition, the reaction can be extended over time. It is possible that a recount and verification of votes will be needed, and it is also possible to challenge the election results in court.

It is unlikely that the name of the winner will become known in the next few hours, most likely, it will take several more days to count the votes. Now all the attention is on the results of the voting in the states of Wisconsin, Michigan, and Pennsylvania. These states are not yet ready to announce even preliminary results. However, Michigan promised to clarify the picture within 24 hours, the state authorities asked to be patient.

Joe Biden may win if he overtakes Nevada, Wisconsin, and at least one of the hesitant states.

Meanwhile, Donald Trump has already managed to speak to his supporters and share with them confidence in his victory, which, of course, angered Biden's headquarters. Trump is already threatening the Supreme Court, and Biden promises to fight back.

Against this background, it is worth waiting for the return of the dollar index above the level of 94. The situation with the elections cannot be diplomatically resolved when candidates vote about their victory in advance before summing up the results.

The EUR / USD pair, despite the growth, was trading below the important short-term resistance level of 1.1750 during the European session. If the euro does not move above this level, then short positions on the main pair will be preferable. The target will be the levels of 1.1550, 1.1470.

By the way, because of the elections, the Fed meeting practically dropped out of the investors' field of view, the decision of which on the rate will be announced on Thursday. After the last meeting in September, the outlook for the US economy has deteriorated due to the second wave of the pandemic. America consistently tops the list of the largest number of COVID-19 cases. It is unlikely that there will be any major changes at this meeting. Jerome Powell is likely to reaffirm his commitment to loose monetary policy and highlight the current risks to the country's economic recovery.

With more aggressive signals aimed at easing policy, the dollar may come under additional pressure.