The EUR/USD pair showed high activity on the information noise flow related to the US presidential elections. The high and low points in the rally were the coordinates 1.1767 and 1.1602. During yesterday's Asian session, the entire scale fell, where the first voting results appeared.

Looking at the above material, the main leverage for action is the news background regarding the elections, where technical analysis acts as a secondary role in the market.

Therefore, we should continue monitoring the counting of votes, where Joe Biden's victory may lead to a weakening of the US dollar, which will allow the EURUSD pair to grow.

In terms of technical analysis, price coordinates are located at 1.1700 – a conditional support in the current stagnation and 1.1767 – a conditional ceiling for the current week.

Here's the trading recommendations based on price levels and speculative hype, where it is possible to enter local positions in the direction of a breakdown of a particular coordinate.

- Buying a pair is recommended at a price above the level of 1.1767, with the prospect of moving to 1.1810.

- Selling a pair is recommended at a price below the level of 1.1700, with the prospect of moving to 1.1650.

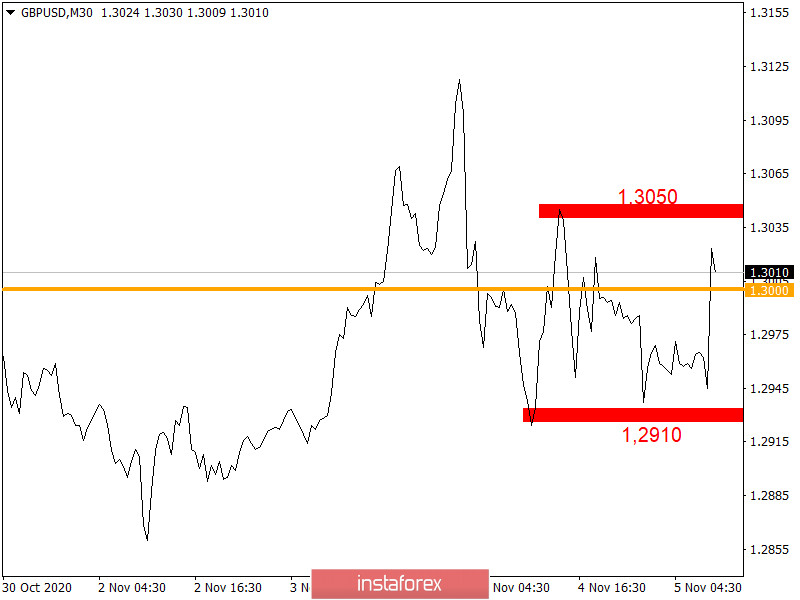

As for the GBP/USD pair, a similar speculative behavior in the market is observed due to strong information noise from the United States.

The key price coordinates are 1.2913 and 1.3048, which reflects the amplitude of the variable deceleration during the afternoon yesterday.

Similarly to the EUR/USD pair, the leverage for action is also related to the US presidential election results. But to enter trading positions, the primary points are coordinates 1.2913 and 1.3048, working on their breakdown.

- Buying a pair is recommended at a price above the level of 1.3050, with the prospect of moving to 1.3110.

- Selling a pair is recommended at a price below the level of 1.2910, with the prospect of a moving to 1.2850.