Investors continue to closely monitor the results of the US presidential election. At the moment, the democratic candidate Joe Biden is still ahead of the current head of the White House, Republican Donald Trump. According to the latest information, Biden has 264 electoral votes, while Trump has only 214. A curious situation is also happening in the fight for the Congress of the United States of America. Democrats who had hoped to control the Upper House of Congress are a little disappointed. So far, the Democrats have 48 seats in the Senate, while their opponents have 46 seats. But in the House of Representatives, the Democrats seem to have the advantage, as they currently have 204 seats, while the Republicans have only 190 representatives. I believe that the results of the US presidential election can be summed up more definitely on Monday, but for now, we will move on to another important event of the day.

So, at 14:30 London time, data on the labor market in the United States will arrive. The consensus forecast for the unemployment rate for October is 7.7%, which is lower than the previous figure of 7.9%. The number of newly created jobs in non-agricultural sectors of the American economy is expected to reach 660 thousand, while the previous figure was 661 thousand newly created jobs. Average hourly wage growth is forecast at 0.2%, which is higher than the September growth of 0.1%.

If we touch on the topic of the COVID-19 pandemic, its second wave completely covered the United States, where a new anti-record of the daily number of infected people was recorded, which amounted to 118,000 people. An impressive and terrifying figure! COVID-19 outbreaks have been reported in the following states: Utah, Pennsylvania, Wisconsin, Illinois, Minnesota, and Colorado.

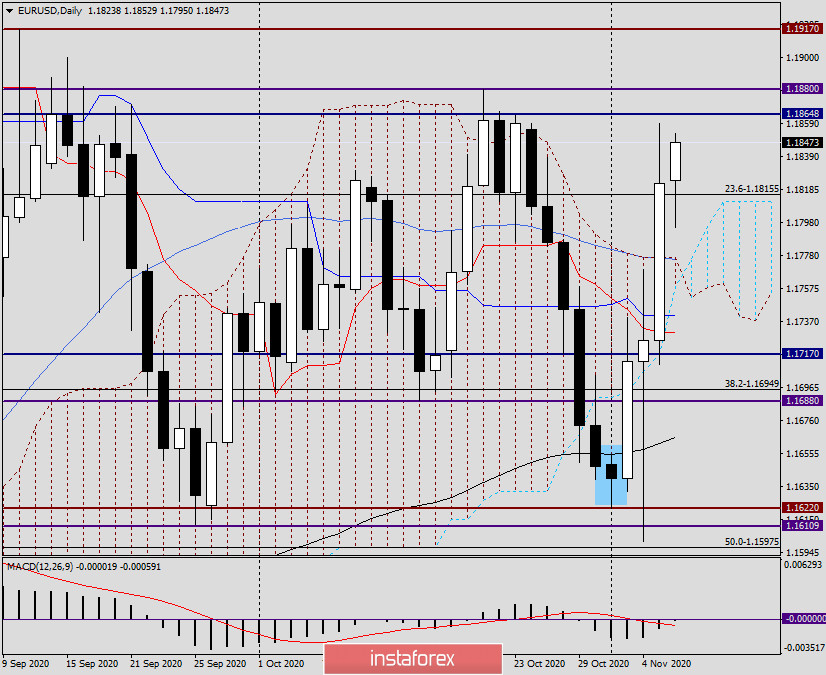

Daily

Turning to the technical analysis of the main currency pair of the Forex market, I would like to remind you that the victory of Joe Biden did not promise the US currency anything good. At least in the short or medium term. So far, this is exactly what is happening. Given that the democratic candidate is ahead of the incumbent president, there is moderate risk sentiment in the markets, which puts pressure on the US dollar.

Following the results of yesterday's trading, the euro/dollar currency pair rose and ended the session at 1.1822. This is quite a positive moment for the euro bulls, which allows us to hope for further growth, possible goals of which will be 1.1860, 1.1880, 1.1900, and 1.1917. However, today much will depend on American labor reports and the reaction of market participants to them. Of course, if such a reaction is adequate to the data obtained. We can assume that the US election will partly overshadow such serious statistics as Nonfarm Payrolls, so you should not be surprised and you need to be prepared for a variety of surprises

According to the technical picture, the bullish scenario will continue only if the sellers' resistance breaks at 1.1860, where the maximum values of yesterday's trading were shown. It is worth noting that the prospects for further growth of EUR/USD technically look very good since yesterday the pair broke through the 50 simple moving average and went up from the daily cloud of the Ichimoku indicator.

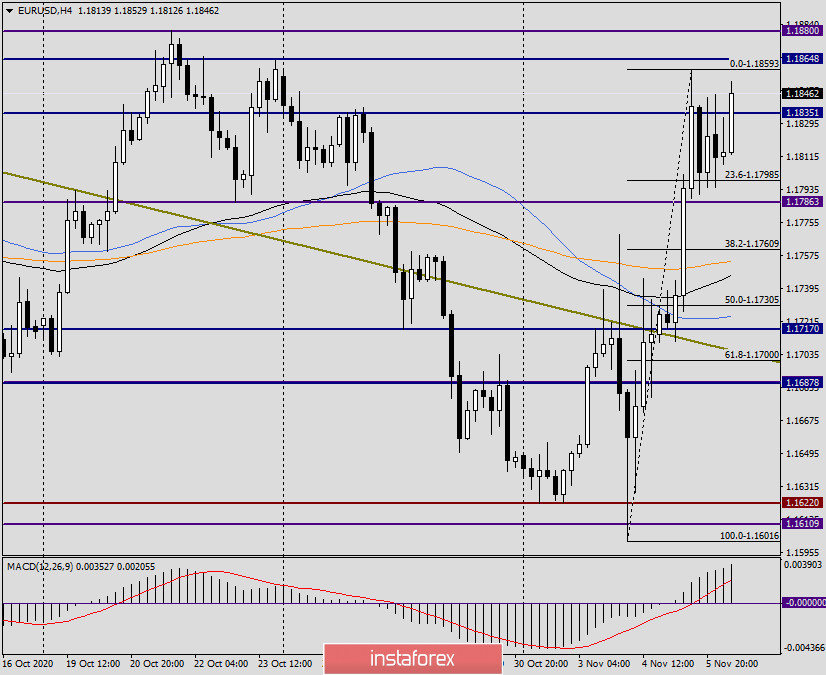

H4

If we stretch the Fibonacci grid to the growth of 1.1601-1.1859 in this timeframe, we see that the pair corrected only to the first pullback level of 23.6, after which it turned to continue the upward dynamics. As a rule, such minor pullbacks indicate the strength of the current trend and increase the probability of its continuation. However, the situation is complicated by the presence of resistance levels of 1.1864 and 1.1880 at the top, so buying on the breakout of yesterday's highs, in my opinion, is quite risky. However, given the high volatility and Biden's leadership in the presidential election, you can try just such a trading strategy, especially since there has already been a corrective pullback. Another option for purchases will be a rollback to the truly broken resistance level of 1.1864 if it takes place.

In the current situation, there are no other trading ideas yet. For those who do not want to take risks, I suggest waiting for Monday and building trading plans based on the week that has ended.