In the most global sense, the construction of an upward trend section may resume, however, the entire wave marking takes a more complex form. The section of the trend that starts on September 23 takes a five-wave form, however, it is not an impulse one. Thus, after the end of the next rising wave, the construction of a new three-wave section of the trend can begin. However, given that there is no classical wave marking now, the section of the trend from September 23 can be complicated as many times as necessary. The news background is now of great importance for the markets. Now the British dollar is rising, as markets are afraid of dollar purchases. In a week, the dollar may start to grow, as the markets will start to get rid of the British dollar.

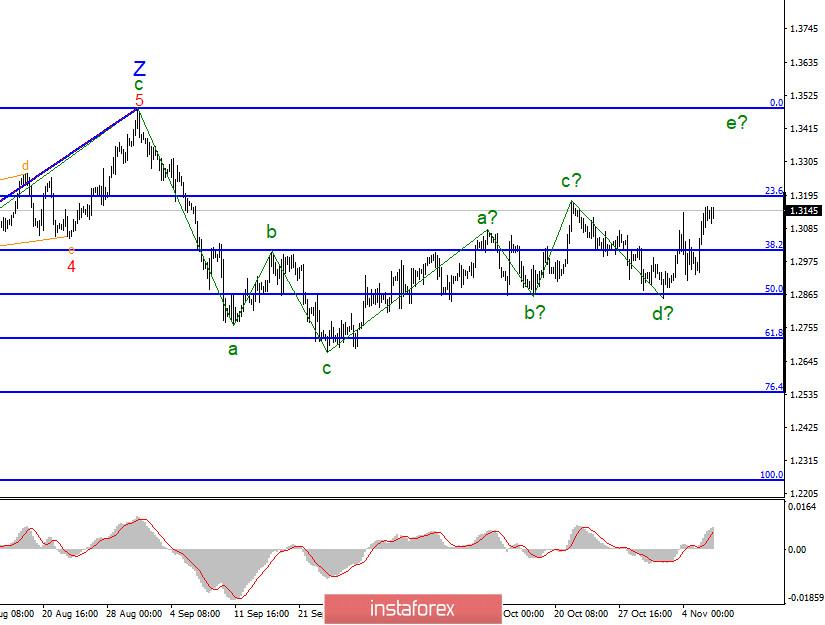

The lower chart clearly shows two failed attempts to break the 50.0% Fibonacci level, which are currently interpreted as the lows of waves b and d. Thus, the wave marking takes on a rather non-standard appearance, and the construction of the next ascending wave can be completed already around the 23.6% Fibonacci level. At the same time, a successful attempt to break the 1.3189 mark will indicate that the markets are ready for further purchases of the British dollar within the expected wave e.

Yesterday, the Bank of England and the Federal Reserve met, and Jerome Powell and Andrew Bailey delivered speeches. If the Fed meeting turned out to be quite boring, since no important decisions were made, then the Bank of England meeting turned out to be quite interesting. In particular, the Central Bank expanded the QE program by 150 billion pounds. Now markets are waiting for a reduction in key rates in the UK, as the economy continues to "limp", and at the end of 2020 may again shrink due to the coronavirus and a new "lockdown". There is also no trade agreement with the European Union, so during 2021, the British economy may "limp" on two legs. However, Jerome Powell also hinted at possible new economic stimulus actions. All this data did not interest the markets at all. Demand for the British pound persisted despite the dovish actions of the Bank of England.

Today in America, an important Nonfarm Payrolls report was released, which showed that in October, 638,000 new jobs were created outside the agricultural sector. Markets were expecting only 600,000. The unemployment rate in October fell from 7.9% to 6.9%, although expectations equated to 7.7%. Thus, two very important reports showing a good recovery in the US economy did not provide any support to the dollar. Consequently, the markets remain fully focused on the vote count, as well as on the political chaos that may begin in the near future. Statistics (even important ones) are not important now, and even the topic of Brexit is fading into the background. Thus, we need to wait for the final results of the elections and further actions of both presidential candidates.

General conclusions and recommendations:

The pound/dollar instrument resumed building an upward trend section, but its last wave may end near the 23.6% Fibonacci level. Thus, in case of a successful attempt to break the 1.3189 mark, I recommend buying a tool with targets located near the 1.3484 mark, which corresponds to 0.0% Fibonacci. Otherwise, a new downward section of the trend may start building.