Joe Biden has won in the recently-held US presidential elections. However, such an event did not affect the euro and the dollar in any way, much to the dismay of many traders. The EUR / USD pair did manage to return to the area of the 19th figure, but around there, growth stopped again.

The recurring halt in growth around the 19th figure suggests that traders, particularly the euro bulls, find rather big problems along the range. It seems that the euro will move depending on how traders handle the level of 1.1915, as a test of which is expected to occur in the near future. A breakout from the level is predicted to trigger a strong rise towards 1.1970 and 1.2010, which, by the way, is the high of this year. Thus, without any good news in the eurozone, it is unlikely that the quote will reach this price level, and even more so to gain a foothold above it. Traders need to be very careful, especially since there are no real objective reasons that could keep the short-term bullish momentum in the near future. As for the downward correction, a lot will depend on the level of 1.1850,

In any case, it is already clear that the US dollar is not as strongly dependent on political events as many previously assumed, and its further direction will sooner be associated with the second wave of the coronavirus pandemic and its impact on the economy of the eurozone and the United States. The long-awaited new stimulus measures in the US, no matter if it amounts to more than $ 2 trillion, will also heat up the stock markets. Thus, the pressure on the US dollar, in the event of such an extensive package of measures, will clearly be limited.

In addition, the only possible situation that could pull the US dollar down is a scenario in which the Democratic Party takes control of the Senate to bring about significant political changes. For example, a tax increase or a tighter regulation of large technology companies.

The continued dominance of the dollar in all the markets will very much play on the side of the euro bears.

Meanwhile, quite an interesting forecast was published from Fitch last Friday, according to which the main "headache" for the EU is a double recession in Europe, which will put pressure on the global economic recovery. The resumption of lockdowns is predicted to lead to a new decline in economic activity in the 4th quarter of this year, thus, Fitch expects the eurozone GDP to contract by 4% in Q4. A rapid recovery is expected only in spring next year.

As for the US GDP, Fitch said it would shrink to 3.7% instead of the forecasted 4.6%.

China's GDP forecast was also revised from + 2.7% to + 2.3%.

Nevertheless, it is clear that whatever the forecasts are, everything will depend on how long the lockdowns will last. Moreover, if similar quarantine measures are introduced in the United States, serious problems will arise for the global GDP, as such may lead to another disruption in supply chains, as well as general disruption in the functioning of the economy. which will be another impetus for the strengthening of the US dollar.

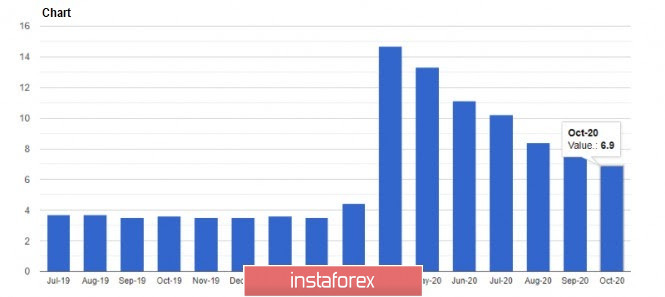

With regards to statistics, quite a good report was published from the US Department of Labor last Friday, mainly because the latest data said the number of jobs outside of agriculture was significantly better than the forecasts. This indicates the continued recovery of the US labor market, after the downturn caused by the first wave of the coronavirus pandemic. The report said 638,000 jobs were created in October 2020, while economists had expected a figure of only about 530,000. As for the overall unemployment rate, it fell to 6.9%.

Looking more closely at this data, growth was mainly driven by the private sector, which created 906,000 jobs last month. On the other hand, the public sector lost 268,000 jobs during the reporting period, which was due to the layoff of temporary employees hired to conduct the population census. The problem is that most jobs were created in the leisure and services sector, which is about to collapse again amid the rapid rise of COVID-19 incidence in the United States. So far, no serious measures have been taken, but if a number of restrictions are introduced and the operation of entertainment and catering establishments is suspended, another surge in layoffs may occur and, accordingly, an increase in unemployment along with a reduction in the number of new jobs. And although the October report suggests that the labor market still has a fairly strong impetus for recovery, it will hardly be possible to expect similar growth rates in the future.

As for Europe and the UK, the rise in unemployment will soon slow, and this is because of the support programs that the government adopted during the first wave of the coronavirus pandemic.