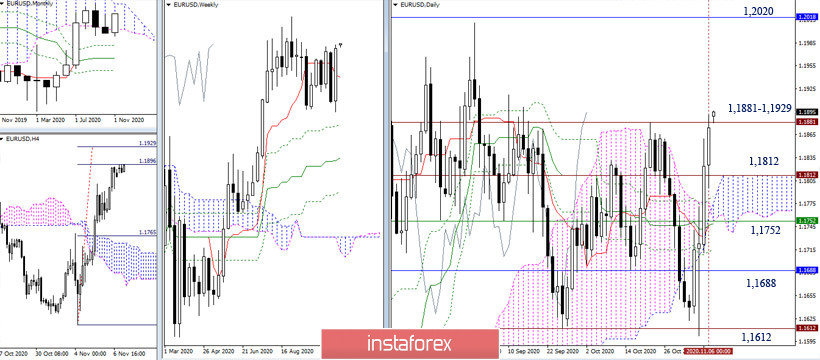

EUR / USD

The bulls closed last week's trading positively and updated the previous extreme high (1.1881). At the same time, the first goal for the breakdown of the H4 cloud (1.1896 - 1.1929) was tested. The main task for the near future is to maintain current positions and securely consolidate above 1.1881 - 1.1929. After that, it will be possible to consider rising to the level of 1.2020 (high of the upward trend + the upper limit of the monthly cloud). If the bulls failed to increase their current positions, the next change of mood can delay the implementation of bullish plans for a long time. The support and downside pivots remain the same and retain their location - 1.1812 - 1.1752 - 1.1688 - 1.1612.

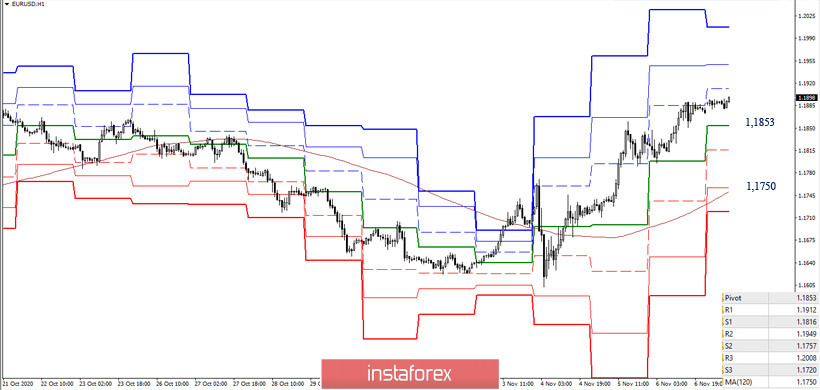

The favor in the smaller time frame is on the bulls' side, who continue the upward trend and are now conquering new peaks. The resistance levels within the day are 1.1912 (R1) - 1.1949 (R2) - 1.2008 (R3). If the correction develops, the nearest important support is located today at 1.1853 (central pivot level). We can continue with this movement until the support of the weekly long-term trend (1.1750) will be important. In this direction, the nearest support can be noted at 1.1816 ( S1). A consolidation below 1.1750 will change the balance of power not only in the smaller time frames, but it will be practically a turning point for the bigger time frames as well, as the bearish players will return to the bearish zone relative to the daily cloud and take over the weekly short term.

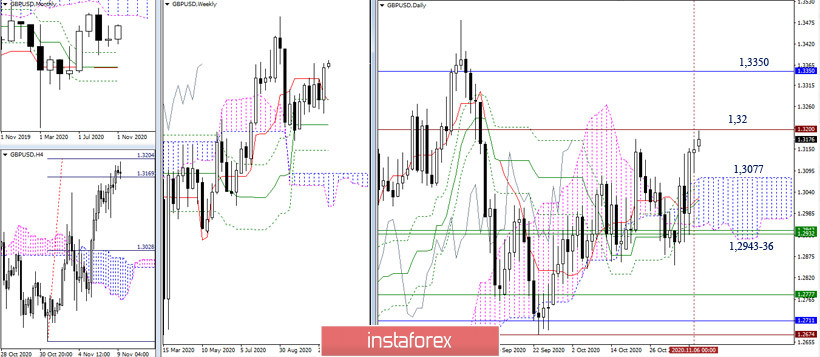

GBP / USD

The bulls remain active and are now testing an important level of 1.32 - a historical level that has been tested by time. Currently, their main task is to decline with a reliable consolidation above 1.32 (historical level + target for the breakdown of the H4 cloud). After that, it will be likely to consider the following pivot points 1.3350 (lower limit of the monthly cloud) and 1.3481 (extreme high). In turn, an important support is currently being formed by the daily cloud, strengthened by weekly levels (1.3077 - 1.2943-36). A breakdown below which will change the current balance of power and require a new assessment of the situation.

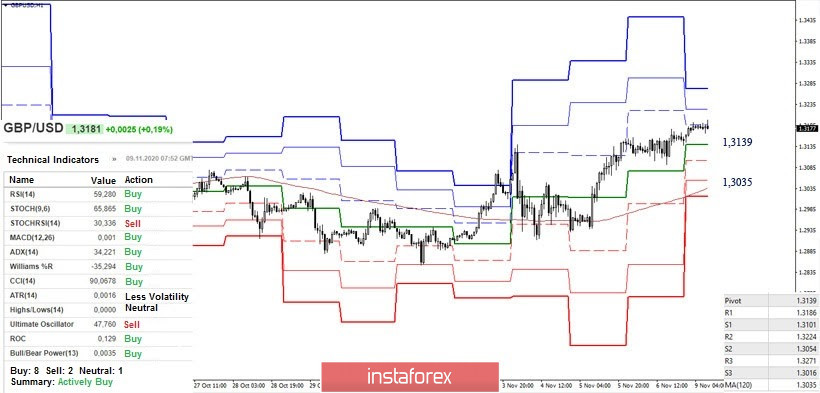

As mentioned above, the bulls, which are now testing the resistance R1 (1.3186), are of advantage. The next intraday upside goals are located at 1.3224 and 1.3271. Now, if a rebound forms from resistance and a downward correction develops, the bears' interest will be focused on the key supports 1.3139 (central pivot level) and 1.3035 (weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)