To open long positions on GBPUSD, you need:

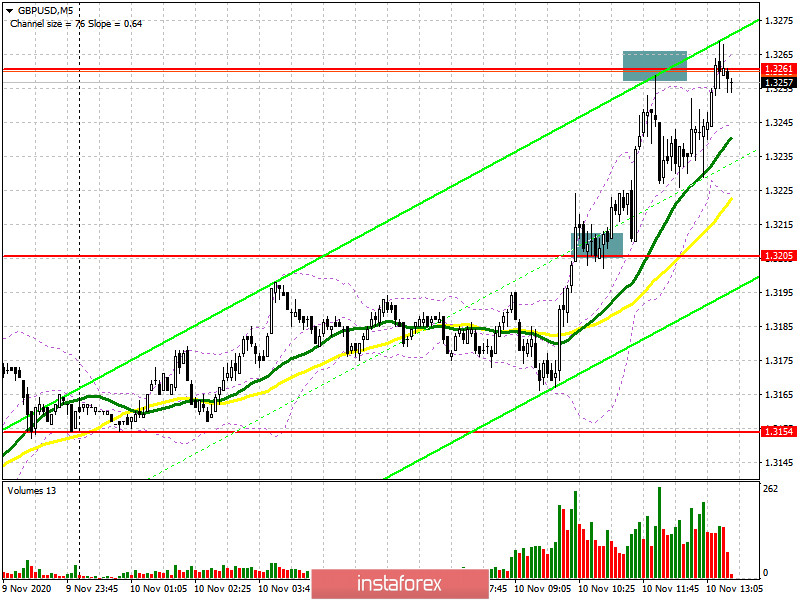

Today, in the first half of the day, data on the UK labor market was released, which in some points turned out to be even much better than economists' forecasts, which led to the formation of another signal to buy the pound and further growth of the pair. Let's look at the deals and see where you can and should have bought the pound. The 5-minute chart clearly shows how the bulls break through and consolidate above the resistance of 1.3205, after which I recommended opening long positions in the morning. As a result, the growth was more than 50 points and the goal of 1.3261 was reached. From the level of 1.3261, I recommended selling the pound immediately for a rebound with a correction of 20-30 points. In the end, this is what happened. After the test of 1.3161, the pound bounced down about 33 points.

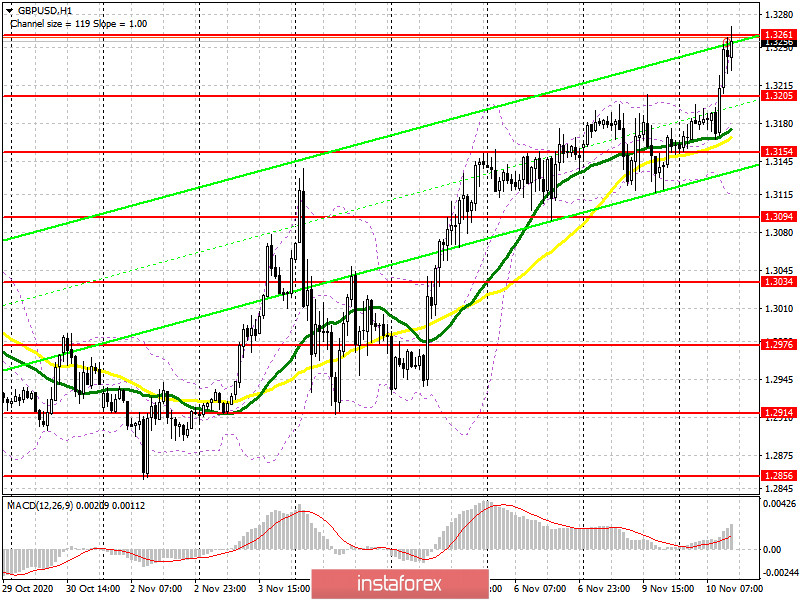

At the moment, the next target of the bulls is the resistance of 1.3261, near which the main trade is currently being conducted. However, I recommend opening long positions from there only after a confident breakdown and fixing above this range, similar to the morning purchase that I analyzed above. Only this will lead to further growth of GBP/USD with the release of the highs of 1.3315 and 1.3378, where I recommend fixing the profits. If we observe a downward correction of the pound in the second half of the day, it is best not to rush with purchases, but wait for the formation of a false breakout in the area of 1.3205. I recommend opening long positions immediately for a rebound from the minimum of 1.3154, based on a correction of 20-30 points within the day.

To open short positions on GBPUSD, you need:

Bears can only rely on good fundamental statistics on the American economy, which is not particularly important. However, this may slow down the bullish momentum, which will lead to the formation of a false breakout in the resistance area of 1.3261. This will be the first signal to open short positions in the expectation of a downward correction to the area of the morning level of 1.3205, where I recommend fixing the profits. An equally important task for sellers will be to break through and consolidate below the support of 1.3205, which will quickly push the pound to a minimum of 1.3154, where I recommend fixing the profits. In the scenario of further growth of the pair and lack of activity in the resistance area of 1.3261, I recommend that you postpone short positions until the update of the maximum of 1.3315, where you can sell the pair based on a correction of 20-30 points, similar to the morning sale from the resistance of 1.3261.

Let me remind you that in the COT reports (Commitment of Traders) for November 3, there was a reduction in long positions and a slight increase in short ones. Long non-commercial positions fell from 31,799 to 27,701. At the same time, short non-commercial positions rose just slightly to 38,928 from 38,459. As a result, the negative non-commercial net position was -11,227 against -6,660 a week earlier, which indicates that the sellers of the British pound retain control and their minimal advantage in the current situation.

Signals of indicators:

Moving averages

Trading is above 30 and 50 daily averages, which indicates a continuation of the bull market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pound declines, the lower border of the indicator around 1.3125 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.