The AUD/USD pair plunged after reaching 0.7283 today's high. The USD dragged the pair down as the Dollar Index has managed to rebound. The DXY ended its temporary retreat after retesting the immediate downside obstacles.

In the first part of the day, AUD/USD rallied as the Reserve Bank of New Zealand raised its Official Cash Rate from 0.75% to 1.00% as expected. The Australian Wage Price Index rose by 0.7% matching expectations, while the Construction Work Done dropped unexpectedly by 0.4% even if the traders expected a 2.6% growth.

Still, a potential sell-off was somehow expected after the US reported better than expected data yesterday.

AUD/USD Erased Some Of Its Gains!

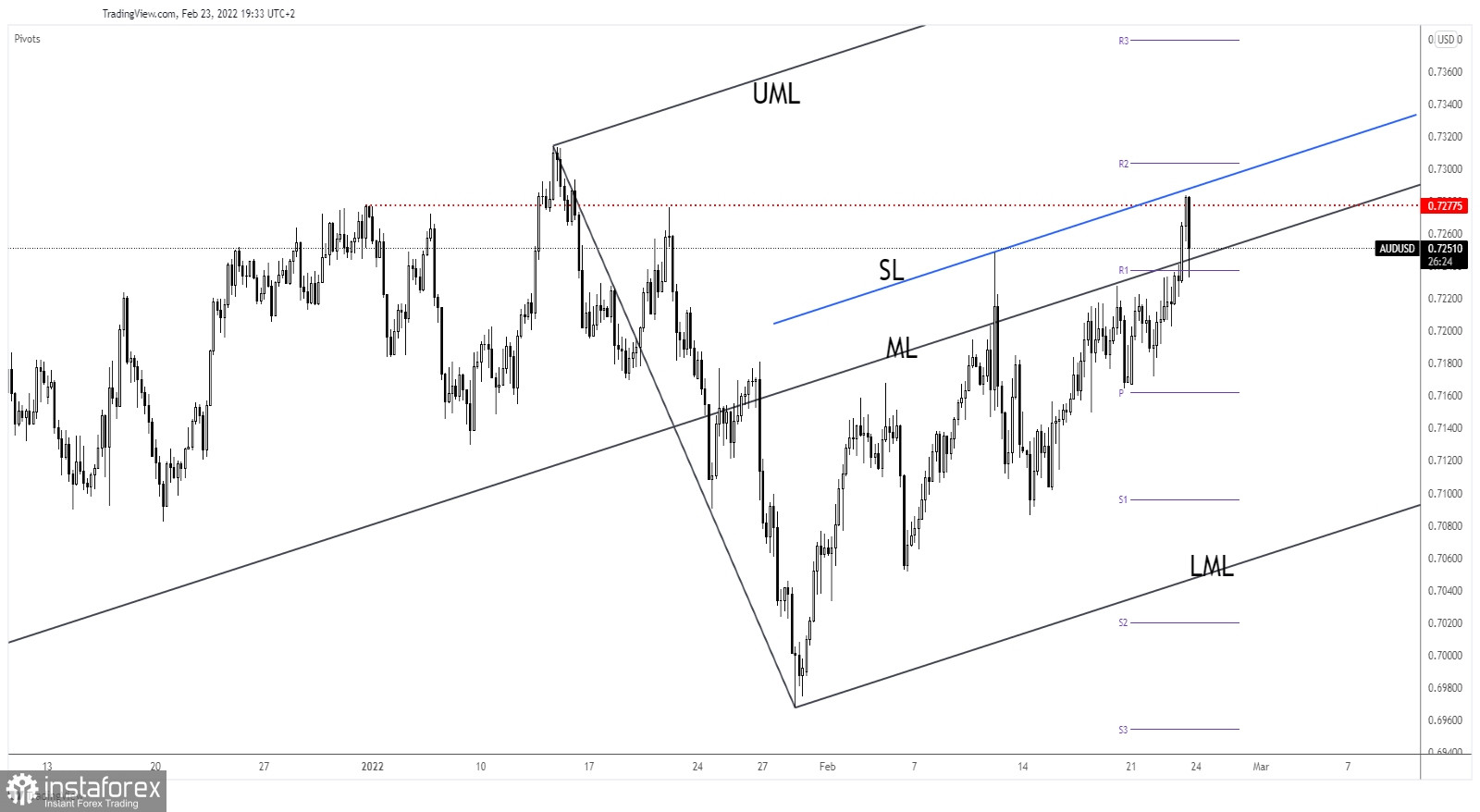

AUD/USD found resistance at the 0.7277 level and now it challenges the ascending pitchfork's median line (ML). As you can see, the currency pair registered a false breakout above the median line in the previous attempt.

Staying above the median line (ML) may signal that AUD/USD could try to climb towards new highs. On the contrary, a new false breakout above the median line, coming back and stabilizing below it may signal that the AUD/USD could develop a new downside movement.

AUD/USD Outlook!

A new higher high, jumping and closing above the 0.7283 could announce an upside continuation. Still, the pair is in a resistance area, a false breakout above the median line (ML) of any other bearish pattern could bring new selling opportunities.