GBP/USD

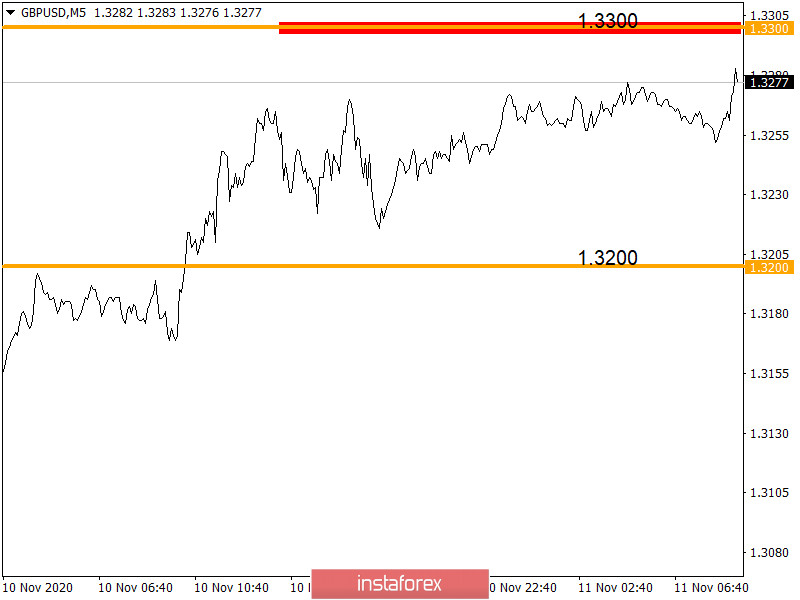

The pound followed the important resistance level of 1.3200 for two consecutive days, showing low activity, which ultimately led to a breakdown of the level of 1.32000, instead of a natural price rebound in the opposite direction.

What is the reason for the price growth? Is it the strengthening of the pound sterling?

The upward movement arose at the time of the publication of statistics on the UK labor market (7:00 Universal time), where it may seem that everything is very bad if we look at it the first time, but that was not the case.

Let's start looking at statistics from the negative side.

The unemployment rate in September rose from 4.5% to 4.8%, and employment in August fell by as much as 164 thousand against the expected decline of 140 thousand.

The UK labor market is weak, but accounting data for September and August.

Moreover, the applications for unemployment benefits for October suddenly fell by 29.8 thousand instead of the expected growth of 36 thousand, which became the reason for the strengthening of the pound.

To put it simply, the latest unemployment statistics for October may signal that the unemployment rate in a subsequent report from the Labor Department, will decline due to a reduction in the volume of applications for benefits.

Today, the UK statistics are not expected to be published. The upward price movement set during the previous day may remain in the market, which will lead to a convergence with the subsequent resistance level of 1.3300.

Now, a decrease in the volume of long positions* (buy positions) is not excluded within the indicated level, which may follow by a corrective movement towards 1.3250-1.3225.

EUR/USD

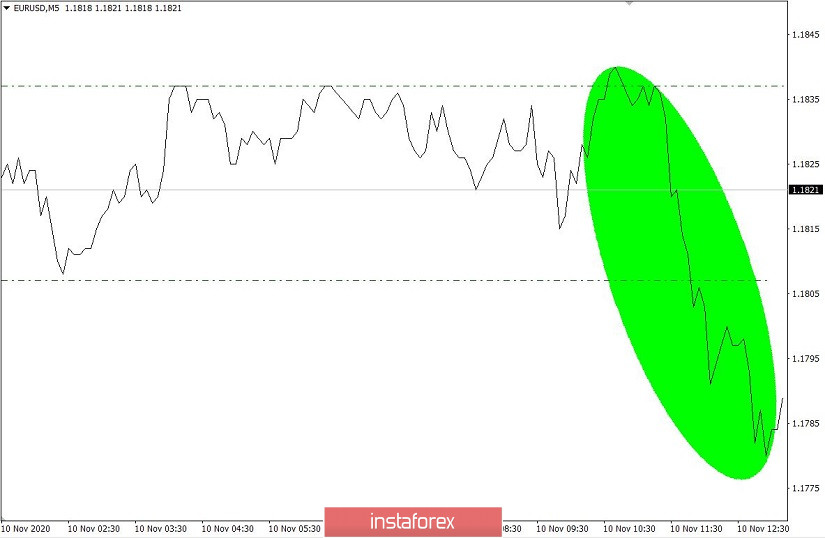

The market continued to react to the positive news about the successful third phase of clinical trials of the COVID-19 vaccine during the afternoon yesterday. As a result, speculation on the US dollar continued, which led to a local decline against the Euro.

The recommendation regarding the price rebound from the upper border of the side channel 1.1807/1.1840 coincided, which brought a small profit to the trading deposit.

Today, statistics for Europe and the United States are not expected to be released, and so, the market follows in the new range of 1.1805/1.1832. We can assume that price fluctuations within the specified limits will remain in the market for some time, where the most optimal trading tactic is considered to be the method of breaking a particular range boundary.

- Buying a pair is recommended at a price above the level of 1.1840, with the prospect of moving to 1.1875

- Selling a pair is recommended at a price below the level of 1.1800, with the prospect of moving to 1.1780-1.1760.