Yesterday, the euro and the pound initially showed good growth, but they had to give up all their gains in the end. At first glance, it may seem that it's all about Christine Lagarde's earlier speech. After all, it was assumed that amid reports about the COVID-19 vaccine, the European Central Bank might possibly hint at reducing the introduced stimulus measures due to the fact that the pandemic hit Europe very hard. However, the speech of the ECB's head has nothing to do with this, as she did not address this issue at all. After all, not only the single European currency was declining, but also the pound. Therefore, we can assume that the things that happened yesterday are because of something else.

Apparently, it's all about the rumors that began to spread in the American media. There are more and more reports that Mr. Trump may stop struggling further for the presidency and even withdraw lawsuits filed due to massive violations and falsifications during the voting itself and the subsequent vote count. This assumption is due to the fact that even if Donald Trump manages to achieve a recount of ballots in a number of states, he will not be able to do it in key states. As a result, he will still not get enough electoral votes. In other words, fighting his position will be meaningless. Although, according to rumors, the current president still does not recognize the past elections as fair. However, if these rumors are even slightly close to the truth, it is a factor that reduces uncertainty, and therefore has a positive impact. Most likely, this is what allowed the dollar to recoup its losses.

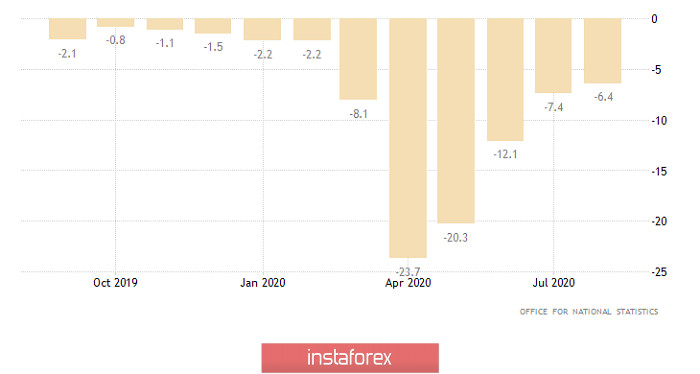

It is time for investors to turn their attention to macroeconomics due to the fact that the conflict regarding the US election is already ending. Fortunately, today's statistics are all right and there will be quite a few of them. The first to report will be the UK, where the pace of economic decline is expected to slow down from -21.5% to -9.7%. This is a fairly significant improvement in GDP dynamics, but only for the preliminary data. At the same time, certain improvement is expected in the industry, whose rate of decline may slow down from -6.4% to -6.2%. Against this background, the forecasts are entirely positive and quite impressive, although we are still talking about a recession. Nevertheless, even a hint of improvement is now being received with great optimism.

Industrial production (UK):

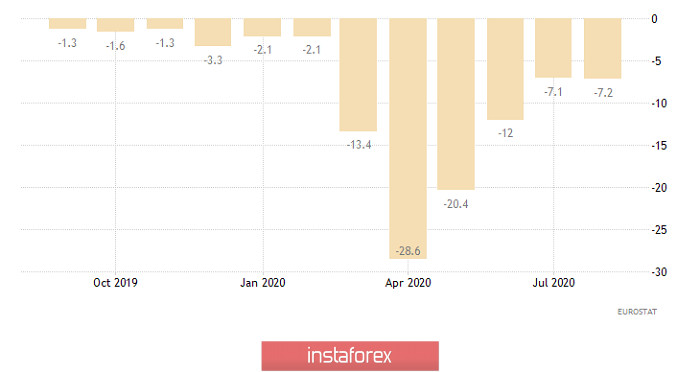

Industry in the euro area should also show improvement, where the rate of its decline may slow down from -7.2% to -5.4%. All this should lead to the fact that the euro will slightly grow with the pound.

Industrial production (Europe):

However, the euro's growth will be temporary. We may witness not just a return, but also a subsequent strengthening of the dollar after the opening of the US session. Of course, it's all about inflation growth, which is expected to rise from 1.4% to 1.5%. This is a favorable factor. However, we are talking about the fact that inflation has been growing for five consecutive months, given that the forecasts are confirmed.

In other words, US inflation is growing steadily, which means that the Fed does not need to think about any additional stimulus measures. Rather, on the contrary, it's time to think about reducing them, by tightening the parameters of monetary policy.

In addition, the dollar will be supported by data on applications for unemployment benefits, which may continue to decline. In particular, the number of initial applications should be reduced from 751 thousand to 743 thousand. But this is not much, so repeated applications are greatly interesting, which is expected to decline from 7,285 thousand to 6,820 thousand. As a result, US inflation is expected to continue to rise and unemployment is expected to decline.

Repetitive Unemployment Insurance Claims (United States):

The EUR/USD pair has been consistently forming a downward movement since this trading week started, as a result of which the quote declined to the level of 1.1750, where a stop occurred with a subsequent pullback. We can assume that there will be another decline which will lead to the values 1.1700 - 1.1650 --- 1.1620, if the price consolidates below 1.1745.

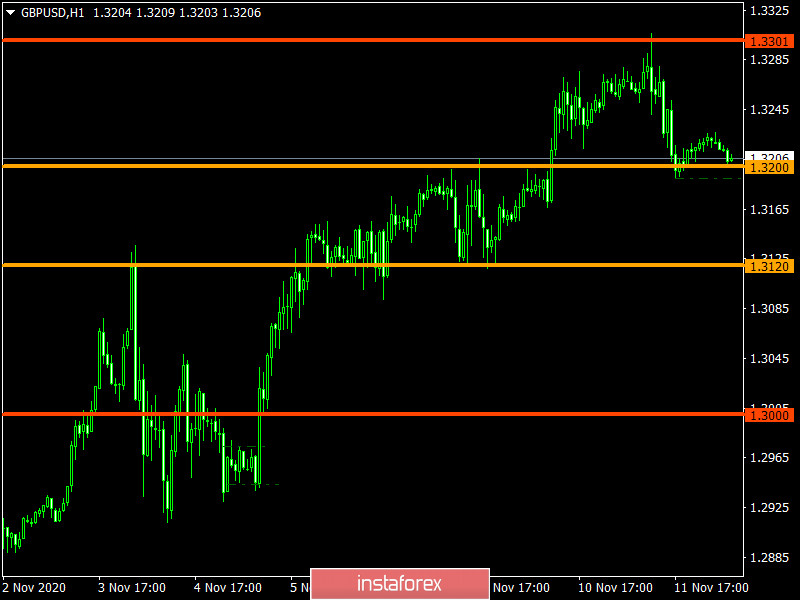

The GBP/USD pair found a resistance around the level of 1.3300, where there was a stop, followed by a corrective move. We can assume that a price consolidation below the level of 1.3190 will lead to a decline towards 1.3140-1.3100. It should be noted that as long as the quote does not consolidate below 1.3190 on an H4 TF, a variable gap in the amplitude 1.3190/1.3240 is possible.