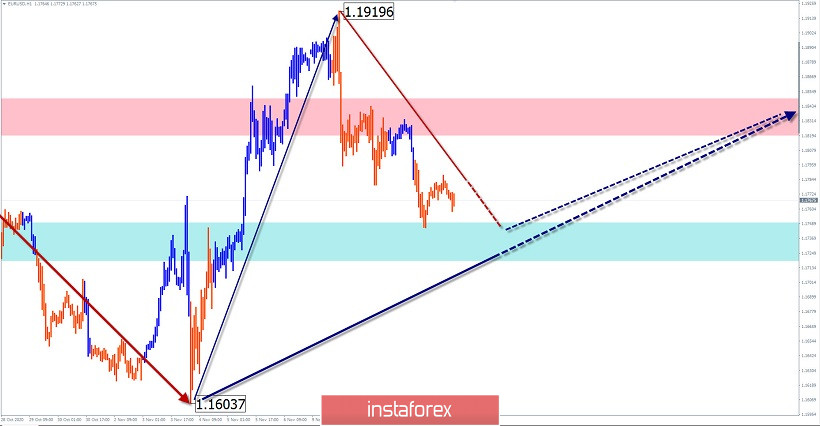

EUR/USD

Analysis:

In the upward wave of the euro from November 4, a corrective pullback has been formed in recent days. The price has reached the borders of the preliminary target zone. Its structure looks complete. Since yesterday, an ascending structure with a reversal potential has been formed on the chart.

Forecast:

In the next 24 hours, the bearish mood of the movement is expected to end, a reversal, and the beginning of price growth. A breakout of the upper limit of the resistance zone is unlikely today.

Potential reversal zones

Resistance:

- 1.1820/1.1850

Support:

- 1.1750/1.1720

Recommendations:

There are no market conditions for selling euros today. It is recommended to track signals for buying a pair in the area of settlement support.

AUD/USD

Analysis:

The price of the major Australian dollar moves according to the algorithm of the rising wave from September 25. The final part (C) is formed in the movement structure. As part of this movement, a correction has been developing from strong resistance since the beginning of this week. It looks formed.

Forecast:

The flat phase of the movement is expected to end today. By the end of the day, volatility is likely to increase and the exchange rate will change. The price growth can be expected, at least, to the resistance zone. During a reversal, a short-term puncture of the lower support border cannot be excluded.

Potential reversal zones

Resistance:

- 0.7320/0.7350

Support:

- 0.7250/0.7220

Recommendations:

There are no conditions for sales on the market today. It is recommended to look for buy signals in the support area.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!