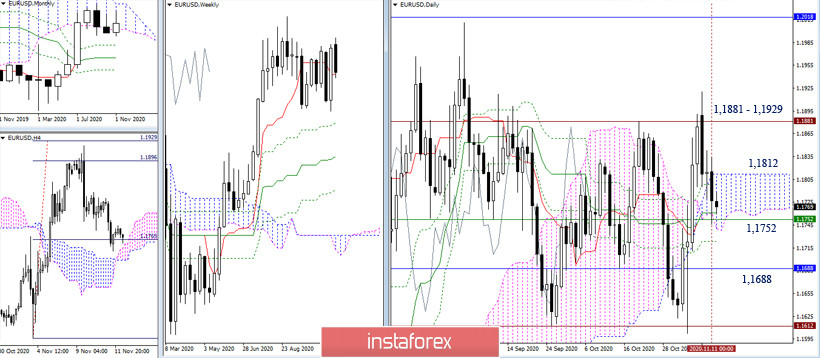

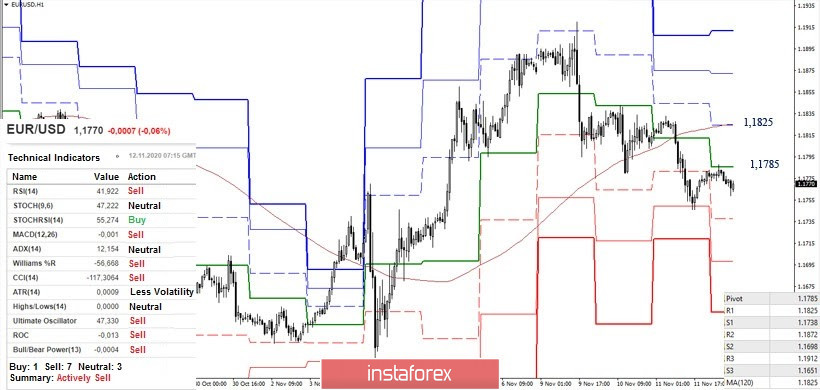

EUR / USD

Bears are trying to strengthen their positions and achieve a result that would allow them to make further plans, but for now, the situation continues to rest on the accumulation of support level located at 1.1752 (lower limit of the daily cloud + daily Kijun + weekly Tenkan). Meanwhile, the daily cloud (1.1812 - 1.1752) is now more of a neutral zone. A breakdown above which could help the further recovery of the bullish mood. In contrast, a breakdown below will allow the bears to strengthen.

The key levels in the smaller time frames have turned to the bears' side and are now acting as resistance levels – 1.1785 (central pivot level) and 1.1825 (weekly long-term trend). At the same time, technical indicators also support the continuation of the decline, despite the pair being in the correction zone. The downward pivot points within the day are the support levels that are located today at 1.1738 - 1.1698 - 1.1651. In case that the correction develops and there is consolidation above the key levels (1.1785 - 1.1825), strengthened by the daily cloud, the current balance of forces can change.

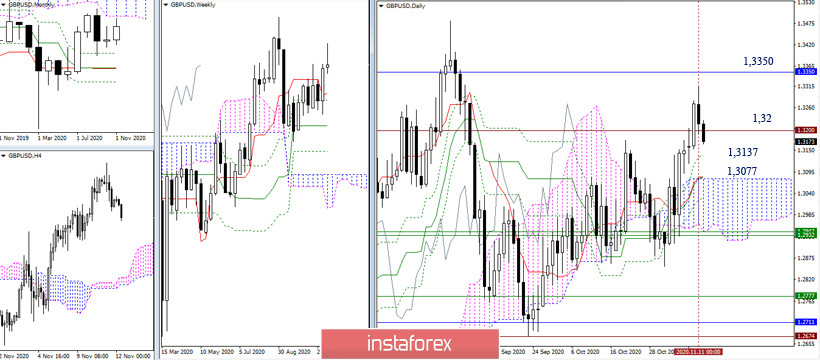

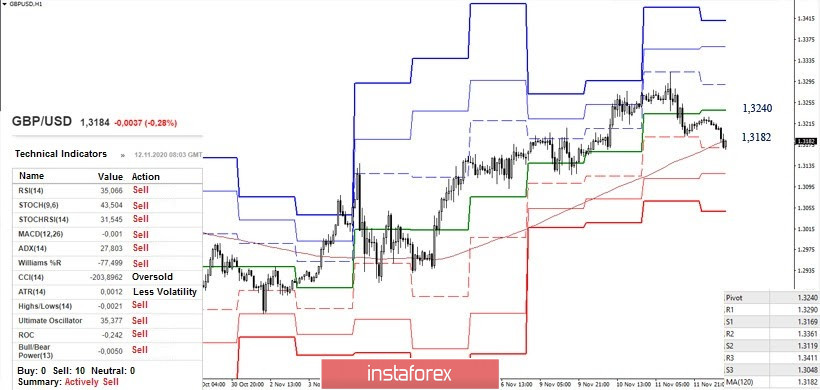

GBP / USD

The bulls, in turn, failed to stay near the influence zone of the lower limit of the monthly cloud (1.3350) yesterday. As a result, the mood changed and the level of 1.32 has been lost in the smaller time frames. On the other hand, the formation of a weekly rebound will allow us to consider plans to further decline. The nearest supports can be noted at 1.3137 (daily Fibo Kijun) and 1.3077 (daily cross + upper limit of the daily cloud).

The downward movement led the pair to the final corrective support at 1.3182 (weekly long-term trend). A consolidation below and reversal of moving averages can change preferences and trends. At the same time, the formation of a rebound from the reached support and a return to the bulls' side of the central pivot level (1.3240) can give bulls new strength. In this case, their main task will be to restore the upward trend (1.3312) and break through the resistance (1.3350) of the larger time frames. Now, if the level of 1.3182 breaks down, the pivot points will be 1.3119 (S2) and 1.3048 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)